Help Clients Bridge The Retirement Knowledge Gap

Americans tend to overestimate how many years they will be able to keep working, while they tend to underestimate how long they will live.

That was among the findings of the 2020 Retirement Income Literacy Survey taken by The American College. The study showed that consumers have a wide knowledge gap in retirement income literacy and they struggle with awareness of basic investment management.

The survey showed four in five Americans ages 50-75 fail to understand the basics of planning for a financially secure retirement. Retirees as well as pre-retirees lacked knowledge surrounding income in retirement, basic investment management and planning for long-term care needs.

Most survey respondents said they are holding their financial plans steady amid the COVID-19 pandemic, yet just one in three report having a formal, written retirement plan in place.

“The biggest trend we saw was that people who have a plan do better,” said Timi Jorgensen, assistant professor and director of financial literacy at The American College. “They feel more prepared and they have a stronger relationship with their advisor.”

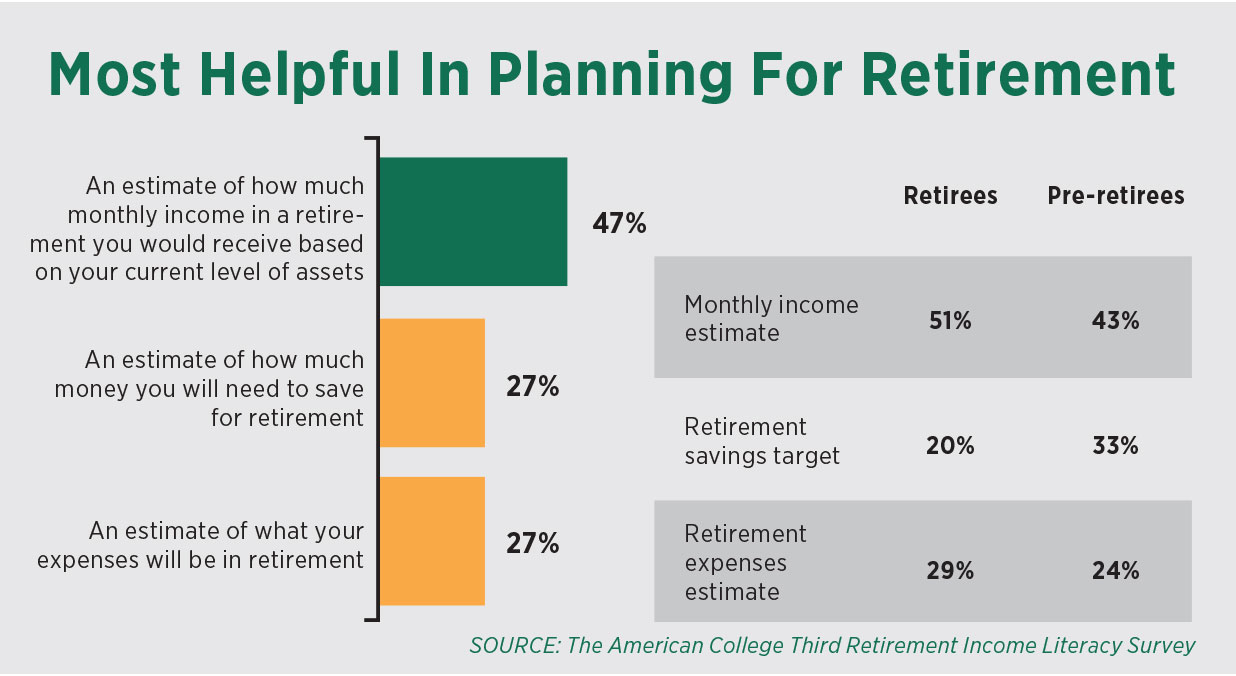

When it comes to retirement planning, Jorgensen said, a partial plan is better than no plan. “We asked pre-retirees whether they had just a retirement income plan. Such as, ‘Do you know how much money you will have for spending every month in retirement?’ People who reported yes on that did so much better in retirement than those who said no.”

Having a plan benefits the advisor as well as the client, Jorgensen said.

“The plan is something that anchors both the advisor and the client. It gives you a reason to call your client, to say something like, ‘The pandemic is kind of shifting the way that we thought this year was going to look like. Would you like to come in and talk about your portfolio? Or would you like to set up a Zoom call and talk about your long-term care solution? I noticed we don’t have anything in your plan to address that.’”

As for the client, Jorgensen said, a written plan “gives them a real sense of security.”

“Even if you have an advisor, you may not know what questions to ask. Having a plan gives clients something to go back to with their advisor and use as a basis for a conversation. What we’re hoping is that the plan strengthens that advisor-client relationship.”

Beyond The Plan

The survey showed consumers have a particularly low level of knowledge about preserving assets and sustaining income in retirement.

• More than half underestimate the life expectancy of a 65-year-old man, suggesting that many do not realize how long their assets may have to last.

• Only 32% know that $4,000 is the most they can afford to “safely” withdraw per year from a $100,000 retirement account, suggesting most do not know how to determine a prudent withdrawal rate.

• Only 35% know that a negative single year return in a retirement portfolio has the most significant impact on long-term retirement security if it happens at the year of retirement, suggesting a fundamental lack of knowledge about investment risk in the pre-retirement and retirement period.

Consumers also displayed a significant lack of knowledge when it comes to understanding investments, despite the fact that a majority said they believe they are at least moderately knowledgeable about investment management.

• Just 26% understand that the value of bonds and bond funds fall as interest rates rise.

• Just 28% know that actively managed mutual funds have higher fees than exchange-traded funds.

• Only 18% know that B-rated corporate bonds have higher yields than AAA corporate bonds or Treasury bonds.

Jorgensen said one survey finding she found particularly concerning is that one in three baby boomer respondents said they believe they will never retire.

“They think that they’ll be able to work forever. And while that may be true — that they may be able to bring in some active income — I think a lot more people are going to find themselves in a situation where they haven’t considered retirement planning issues because they thought they had more time. And they’ll find that they don’t have any more time to do it.”

The COVID-19 pandemic led to record numbers of job losses, and many older employees who thought they would remain in the workforce beyond retirement age found themselves without a job.

“I think the pandemic has shifted people to focus on retirement income, such as ‘How much do I have to work with every month?’” Jorgensen said. “Another trend we saw is that people are already thinking in terms of cash flow, a monthly budget, monthly income. So when an advisor can convey a plan to them in those terms, it’s much less ambiguous for them. People can understand what that means for their lifestyle instead of having advisors use planning terms like ‘Are you going to be able to live off of 60% of your pre-retirement income?’ And clients are saying, ‘I don’t know.’”

Weathering The Pandemic

Although it is unlikely that many of the survey respondents saw the COVID-19 downturn coming in advance, most said they felt moderately prepared to weather the storm.

• While many feel prepared, the pandemic has shifted the mindset of many investors. Four in 10 (39%) say they now feel less comfortable taking investment risk. Only 8% say they’ve actually adjusted their allocations to be more conservative, but a realignment of risk tolerance is noteworthy.

• Consumers have largely stayed the course since the pandemic in terms of financial behaviors, but a large portion (42%) report that they have decreased spending. This could be precautionary or simply a function of being quarantined.

Survey respondents also were increasingly worried about market volatility. Concern about market volatility was up among those ages 60-75 (22% said they were highly concerned in 2017 while 31% said they were highly concerned in 2020).

A third of consumers overall (34%) say that volatility in investment returns is highly concerning, behind only concern for the cost of health care in retirement and concern about potential cuts to Social Security.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Americans Are Split On Return To Normal Life

When Closing Down Means Opening Up

Advisor News

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Many died in sober living homes due to fumbled fraud response

- Let's talk about Long Term Care insurance

- Many died in sober living homes as Arizona officials fumbled Medicaid fraud response

- Peter Daniel: Government mandates are driving up healthcare costs in NC

- NC bill would limit insurers' prior authorizations

More Health/Employee Benefits NewsLife Insurance News

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

- Best’s Special Report: Impairments in US Life/Health Insurance Industry Jump to 10 in 2023

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

More Life Insurance News