Financial influencer studies show TikTok is not just for twerking

Financial advice has always been about influencers, but who are today’s influencers?

In the past, key influencers were respected brokerages reaching prospective clients through TV ads. Boomers will most likely be able to fill in this blank, “When _____ talks, people listen.”

This popular TV commercial in 1979 could convey that even second-hand gossip from a respected broker could command attention. The ad showed two things: 1. how everybody should be investing and 2. that a broker was the keeper of market information.

The brokerage business was built on that model and still operates as if brokerages are the only source investors can rely on for information. A recent survey by Cerulli Associates, however, reveals that influencers now appear in a range of outlets from The Wall Street Journal to Twitter – and even to TikTok, where their financial advice coexists alongside the platform’s twerkers.

“The growth of the modern investment advice industry initially was driven by a need for information,” according to the report. “In the 1970s and 1980s, if investors wanted to learn about personal finance, they could find a book on the subject or rely on the occasional column in the business section of their local newspaper. … In contrast, investors today are more likely to be overwhelmed with the variety of investment advice resources available to them. The real challenge has transformed from finding relevant information to trying to identify trusted resources from the thousands of options spewing opinions and analysis on a daily basis.”

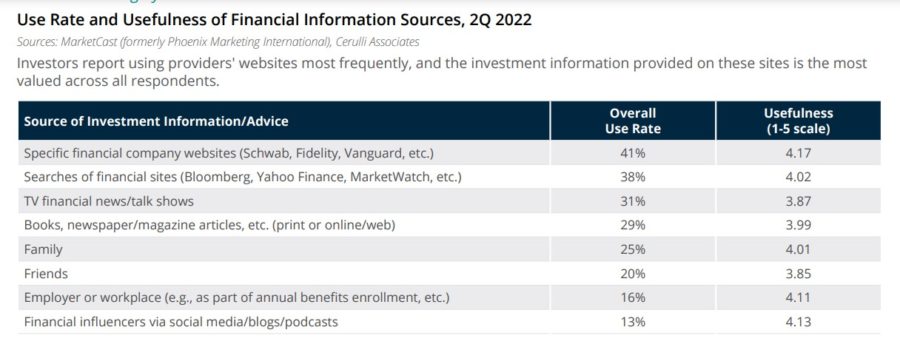

The survey shows that investors still turn to investment firms for financial information, but on their websites. That was the top source of information, with 41% saying they use websites from firms such as Schwab, Fidelity and Vanguard. At the bottom, 13% said they listen to online influencers. But even though this was last on the list, the users rated the information as useful as investment firm sites.

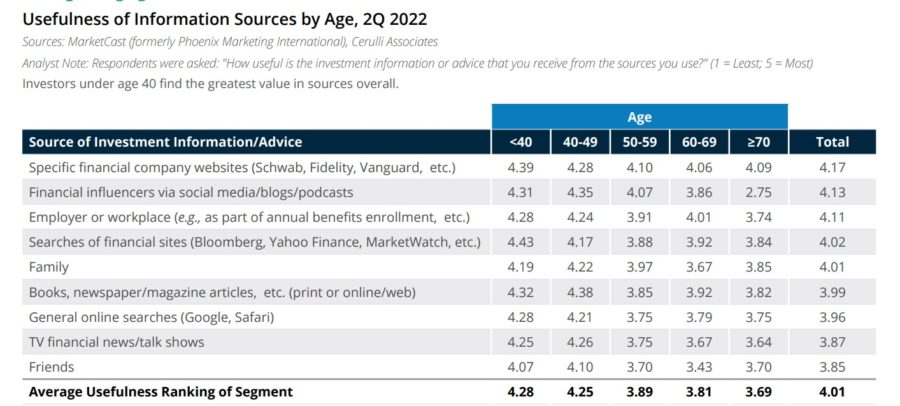

As might be expected, younger investors are more into alternate sources of information.

“Platforms such as TikTok that are much more highly embraced by younger client prospects have yet to become much of a focus for many wealth management providers,” according to the report. “Though these platforms frequently are dismissed as hubs for entertainment, they are a valid information avenue for younger investors.”

Financial firm websites were rated most useful at 4.17 on a 1-5 scale, with financial influencers at a close second at 4.13, largely driven by younger and less wealthy investors. Investors over 60 and up only rated investment firm websites over a 4, with the 60-69 group also giving an employer benefits site a 4.01.

Financial firms can feel secure that they are the top of the information chain, but not by much. Firms and advisors will need to branch out if they want to entice the next generation of investors. Cerulli researchers said firms will have to meet investors where they are.

“For example, on TikTok the hashtag ‘#investing’ already has been attached to 8.7 billion views as of Nov. 11, 2022,” according to the report.

“While the content in many of these videos certainly is more for entertainment, there are hundreds of creators offering truly educational information, including the difference between Roth and Traditional 401(k)s (igobyadi, 1.7 million likes) and the benefits of investing in ETFs rather than individual securities (erikakullberg, 519,000 likes as of Nov. 11, 2022).”

These examples are from young influencers who can offer solid basic information such as the difference between a Roth and traditional IRA, but they can also steer people in perhaps inadvisable directions. Cerulli’s first example, gobyadi on TikTok, has a link to a website “Stacks by Adi,” which prominently features a link to buy cryptocurrency from FTX, the crypto exchange that recently collapsed amid massive fraud allegations.

Some established firms are trying a hand a TikTok, with Fidelity joining last year and now with more than 60 videos with millions of views.

“The first video, which explains the basics of mutual funds through an analogy to building a burrito, has more than 3.8 million views,” according to the report. “Another post explaining fractional shares has recorded more than 12.6 million views.”

And although the younger advisors focused on financial matters, Fidelity mixed up their offerings with purely entertaining ones, such as one employee messaging another to ask about lunch at 9:05 a.m.

Fidelity’s content is aimed at a younger audience, but firms and advisors are usually trying to engage peers, often through podcasts aimed at older investors.

Don’t forget about Reddit

Putnam Investments has been keeping an eye on the trend with its Social Advisor Survey, which found that 21% of advisors were using TikTok for either just for business or for both business and personal use. The survey also found 31% using Reddit for the same purposes.

The advisors using these two channels were not just in it for kicks. They were able to show some return on their investment.

“The average age of an advisor using Reddit for business was 38, and they told us they gained an average of $8.3M in client assets from using social media,” according to the Putnam study. “Those using TikTok for business are on average 39 years old, and report average assets gained attributable to their use of social media at $6.9M.”

Researchers found that advisors had better success with Reddit, with a 73% chance of turning a prospect into a client vs. TikTok, where they had a 56% chance of doing so.

Advisors on TikTok posted original content 30% of the time and did paid promotions 39%, with some respondents reporting great gains with TikTok ads. Researchers said advisors usually used TikTok as a direct messaging platform rather than positioning themselves as content experts.

Putnam’s 2021 study focused on Reddit, which had recently achieved fame (or infamy) in the GameStop drama in which investors were sharing information on Reddit on moribund stocks to pump up, such as GameStop and AMC. Advisors were using Reddit more to get information (88%) and participate in discussions (66%).

For advisors wanting to explore the channels, Putnam researchers suggested starting with a personal account on the platform to observe activity around the subjects, but not injecting their own business at first.

Once they have evaluated the platform, they could move onto a business-branded account and paid promotions, with consultation with compliance officers.

Investors ready to jump back in

Getting on social media might be a way to catch the next wave of investing, because according to the Cerulli study, a wave is coming.

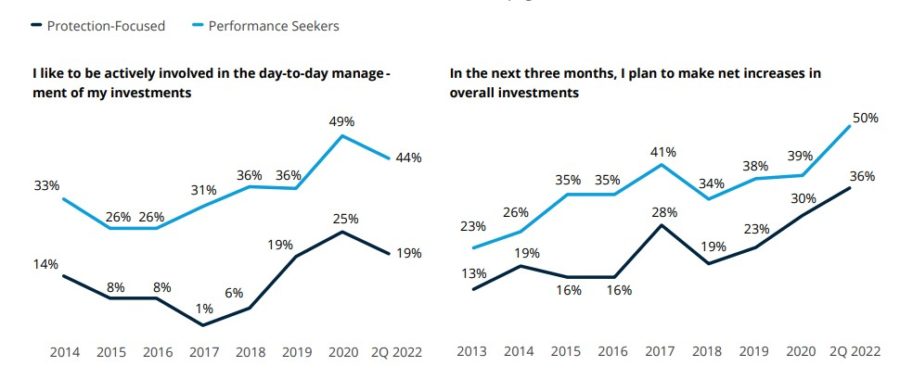

For the first time in a decade, half of all performance-focused investors plan to increase investments in the next three months, with 36% of protection-focused investors looking to do so.

“It is commonly seen as folly for a retail investor to try to time the markets, but it should be seen as encouraging that investors still understand the historical upward trajectory of markets and are setting themselves up as best they can to take advantage of the recovery when it eventually happens,” according to the Cerulli report.

Firms can take these bearish days as time to delve into social media channels that will connect them with younger investors as they contemplate jumping back into investing.

“While these efforts may not translate to substantial immediate inflows,” the report stated, “firms choosing not to include engaging social media efforts as part of their strategy are forgoing the opportunity to build brand recognition with the next generation of investors.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Don’t shy away from the LTCi conversation

Boston Mutual offers Individual Solutions Program

Advisor News

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

More Advisor NewsAnnuity News

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

More Annuity NewsHealth/Employee Benefits News

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Confidence is the new workplace currency

- Governor signs education package on reading, math, teacher benefits

- Findings from Belmont University College of Pharmacy Provide New Insights into Managed Care and Specialty Pharmacy (Comparing rates of primary medication nonadherence and turnaround time among patients at a health system specialty pharmacy …): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Study Data from Ohio State University Update Knowledge of Managed Care (Preventive Care Utilization, Employer-sponsored Benefits, and Influences On Utilization By Healthcare Occupational Groups): Managed Care

More Health/Employee Benefits NewsLife Insurance News

- Third Federal Named a top Financial Services Company by USA TODAY

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- Investors Heritage Promotes Andrew Moore to Executive Vice President; Names Him CEO of Via Management Solutions

- Kansas City Life: Q4 Earnings Snapshot

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

More Life Insurance News