Firms Urged To Strike Fast For Piece Of SBA Loan Pie

With $310 billion in federal funding on the way to replenish the small business emergency loan program, advisors in need of the money are being advised to move quickly and keep good records.

The money for the Paycheck Protection Program is part of a larger $484 billion pandemic relief bill that President Donald Trump has indicated he will sign. Administered by the Small Business Administration, the PPP is designed to keep employee payrolls afloat during the COVID-19 pandemic.

Money is being awarded on a first-come, first-served basis and in the form of forgivable loans as long as employees are not let go for eight weeks. The SBA exhausted the initial $349 billion allocated for the program in less than two weeks.

There are many details about the program yet to be settled, explained Armstrong Robinson, vice president of legislative affairs for the Association for Advanced Life Underwriting. The federal government is releasing guidance weekly to fill in those regulatory details.

“While the application process around all of these loans have been phenomenally streamlined, whatever process you do for accounting for how you spend this money should be very detailed," he said on a recent AALU webinar. "You should document all payments you make with this money very clearly."

In particular, the government has not explained how that repayment formula will be calculated for businesses forced to let employees go during that eight-week period, said Ken Kies, managing director of the Federal Policy Group, a Washington, D.C. lobbying firm.

'Mad As Hell'

The PPP is not without its critics, most of whom say it is far too little and too late for many small businesses.

“I can count on one hand — literally on one hand — the number of businesses in my district who have received assistance,” Rep. Adriano Espaillat (D-N.Y.), who represents Manhattan, said Thursday during a hearing on Capitol Hill. “They got bamboozled. They are mad as hell. I am mad as hell.”

All the more reason to be prepared with accurate applications as soon as the next application period starts, Robinson said, adding that some confusion has emerged about the program and gained steam on the internet.

“The whole idea and structure behind this program is to keep your business idling across the shutdown of the economy and prime you to road back when the economy reopens,” he added.

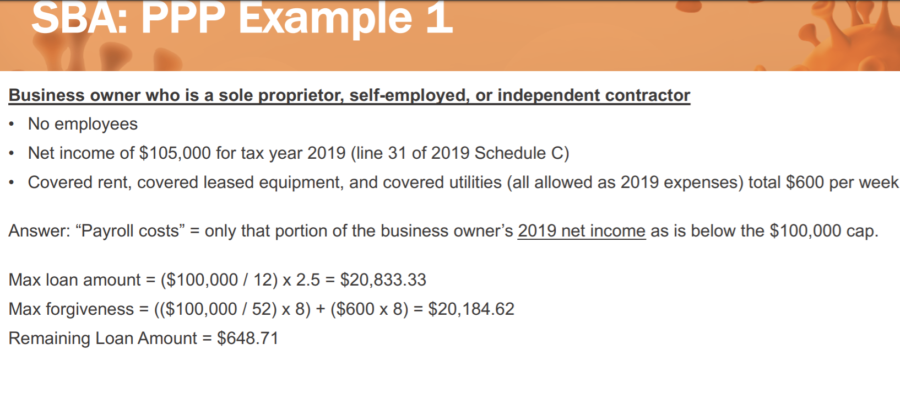

The key PPP details: your max loan amount is the average monthly payroll expenses for the past year times 2.5. Payroll or earnings up to $100,000 per individual are eligible. Most or all of that loan may be forgiven, federal tax free, if spent on payroll and eligible expenses for the eight weeks.

AALU/GAMA provided several scenarios to show how employees, independent contractors and LLCs should apply under the PPP:

A business owner with employees gets to claim additional salary, and even benefit costs for the employees. Being able to claim the cost of employee benefits was "a pleasant surprise," Kies said.

Independent contractors, even those who might seem like an employee in many aspects of the relationship to their company, nonetheless must file their own PPP applications, Kies said. Many independent insurance agents are classified as independent contractors by law.

In firms that are set up as LLCs, the LLC is the official applicant of record, Kies said. The same $100,000 salary threshold remains, however.

Another Backlog?

As The Hill noted in a Thursday story, the SBA has been unable to process PPP applications since funding for the program expired, which means another massive backlog could be looming for the agency that could quickly draw down the new pool of funds.

The new emergency bill also adds $10 billion in funding for the Emergency Economic Injury Disaster Loan program, which allows businesses to borrow up to $2 million with an initial grant of up to $10,000.

AALU is hosting webinars weekly on industry issues.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Retirees Still Confident But Workers Fear Unemployment Could Derail Their Plans

Low Interest Rates Challenge Retirement Investors

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- Falling off the cliff: Loss of insurance subsidies hits Durango's middle class

- Universite Paris 1 Pantheon-Sorbonne Reports Findings in Science (Misperception, self-reported probabilities and long-term care insurance take-up in the United States): Science

- Genworth Financial Announces Fourth Quarter 2025 Results

- 'Welcome to the movement': Whitman College staff seek to form union

- Red and blue states want to limit AI in insurance. Trump wants to limit the states

More Health/Employee Benefits NewsLife Insurance News