Financially Stressed Workers Look For A Way Forward

Almost half of Americans are worried about their financial future following the COVID-19 crisis, according to research from Prudential.

The Prudential Financial Wellness Census showed that Americans who are employed are looking to their workplace as a source of financial health, and the carrier has launched a package designed for these financially stressed employees and time-strapped human resources teams.

“The Way Forward: Financial Life After Lockdown” combines financial wellness information, online tools, and virtual and in-person programs. The goal is to help employees manage day-to-day finances, safeguard against financial disruptions, and develop a plan for meeting specific financial goals.

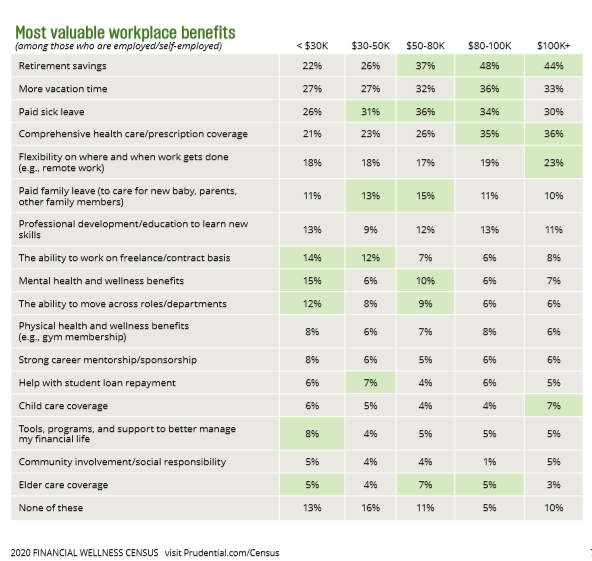

In the financial wellness census, employees said medical leave, paid leave and retirement planning are among the workplace benefits that would help them manage future economic disruptions.

The financial wellness package will be offered through Prudential Group Insurance.

Julie Brandon, head of financial wellness distribution at Prudential, told InsuranceNewsNet the carrier is educating its benefits brokers on how to work with employers to implement financial wellness strategies in the workplace.

“Employers have a front-row seat to their employees’ financial challenges,” Brandon said. “We already had offered financial wellness programs as a voluntary benefit but COVID-19 showed us that employers and workers have a heightened interest in financial wellness education.”

The Way Forward came out of employers’ desire to offer “something to their employees who have experienced challenges that they are not used to over the past several months,” she continued.

The program addresses several “bedrock items that a worker needs to address as they relate to their financial house,” Brandon said.

Those items include:

- Understanding their credit. What’s their credit score? Have they reviewed their credit report recently?

- Budgeting and spending. Do they know how much money is coming in and going out every month? Do they have money saved for an emergency?

- Medical and life insurance coverage. Have they reviewed their coverage recently? Are their beneficiaries correct? If they have dependents, is there enough life insurance in place to take care of their needs?

- Retirement saving and investing. Are they saving at least the amount of the employer’s match in their 401(k) plan? Have they reviewed their investment allocation to determine whether they are appropriately diversified?

With so many employees continuing to work remotely, Prudential changed its financial wellness programs from being delivered mainly in-person to being delivered 100% remotely, Brandon said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Broker Partnerships Can Weather A Hardening P/C Market

The 5 Myths That Keep Black Americans From Buying Life Insurance

Advisor News

- Social cultivation: How to talk with wealthy prospects

- How important is a written financial plan?

- Coalition wants to advise people impacted by policy changes in new administration

- Diagnosing miscommunication in retirement planning

- Election creates an opportunity for advisor/client dialogue

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Doctor’s bills often come with sticker shock for patients – but health insurance could be reinvented to provide costs upfront

- AI usage outpacing regulation, NAIC panel told

- Workers show growing interest in mental health, caregiving and leave benefits

- November Issue of Best’s Review Ranks U.S. Workers’ Compensation and More

- Doctor’s bills often come with sticker shock for patients − but health insurance could be reinvented to provide costs upfront

More Health/Employee Benefits NewsLife Insurance News