Fed eyes big rate boost while half of Americans say they are worse off today

The stock market slid on Monday because of many worries, but one key concern may be good news for the life and annuity industry: a potential 100 basis-point boost to the key Fed funds rate.

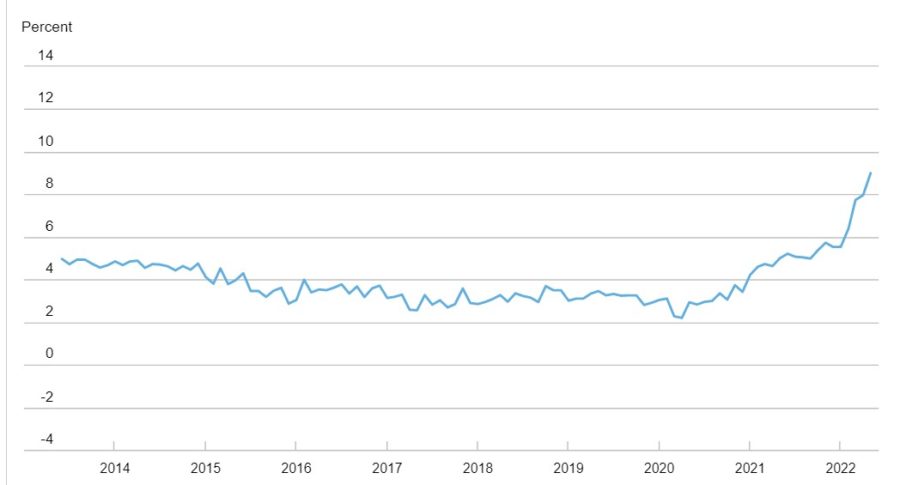

Analysts had been expecting an increase as high as 75 basis points when the Federal Reserve releases its funds rate on Wednesday, but some are floating a 100 basis-point increase, according to Bloomberg News.

“The Fed’s trying to erase any perception that they’re behind the curve,” Steven Englander, global head of G-10 FX research at Standard Chartered Bank, told Bloomberg. “Fifty was the big round number six months ago. Meanwhile, 75 is a very middling type of hike. So, the Fed might say: ‘Look, if we want to show commitment, let’s just do 100.’”

The article also showed that equity markets had priced in a 175 basis-point increase over the next three quarterly Fed meetings. The projection of a full percentage point increase in one meeting this week apparently is shared by a small minority, but many have revised their estimate to 75 basis points, up from 50, which in itself was considered dramatic in as little as a half year ago.

The rate increase is good news for annuity rates, which have been ticking up along with Fed rates, with expectations of further increases.

Also on Monday, the New York Federal Reserve adjusted its one-year ahead inflation expectation in May to 6.6%, up from 6.3%, the highest reading since the inception of the survey in June 2013.

Americans expect to continue spending big a year from now, with the median household nominal spending growth expectation increasing sharply to 9%, up from 8% in April, for the fifth consecutive increase and a new series high.

“The increase was most pronounced for respondents between the age of 40 and 60 and respondents without a college education,” according to the Fed.

Respondents in the Fed’s survey also reported more difficulty accessing credit with the expectation of more difficulty in the year ahead.

Consumer Anxiety Accelerates

Consumers’ anxiety over the probability of missing a minimum debt payment over the next three months increased 0.4% to 11.1% in May. This was especially true of those between 40 and 60 and those with a high school diploma or less.

Perceptions about households’ current financial situations deteriorated “noticeably” in May with more respondents reporting they are financially worse off today than a year ago, according to the Fed, reporting that 32.8% of respondents said they were worse off than they were a year ago and 13% much worse off, meaning nearly half of Americans (46%) are worse off than they were a year ago.

Last May, only 15.6% said they were somewhat worse off and 4.2% were much worse off than they were a year prior, totaling 19.8%.

Americans were not expecting their financial situation to improve over the next year with 28.6% saying they expected to be somewhat worse off in a year and 10.8% expected to be much worse off, meaning nearly 40% of Americans expect to be doing even worse than today’s low point.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

AmeriLife announces strategic investment from Genstar Capital

Insurance industry awaits impact as regulators grapple with data privacy

Advisor News

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

- Emergency Preparedness: How advisors can prepare clients for hurricanes

- Federal employees: An emerging market for advisors

- The financial advisor’s guide to creating an effective value proposition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Ohio Farm Bureau supports bill to create affordable health plan options

- Guest opinion: The high costs of single-payer health care

- Medicaid overhaul proves to be politically perilous proposition

- Worries persist about CVS Health

- Cigna commercial health plans may go out-of-network at large local hospital group

More Health/Employee Benefits NewsLife Insurance News

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

More Life Insurance News