Few players propelling huge private equity push into insurance

Private equity surged 25.8% last year in life insurance and appears to be going strong in 2022, but the investments might be hitting a ceiling with the industry’s caution, as well as legislative and regulatory scrutiny.

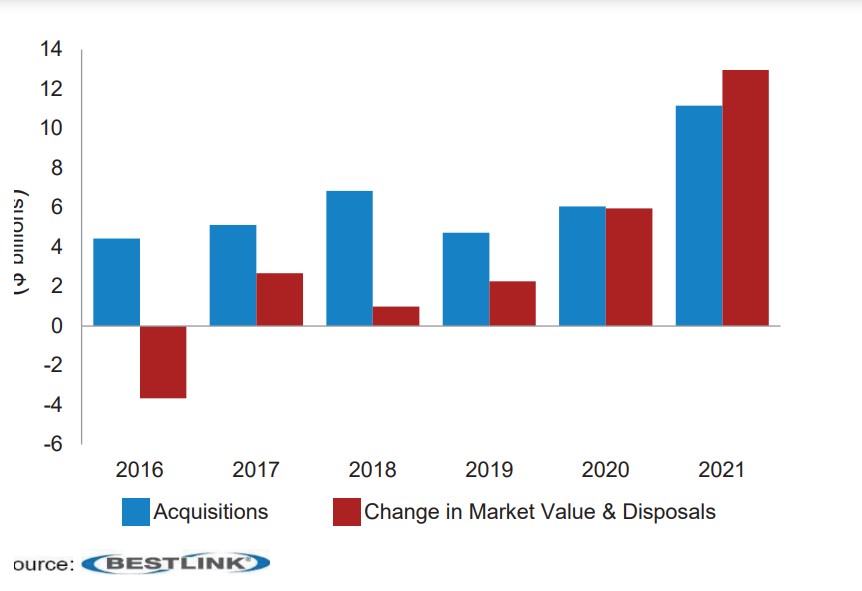

Insurance companies’ private equity investments grew to $117.4 billion in 2021, up from $93.3 billion the previous year in the biggest year-over-year increase in recent years, according to an AM Best report.

“The need for yield continues to make alternative investments such as private equity an attractive option for insurers looking to diversify their investment portfolios or ramp up allocations, to increase returns in an environment characterized not just by low interest rates, but also equity and spread volatility,” according to the report, “Strong Performance, New Investments Drive Private Equity Growth.”

Although the growth has accelerated, relatively few companies are dipping deeply into the private equity well. Ten insurers were involved with 60% of acquisitions for the year, with MassMutual itself accounting for 25% of acquisitions by book value and 10% of total deals. But a chunk of the carriers had their figurative toe in the market.

“Nearly a third of insurers had new investments totaling less than $5 million, well below median $25 million, signaling a more cautious approach by most of the insurers that do not have significant scale or inhouse expertise with this asset class,” according to the report.

In the life/annuity space, 51.4% of P/E was for leveraged buyouts, 24.5% venture capital and 10.5% in mezzanine financing, which allows the lender to convert to equity if the borrower defaults.

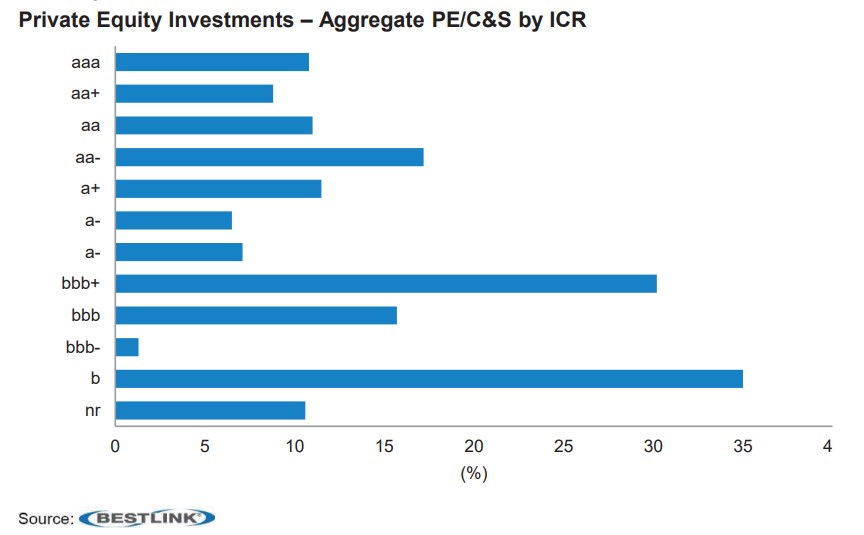

One of the concerns that analysts and regulators have about private equity is the risk the asset managers take for their returns. The AM Best report bears out that the managers’ investments do skew lower on the ratings scale.

SUB: S&P: Legislators, Regulators Are Watching

An article from S&P Global also noted the steady rise in reinsurance over the past several years.

Private equity is a key driver in that growth, which is expected to continue, which is increasingly catching the eyes of legislators and regulators, according to the S&P Global article, “Large deals elevate private equity-line reinsurers in US life, annuity market.”

The U.S. Senate Banking Committee asked the Federal Insurance Office to work with the National Association of Insurance Commissioners to examine the growing number of insurance obligations being transferred to alternative asset managers. The S&P article quoted committee Chairman Sherrod Brown, D-Ohio, expressing concern that the management firms pursue associated with the growing number of insurance obligations being transferred to alternative asset managers.

Brown alleged that those firms pursue much higher risk strategies without the same regulatory scrutiny that “well-regulated” insurance companies, putting retirement savings at risk. NAIC is already looking into regulations around private equity-owned insurers.

New designation considered

The NAIC is considering a new designation to distinguish between a traditional stock insurance company from a financial entity-owned insurer that is more focused on “focused on generating fees than upstreaming dividends to a parent company or individual stockholders,” according to the S&P article.

The NAIC defines the financial entity as one that derives most of its revenue through financial assets, is not a regulated insurer and has assets under management. The definition would cover the usual leaders such as Apollo, Carlyle, Sixth Street and Brookfield, most of which have made headlines with huge deals. But the wide net would capture other perhaps unsuspecting carriers.

“The wide net seemingly cast by the NAIC concept, however, could result in financial-entity-owned insurer designations for the likes of the Fidelity & Guaranty Life Holdings Inc. subsidiaries of Fidelity National Financial Inc. based on their strategic investment agreements with Blackstone,” according to the article.

Conning: Outside the comfort zone

Conning, in a report this month, also noted the dramatic increase in asset manager-affiliated insurers’ share of the annuity market. But researchers also detected a plateau approaching because of risk appetite, according to Scott Hawkins, head of insurance research.

“We’ve seen some AM-affiliated annuity insurers pursue PRTs (pension risk transfers), variable annuities and annuity-style income solutions for 401(k)s while others acquire credit and issue securities backed by financing agreements,” Hawkins said. “Going beyond annuities may capture more assets, but may also push these AM-affiliated annuity insurers out of their comfort zone and introduce new risks.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

NAIFA symposium provides insight, advice on engaging a more diverse client base

Pandemic, disparities, trust erosion challenge health care

Advisor News

- Raven MacFarlane-Bradbrook: We need Medicaid more than billionaires need tax cuts

- Could in-plan annuities head up a new asset class?

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Medicaid reform bill heads to Senate

- Ask The Medicare Specialist

- House approves health care coverage for firefighters

- Artificial intelligence is a hot topic

- Raven MacFarlane-Bradbrook: We need Medicaid more than billionaires need tax cuts

More Health/Employee Benefits NewsLife Insurance News