Health Insurance CEO Pay Outpacing Revenue Growth, Survey Says

Health insurance CEO pay is outpacing the growth of revenue and growth of other top executives’ pay according to a report.

BDO USA surveys between 16 and 23 health insurance companies annually to obtain data on compensation, benefits, perquisites and contract agreements for executive and senior management positions in their organizations.

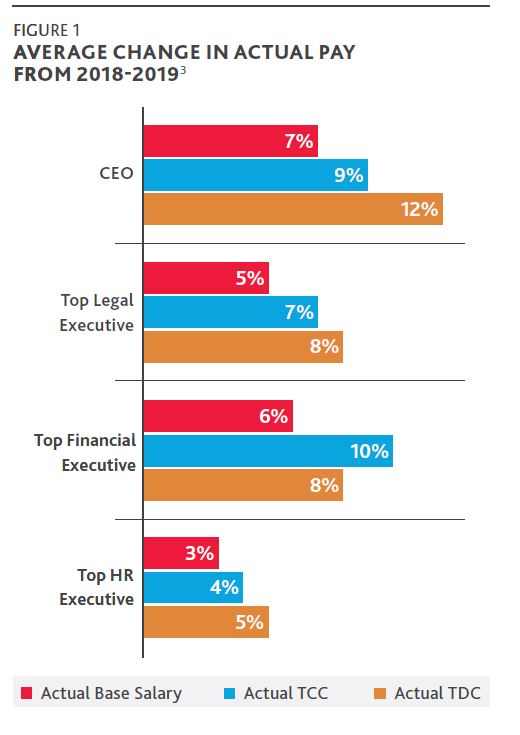

The most recent survey showed that total direct compensation (the sum of base salary plus annual incentives and long-term incentives) for health insurance CEOs increased 12% from 2018 to 2019, while the companies themselves experienced a 6% increase in total revenue during the same period. Total direct compensation for health insurance CEO is outpacing most other top executives as much 1.5 to 2.4 times faster.

The BDO USA survey revealed four trends for health insurance companies to consider when evaluating opportunities to reward their top executives and guide their executive compensation planning.

- CEO pay outpaces growth of revenue and pay for other top executives.

2. Growth in premiums and other incentive plan financial metrics outpace membership enrollment.

The survey found that net income and net premiums written increased at a five-year compounded average growth rate of 16% and 5%, respectively, whereas total health enrollment only increased at a 3% compounded average growth rate.

- Variable pay continues to gain prominence for health insurance executives.

Survey results showed that all but one company reported having an annual incentive plan; and all but two companies reported having a long-term incentive plan.

- Supplemental executive retirement plans and change of control agreements are common, but carry potential risks.

These plans are very common, offered by 67% of health insurance companies. They serve as important executive retention devices. However, upon a triggering event (two-thirds of surveyed companies require a double trigger), the size of the payouts can be newsworthy. Boards, management and other stakeholders are advised to be aware of the size of these potential payouts and ensure that the amounts are defensible.

Compensation is a critical tool for attracting and retaining executives as well as driving the right strategy, the study’s authors said. It is important to know what other companies are doing; however, it is also important that each company ensures that its programs 1) align with the company’s market, mission, and strategy and 2) is sized correctly to balance the needs of all stakeholders.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Many Americans Lack Trusted Financial Confidant, Survey Finds

10 Reasons Financial Advisors Choose To Go Independent

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News