Four words that move the annuity conversation

Consumers are seeking annuities as part of a holistic investment portfolio that offers them upside potential while guarding against market volatility. But they don’t often know how to articulate that to their advisors, leading to a gap that can be bridged by the right conversation.

That was the word from Adam Rivituso, director of insurance and sub-advisory with Invesco Retail Retirement, who presented ways to have a better annuity conversation in a recent webinar for the National Association for Fixed Annuities.

“People are driven by emotions and language,” Rivituso said. “Facts and figures are important. But when you make big decisions in life, you’re typically not driven by facts and figures — you’re driven by the emotions of the experience.”

Rivituso said the goal is to help advisors have clear, concise and compelling discussions with their clients about income plans with protected lifetime income.

The annuity opportunity

Consumers know they need lifetime income in retirement, and they believe lifetime income is valuable — yet financial professionals are reluctant to discuss lifetime income, Rivituso said. He pointed to a 2018 Guaranteed Lifetime Income Survey conducted by Greenwald and CANNEX that showed:

» 70% of investors think financial professionals have a responsibility to present products that provide guaranteed lifetime income.

» 73% of investors perceive guaranteed lifetime income as valuable.

» 42% of financial professionals often or always recommend annuities as part of retirement plans.

Words shown to work

When advisors recognize the opportunity that exists to present annuities as a solution, and when they acknowledge clients’ emotions surrounding the need for lifetime income, “they become more than just a money manager,” Rivituso said.

Rivituso said, “it’s not what you say, it’s what they hear.” He described the four words that drive a better conversation about annuities.

1. Positive. Clients have become more worried about minimizing losses and less concerned about maximizing gains, Rivituso said. He pointed to Invesco research that found in 2007, 63% of investors would rather see their money invested in something that maximizes gains, while 37% would rather invest in something that minimizes losses. By 2020, though, that gap narrowed, with 55% concerned about maximizing gains, while 45% wanted to minimize losses.

“What if you can marry the concept of maximizing gains while minimizing losses?” he asked, pointing to Invesco research that showed 85% of investors were most interested in an investment that could maximize their gains while protecting their assets.

“People are looking for upside potential with downside mitigation,” he said. “Lead with the fact that what you offer minimizes the downside.”

When choosing investments, consumers believe it is most important that those investments are cost-efficient, high value and low cost, Rivituso said.

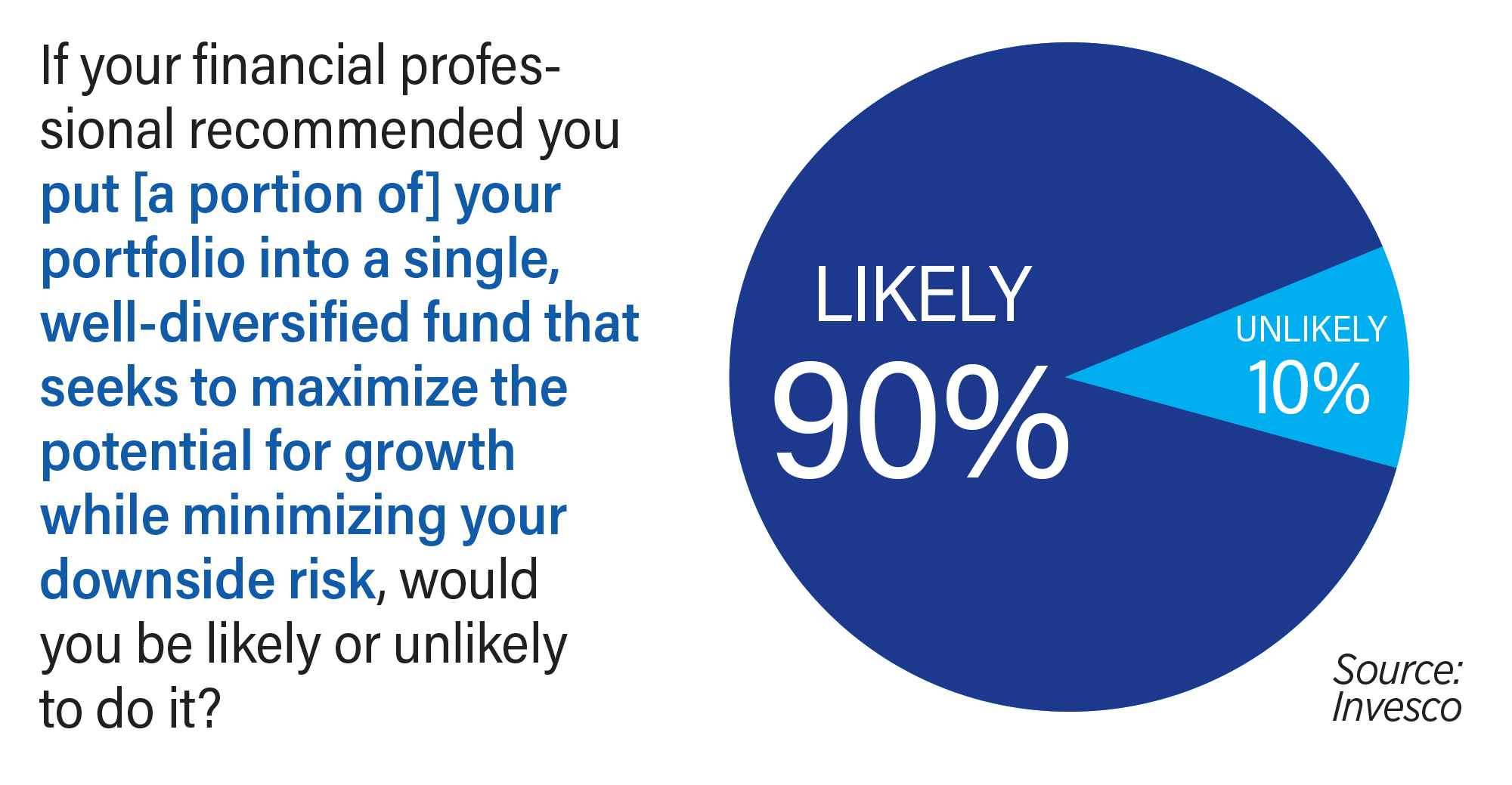

2. Plausible. A simple change of phrase can increase a client’s interest in an annuity, Rivituso said. He pointed to an Invesco survey that showed 50% of consumers responded positively when asked the following question: “If your financial professional recommended you put your portfolio into a single, well-diversified fund that seeks to maximize the potential for growth while minimizing your downside risk, how likely would you be to do it?”\

But when that question was amended to ask consumers how likely they would be to follow that recommendation if the financial professional recommended they put a portion of their portfolio into that same fund, 90% of consumers responded that they would do it.

“Sometimes only a single word can change a no to a yes,” he said.

Consumers also told the Invesco researchers that they are more interested in an investment strategy that anticipates the market (88%) as opposed to a strategy that predicts the market (12%).

“You’re anticipating the risks that exist but not predicting they will happen,” Rivituso said.

3. Plainspoken. Clients often fall victim to what Rivituso called “TME,” or “too much education.”

“What clients tell us is, ‘We just want to know what it does,’ when discussing a product.”

In explaining “what it does” when discussing annuities with clients, he suggested advisors describe them as “designed to provide you with protected income for as long as you live for a better chance of enjoying a comfortable retirement.”

He also suggested describing annuities as moving a client from what they already know to something that’s new to them.

“Annuities are a little like the home and auto insurance you already have. The difference is that annuities are designed to protect your savings.”

4. Personal. When Invesco asked investors the top services they want a financial professional to provide to them, the three most common answers were: creating a financial plan that fits life goals, finding the right investments and building a portfolio with complementary investments.

Using “you” and “your” in the annuity conversation can show clients how annuities can fit into a plan that helps them achieve their life goals. Rivituso provided a way to begin the conversation that addresses the “why now,” leads with the potential benefits and anchors the discussion to something the client already knows.

Begin with the client. “Because I am your financial professional, your goals are my priority, and I am constantly looking for ways to help you achieve long-term financial security.”

Add the why now. “With that said, we’re seeing specific trends that I believe we should address, like market volatility, higher taxes and economic uncertainty. So I’d like to discuss a strategy to address these trends for a portion of your portfolio.”

Emphasize three points, leading with the potential benefits. “The first potential benefit of this strategy is that you will protect the money that you have earned from market and economic uncertainty. The second potential benefit is that we could reduce your tax bill using a tax-smart and tax-efficient approach made possible with this type of investing. The third potential benefit is that we could gain additional choice and control over your portfolio through options that are not currently available to you.”

Anchor to the known. “Annuities as part of a plan may be a strategy. Annuities are a little like the home and auto insurance you already have. The difference is that annuities are designed to protect your savings.”

Address costs. “It’s important to note that we’re smart with your money. What you pay matters to us. We feel that it is important for you to know exactly what you pay so there are no unexpected or unexplained costs. So we’ll discuss the transparent costs with this option”

Close. “I believe this move will keep you well positioned to accomplish your goals in today’s markets. If this is of interest to you, I recommend we schedule some time to discuss the specific details of our recommendation.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

What happens when states purge their Medicaid rolls?

Connect employee benefits to workforce culture

Advisor News

- Confidence is key to cold calling success

- Overcoming the indecision of prospects

- What issues top consumers’ list of financial goals for 2025?

- 3 issues investors must be aware of in 2025

- More Americans plan to focus on finances in 2025

More Advisor NewsAnnuity News

- Sapiens wins XCelent award for Customer Base and Support for UnderwritingPro for Life & Annuities

- SB 263 expected to bring chaos to Calif. insurance, annuity sales come Jan. 1

- Lincoln Financial hires industry veteran Tom Morelli as Vice President, Investment Distribution

- Structured settlements protect young injury victims | H. Dennis Beaver

- MetLife Inc. (NYSE: MET) Highlighted for Surprising Price Action

More Annuity NewsHealth/Employee Benefits News

- Voting rights, health insurance regulations among laws that took effect Jan. 1

- 5 of the most frustrating health insurer tactics and why they exist

- Editorial: Agenda setting

- Thousands of Alaskans face another major spike in their health care costs next year

- Filling jobs will be crucial for Connecticut economy in 2025

More Health/Employee Benefits NewsLife Insurance News

- Confidence is key to cold calling success

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Assigns Credit Ratings to Min Xin Insurance Company Limited

- Proxy Statement (Form DEF 14A)

- Prudential Financial Completes Guaranteed Universal Life Reinsurance Transaction With Wilton Re and Completes Internal Captive Restructure

More Life Insurance News