Fed’s 2% inflation target means deep recession, says BlackRock

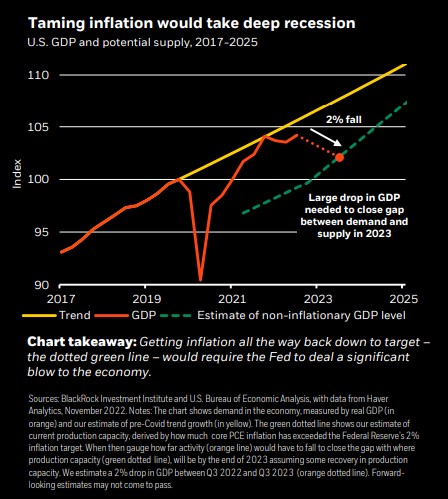

If the Federal Reserve wants to drive inflation down to its target of 2%, it will force a deep recession, according to BlackRock’s 2023 Outlook.

The central bank is using an old tool for the new problem of production constraints, BlackRock analysts wrote. The Fed’s increases of its funds rate will do little to tame inflation that has already sent bond yields soaring while grounding equities and fixed income.

Unlike previous economic downturns, this one was caused by a consumer shift from services to goods during the pandemic, just when manufacturers had more difficulty producing and shipping products. Meanwhile, an aging population has contributed to a worker shortage, so wages have been increased to attract employees. More production would necessitate more wage inflation, according to the report.

“That leaves them with a brutal trade-off,” the analysts wrote. “Either get inflation back to 2% targets by crushing demand down to what the economy can comfortably produce now (dotted green line in the chart) or live with more inflation. For now, they’re all in on the first option.”

Besides the aging population’s suppression of labor supply, two other factors affecting the economy are geopolitical tension disrupting trade and carbon control causing a mismatch between energy supply and demand. These factors mean that the Fed’s tools won’t fix modern problems.

Rethinking equities and bond strategy

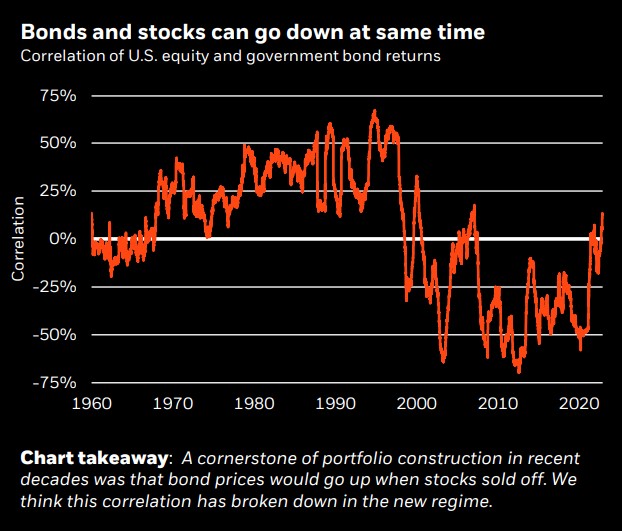

Just as the Fed’s antiquated thinking won’t solve today’s economic problems, old financial standbys won’t serve current investors’ needs, according to the report.

“That’s why the old playbook of simply ‘buying the dip’ doesn’t apply in this regime of sharper trade-offs and greater macro volatility,” analysts wrote. “The new playbook calls for a continuous reassessment of how much of the economic damage being generated by central banks is in the price.”

The new strategy will require frequent reassessment of risk because the damage caused by the Fed’s policies is compounding. For example, soaring mortgage rates have cratered home sales, sending shock waves through the economy. CEOs are losing faith in the economy’s rebound, so they are delaying capital spending and laying off workers.

All of these effects have not been priced into equity earnings expectations, which the analysts said have not factored in an even mild recession. That is why BlackRock is underweight in developed market equities. As such, market valuation seems to be priced for a soft landing, according to the report.

On bonds, fixed income is finally living up to the “income” part of the equation after years of low yields. BlackRock, the world’s largest holder of assets, is turning toward investment-grade credit, especially because companies had refinanced debt at lower yields.

But BlackRock is not so keen on long-term government bonds, as they would have been in earlier downturns.

“Why? Central banks are unlikely to come to the rescue with rapid rate cuts in recessions they engineered to bring down inflation to policy targets,” according to the report. “If anything, policy rates may stay higher for longer than the market is expecting.”

Central banks are cutting back on bond holdings and Japan might stop buying, while governments continue to run deficits and issue bonds.

The firm prefers short-term government bonds because of the increase in yields, which has two-year Treasuries paying better than 10-year Treasuries. BlackRock is also turning more toward investment-grade credit rather than equities. The firm favors U.S. agency mortgage-backed securities for their higher income and protection though the government ownership of the issuers. And, of course, inflation-linked bonds are also in the buy column.

As far as industries are concerned, the firm likes healthcare and perhaps surprisingly also energy. That’s because even though energy sector earning may be cooling, they will hold up because of continued tight energy supply.

Living with inflation?

It all comes down to the question of whether the Fed will keep cranking up rates and bring on the pain of a significant recession to break inflation. BlackRock is not so sure the central bank has the stomach for that.

But what is clear to the firm’s analysis is that there has been precious little discussion about the damage the Fed’s actions is doing to growth and jobs. That reckoning is probably coming though.

“We think the ‘politics of inflation’ narrative is on the cusp of changing,” according to the report. “As the damage becomes clear, the ‘politics of recession’ will take over.”

The Fed is in danger of turning financial cracks into floodgates if it pursues its rate increases -- and risks a pushback similar to the one in the UK that forced a prime minister to resign, according to the report.

In perhaps an optimistic view, the analysts project that the Fed will not insist on its 2% inflation target and take it easy on the rate hikes.

“The cycle of outsized rate hikes will stop,” the analysts wrote, “without inflation being back on track to return fully to 2% targets, in our view.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

James Lee becomes 2023 FPA president

Stosic named interim Nevada insurance commissioner

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- State-by-state report by Dems projects millions could lose Medicaid coverage

- CT bill would prohibit AI use by health insurers

- Evil stalks the land

- Idaho House approves Medicaid reform bill

- Trump makes it official: The American apology tour is over

More Health/Employee Benefits NewsLife Insurance News