Florida’s Citizens Property Insurance makes case for 12% premium hike

Florida's insurer of last resort, Citizens Property Insurance Corp. made a case to regulators Thursday for double-digit rate increases for Citizens customers across the state.

The proposed increases would vary based on factors such as types of policies. Brian Donovan, the chief actuary for Citizens, said that Citizens is recommending 12% increases for all homes that are primary residences and have what are known as multi-peril policies. These are the most-common type of coverage.

The 2.5-hour hearing took place before the Florida Office of Insurance Regulation.

Increases could be dramatically higher for homes that are not primary residences. A new state law allows increases up to 50 percent for those properties. "We take asking for a rate increase very seriously," Citizens President and CEO Tim Cerio said told regulators. "(For) homeowners' insurance consumers, it's a very difficult time right now."

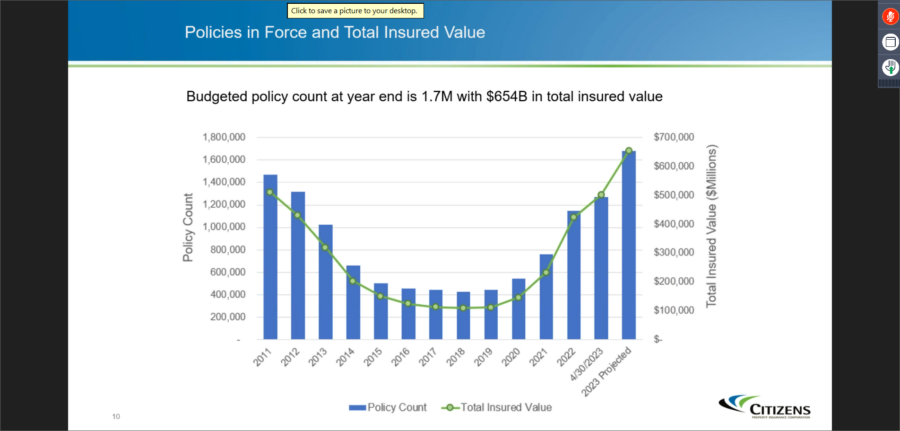

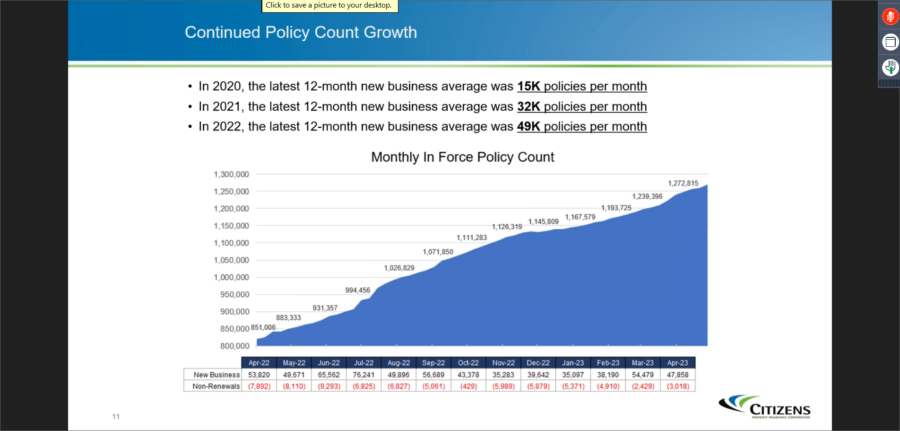

The main issue for Citizens is the large influx of homeowners seeking coverage after several private insurers stopped writing business in Florida. Citizens' policy count more than doubled during the past two years to 1.3 million as of last week. That number could climb to 1.7 million by the end of the year, Cerio said.

Tampa-based insurer Slide is set to take over as many as 25,000 homeowners policies from Citizens, Axios reported.

Floridians are already on the hook for the nation's highest average premium at nearly $6,000 a year, and experts said thrusting more consumers into the private market will leave them with costlier rates.

Citizens holds nearly 300,000 policies from Tampa Bay homeowners. Hurricanes and aggressive litigation have caused the state-run insurer to balloon in recent years.

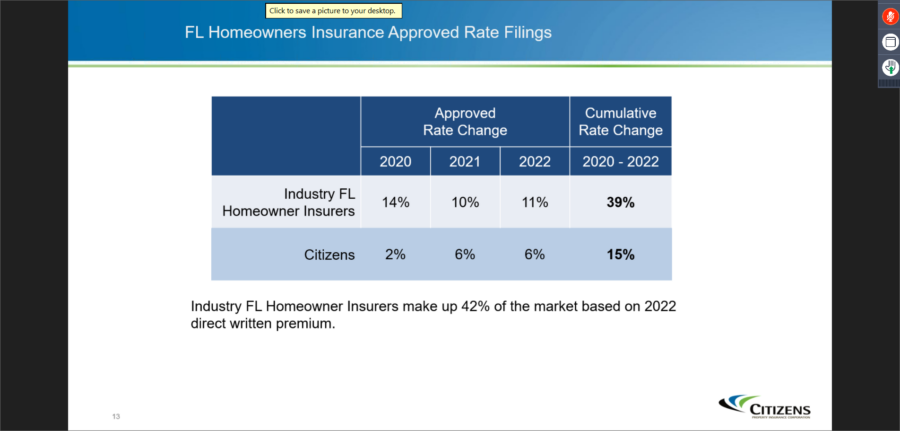

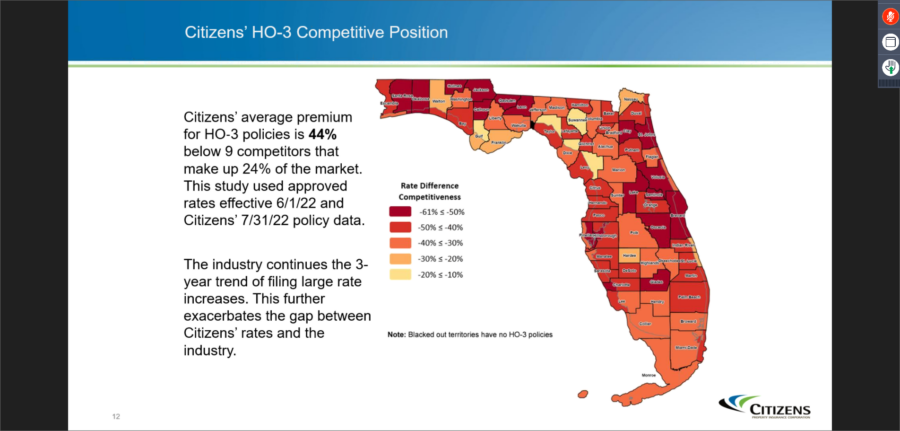

Citizens often charges lower rates than private insurers, insurance industry officials have said, leading homeowners to get the expensive coverage from the state-backed insurer. State law limits annual rate increases for Citizens, with the cap this year at 12 percent for homes that are primary residences.

Louisiana state law requires its state insurer of last resort, also named Citizens Property Insurance, to charge 10% higher rates than private insurers. Florida rate increases have mostly favored private insurers, Thursday's hearing revealed:

The law changes

Florida's high lawsuit culture and costly storms drove up property insurance rates in recent years, with the risks deemed too high for many private insurers. The state legislature passed a lawsuit reform bill this spring designed to bring down the costs.

The bill signed by Gov. Ron DeSantis transitions Florida from a pure comparative negligence system to a modified comparative negligence system. The law took effect March 24 and grew out of an insurance crisis that saw insurers bolting the state or sharply hiking premiums.

Many pointed fingers at the state's high lawsuit culture. Florida has just 9% of all property insurance claims filed in the U.S., yet is home to almost 81% of all lawsuits.

Under the previous laws, a plaintiff could recover in proportion to the defendant’s percentage of responsibility for his injuries regardless of the plaintiff’s own liability. Thus, a plaintiff could be 90% at fault for his own injuries but could still recover 10% of his damages from the defendant.

Under the new modified comparative negligence standard, a plaintiff is barred from recovery if he or she is more than 50% at fault for his or her injuries. The change does not apply to medical negligence.

The new law reduced Citizens need for funding by $900 million, officials said during the hearing.

$24 billion problem

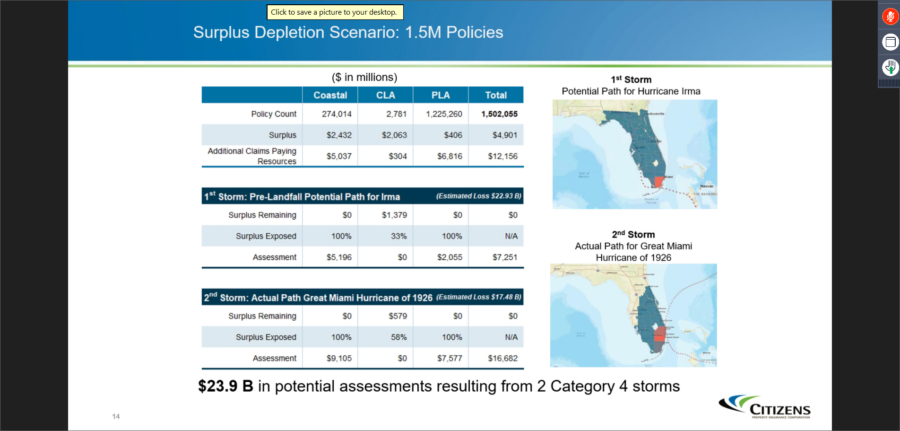

Florida officials have long sought to keep Citizens' policy count low for fear that an unusually rough hurricane season could overwhelm the state with losses. Citizens Property Insurance reserves dropped by 33 percent, Cerio explained, as additional policies multiplied hurricane losses.

There is potential disaster on the horizon, he added. Should the state get hit with two Category 4 storms in one year, the combined losses are estimated at nearly $24 billion.

Reject rate hikes

Joe Walsh, board member for the group Fair Insurance Rates in Monroe, spoke during Thursday's hearing and urged regulators to reject rate increases. Some Florida residents, such as in Monroe County, home of the Florida Keys, have limited choices for coverage other than Citizens.

“I think that if you’re increasing for Citizen’s, then it's almost guaranteed you’re going to be increasing for everyone else," Walsh said.

State regulators said it generally takes weeks to decide on rate increase requests.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Experts share networking tips for financial advisors

Friday Health Plans to wind down operations by the end of 2023

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

- National Health Insurance Service Ilsan Hospital Describes Findings in Gastric Cancer (Incidence and risk factors for symptomatic gallstone disease after gastrectomy for gastric cancer: a nationwide population-based study): Oncology – Gastric Cancer

- Reports from Stanford University School of Medicine Highlight Recent Findings in Mental Health Diseases and Conditions (PERSPECTIVE: Self-Funded Group Health Plans: A Public Mental Health Threat to Employees?): Mental Health Diseases and Conditions

More Health/Employee Benefits NewsLife Insurance News