Finances Top Worker Concerns, But Bosses Don’t Get It

Nearly two-thirds of small business owners are worried about the health of their businesses as they struggle to find and retain workers, according to a MetLife report.

The concern is greater for businesses with 20 or more employees, as 75% of those owners say they are worried about the pandemic’s effect, according to a poll taken in the second quarter before the effect of the delta variant escalated. Smaller businesses of fewer than five employees were less anxious, with 59% concerned about the pandemic’s effect on their business’ health.

Although the level of concern is high at 62% overall, the latest findings show an ease over the previous quarter, when 76% reported some level of worry. The shift was largely because of a shift of some in the “somewhat concerned” group shifting to “not very concerned,” according to the report. A quarter (26%) of owners in the second quarter were still very concerned about the future of their business.

The findings are part of MetLife’s 19th annual Benefit Trends Study, which used data from the U.S. Chamber of Commerce’s quarterly Small Business Index. The second quarter survey was taken in June.

Within the business, owners are most concerned about employees and their families catching the virus, with productivity coming in at second.

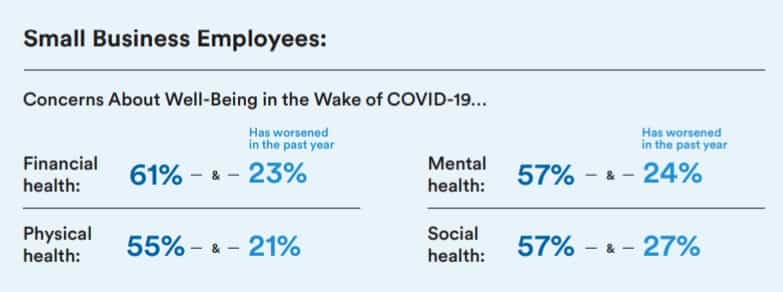

While employers were most worried about the virus itself, 87% of employees said finances were their top concern. That concern has employees most worried about their continued financial well-being, with 61% saying that they were concerned, followed by mental, social and physical health. About a quarter of the respondents said their well-being worsened in the past year.

The four areas are the pillars of well-being, according to the report’s authors.

“The shared concerns mean that employer strategies and programs addressing the spectrum of employee well-being are likely to have the most impact on employees, and therefore, on business objectives relying on employee productivity and resiliency,” according to the report. “However, when it comes to understanding and addressing holistic well-being, small business employers and employees may not be on the same page.”

Thirty-five percent of small business employees reported feeling stressed while working at least half of the time, 28% saying financial stress has made them less productive. A third of employees (32%) sought help for stress, burnout or mental health issues in the past year.

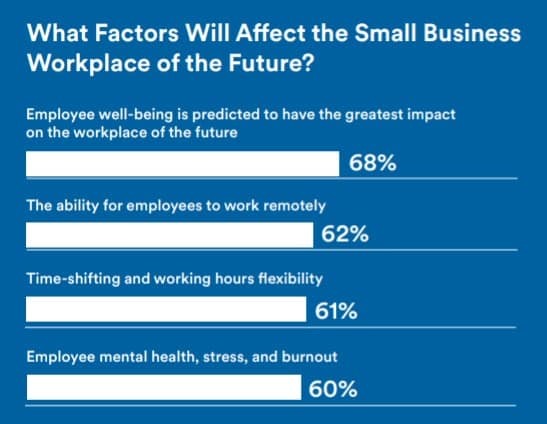

Although employers might not be in sync with employee concerns, they know well-being is a significant issue, with 68% of employers predicting that employee well-being will have the greatest impact on the workplace of the future.

Employers might recognize the impact of employee well-being, but the owners might be overestimating their workers’ financial health, according to the report. Small business employees tend to be younger, with 49% under 40; earn a lower average income, with 42% making under $50,000; one in four have a second job; and 45% say they live paycheck to paycheck.

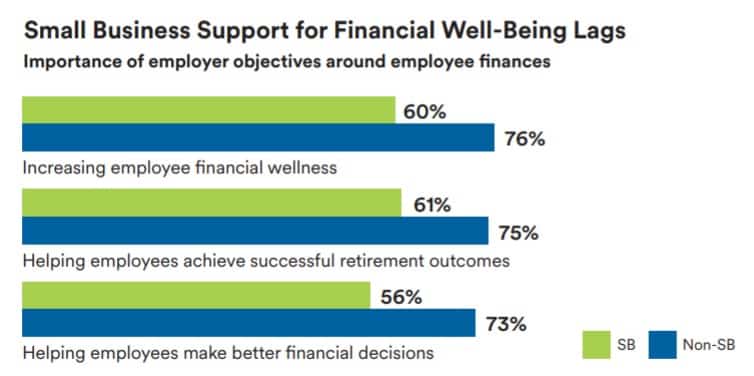

Small business employers are less likely than larger businesses to create objectives around financial well-being.

Another factor in employee well-being was flexibility with respondents saying that when they feel they get the flexibility they need, they said they were 48% more likely to be productive and 62% more likely to be productive.

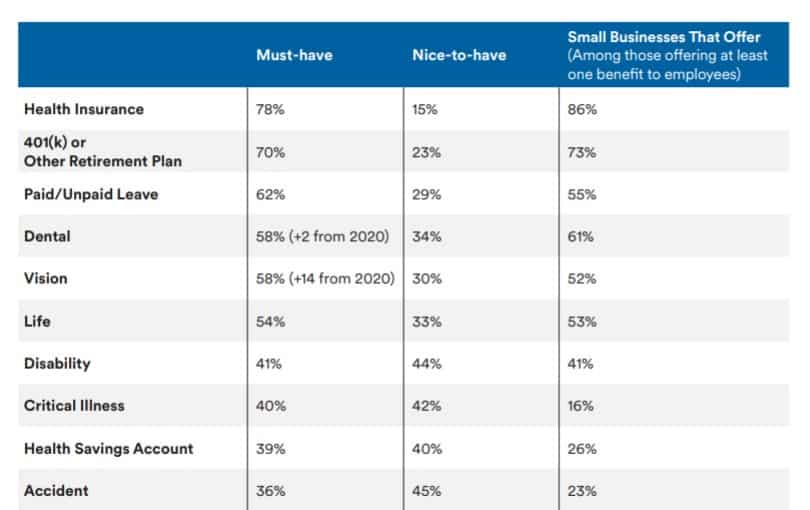

Although three-quarters (74%) of small business employers believe providing a wide variety of benefits helps with recruitment and retention, 22% of the employers plan to reduce their benefits to cut costs. Only 56% of small business employees were happy with the benefits they receive.

Health insurance was the top must-have benefit for employees, even ahead of a retirement plan and paid or unpaid time off.

The report suggested a five-step plan for businesses to improve well-being. They are:

• Review programs and benefits to optimize opportunities to improve employees’ holistic well-being.

• Assess opportunities to offer increased flexibility to employees.

• Gauge employee interest in pilot programs, and measure the business impact.

• Explore options to enhance benefits offering by adding voluntary benefits that enable employees to address their individual situations, mitigate stress, and increase financial security.

• Apply an employee-centric approach to enhance benefits strategies and communications to highlight how traditional and non-traditional benefits work together to address diverse employee needs and challenges. Drive employee awareness and engagement by communicating the value of benefits year-round, not just during annual enrollment.

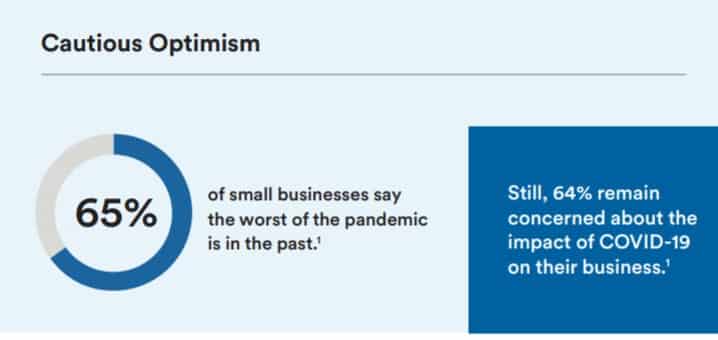

Because the survey was conducted before the latest wave of COVID-19 infections accelerated, employers might have been overly optimistic about recovery, with 65% saying they thought the worst of the pandemic was behind them.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

COVID-19 Drove Insurance Sales In Past Year, MDRT Survey Showed

Michigan Producer Wrote ‘Fraudulent Certificates Of Insurance,’ Docs Say

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Sorensen and Miller-Meeks disagree on ACA health insurance subsidies, prepare for shutdown

- Pittsburgh Post-Gazette to publish final edition and cease operations on May 3

- After subsidies expire, skyrocketing health insurance premiums are here.

- Congress takes up health care again – and impatient voters shouldn’t hold their breath for a cure

- Guardant Health’s Shield Blood Test for Colorectal Cancer Screening Now Available for U.S. Military Members and Families

More Health/Employee Benefits NewsLife Insurance News