Financial professionals can help guide through turbulent times

The year 2022 will probably go down as one of the most challenging in history for individual investors in the U.S. They were forced to contend with a significant stock market sell-off and rapidly increasing interest rates that eroded the value of bonds held in their portfolios — all during a time of high inflation. Such volatile environments can demonstrate the value of having a trusted financial professional to help make appropriate investment decisions and navigate the economic storm — and underscore the need for products with some level of downside protection.

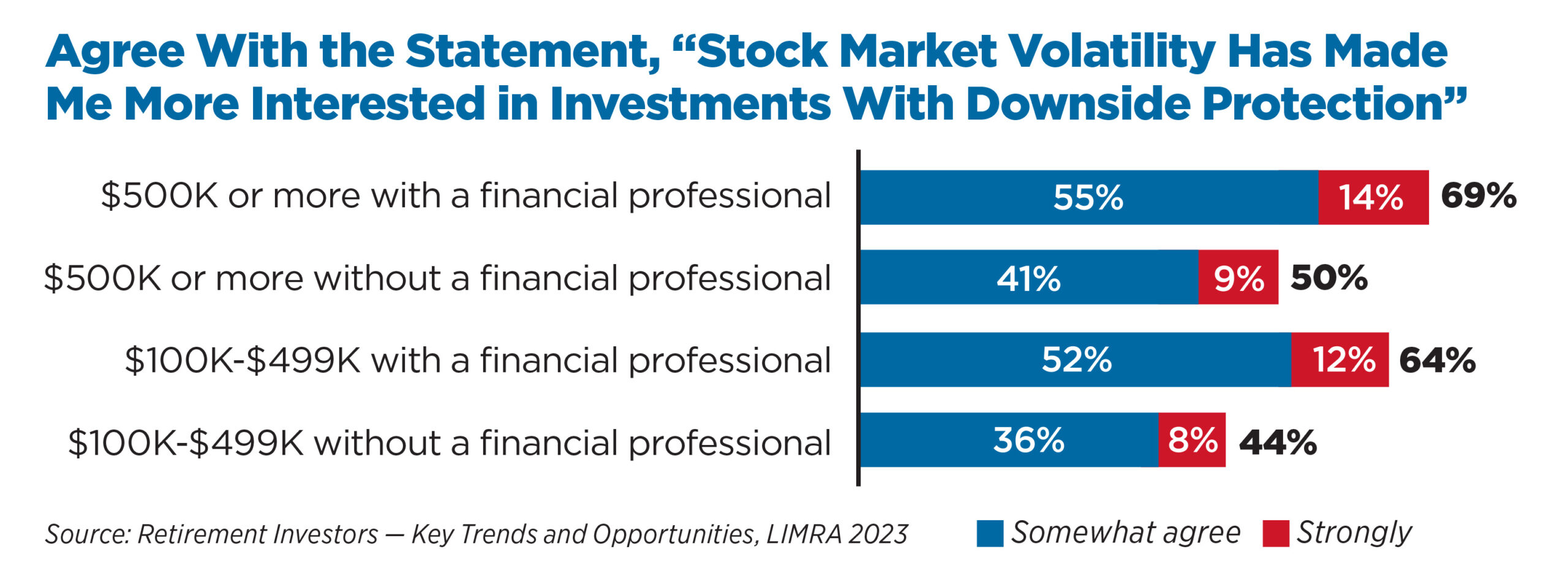

LIMRA recently looked at retirement investors ages 40 to 85 with at least $100,000 in household investable assets, some of whom work with financial professionals to help make financial and investment-related decisions and others who did not. The research examined the degree to which working with financial professionals can improve their clients’ retirement security, as well as the impact of working with a financial professional on an investor’s reaction to current economic trends. Specifically, in light of the market volatility, would clients now be interested in products with downside protection?

The benefits of working with a financial professional are clear. For example, controlling for wealth, investors who consult with financial professionals are more likely to have created a plan for managing income, expenses and assets in retirement, and are more likely to have performed key planning activities such as estimating how long assets will last in retirement. They also have higher confidence in their ability to live the retirement lifestyles they desire. It’s less clear, however, that clients will react differently than non-advised investors to economic conditions or will be amenable to the protection solutions their financial professional recommends in response to such conditions.

The U.S. stock market, as measured by the S&P 500 index, lost about 20% of its value during 2022 and was highly volatile for much of the year. Such bear market conditions often cause a “flight to safety” and can spark interest in products with downside protection. Indeed, interest in products with downside protection is strong, with nearly half (47%) of those surveyed expressing at least some willingness to consider them. This high level of interest is borne out in LIMRA’s annuity benchmarking, which shows that the share of industry sales directed at “protection-oriented” product types has increased substantially over the past several years.

Within each wealth category, investors working with financial professionals — defined as any paid professional, such as a financial advisor, investment broker, banker or mutual fund representative who helps with the household’s financial and investment decisions — were significantly more likely than other investors to express interest in protection-based products.

Wealthier investors (those with $500,000 or more) were more likely than less-wealthy investors to be interested in such products. Given the strong connection between wealth and financial sophistication and knowledge, it is possible that wealthier investors have some familiarity, if not actual experience, with these products. Wealthier investors also tend to have higher exposure to the stock market and have more to lose overall without downside protection following a long bull market before 2022.

Financial professionals who do not have these products on the shelf are probably operating at a disadvantage in these economic conditions. At the same time, many of those surveyed (38%) were neutral toward “investments with downside protection,” possibly because they are unfamiliar with fixed indexed annuities, registered index-linked annuities or other structured products. Given this lack of familiarity and the complexity of some product designs, financial professionals must take the time to ensure that their clients understand these products well enough to make informed decisions.

Connecting the dots between economic conditions, investment solutions, and the specific needs and preferences of each client will be essential, regardless of how the markets change going forward.

Matthew Drinkwater, Ph.D., FSRI, FLMI, AFSI, PCS, is corporate vice president, LIMRA and LOMA. He may be contacted at [email protected].

Coalition aims to keep people covered as Medicaid unwinding begins

The how and when of texting clients

Advisor News

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

More Advisor NewsAnnuity News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

More Annuity NewsHealth/Employee Benefits News

- NC bill would limit insurers' prior authorizations

- Plan to tax employer-provided insurance would harm lower-income Hoosiers

- 'Floridians need to pay attention.' Are we prepared for federal cuts to our health care?

- New New York state tax credit for small businesses introduced

- How did health insurance coverage changes affect older adults? Two new studies take a look: Michigan Medicine – University of Michigan

More Health/Employee Benefits NewsLife Insurance News

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

- Best’s Special Report: Impairments in US Life/Health Insurance Industry Jump to 10 in 2023

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

More Life Insurance News