Excess Mortality recedes, but remains above normal

[ Editor's Note: InsuranceNewsNet recently discussed what is known about excess mortality and what might be done to combat this phenomenon with the "Insurance Collaboration to Save Lives," a new non-profit organized to “seek answers, save lives, and mitigate loss.” The ICSL assembled a panel of insurance, regulatory, and healthcare experts take part in a video discussion on the topic. See the video conversation here; read a the transcript of the discussion here. ]

While the materialization of what the life insurance business calls “excess mortality” during the COVID-19 pandemic was not unexpected, its persistence has raised questions, including whether the elevated levels of death – and disability – are becoming the new normal?

Excess mortality was the bane of the industry’s financial results over the last few years, leading to depressed earnings and losses. The term is a polite way to say more people were dying than was expected or predicted, thus the policy claims were higher and the payouts greater than the companies had reserved for.

While the pandemic, for the most part, has subsided, mortality rates – the number of deaths compared to historically baseline levels – is still higher than normal, and may be poised to climb even higher. And while theories abound as to the cause, no one – from industry analysts to healthcare specialists, to policymakers, to underwriters – has a handle on this chilling phenomenon.

Above: InsuranceNewsNet recently discussed what is known about excess mortality and what might be done to combat this phenomenon with the "Insurance Collaboration to Save Lives," a new non-profit organized to “seek answers, save lives, and mitigate loss.”

'Prime-of-life' deaths remain high

The most likely explanation for the higher-than-normal mortality rates is a combination of lifestyle, health, diet, accidents, suicides, and behaviors, some of which can be attributed or traced to the COVID-19 Pandemic. Though mortality rates have indeed come down, there are some startling findings in the numbers. Particularly, young adults seem to be more affected, with death rates among the so-called “prime-of-life people” unusually high. Among working people 35 to 44 years old, a whopping 34% more died than expected in the last quarter of 2022, and the numbers haven’t subsided much.

“COVID-19 claims do not fully explain the increase,” a Society of Actuaries report concluded.

Excess deaths among white collar workers, traditionally and generally more healthy than blue-collar workers, were proportionally higher - 19% versus 14% above normal. This disparity nearly doubled among top-echelon workers in the fourth quarter of 2022, U.S. actuaries reported.

And there was an unusual and extremely sudden increase in worker mortality in the fall of 2021 even as the world saw a drop in COVID-19 related deaths. In the third quarter of 2021, deaths among workers ages 35-44 reached a pandemic peak of 101% above – or double – the three-year pre-COVID baseline. In two other age groups, mortality was 79% above expected.

And the sad beat goes on. Excess death claimed 158,000 more Americans in the first nine months of 2023 than in the same period in 2019. That’s more than the combined losses from every US war since Vietnam.

Death toll remains 'alarming'

“With the worst of COVID behind us, annual deaths for all causes should be back to pre-pandemic levels — or even lower because of the loss of so many sick and infirm Americans. Instead, the death toll remains ‘alarming,’ ‘disturbing,’ and deserving of ‘urgent attention,’ according to insurance industry articles,” according to an article authored by Dr. Pierre Kory, president and chief medical officer of the Front Line COVID-19 Critical Care Alliance, and Mary Beth Pfeiffer, an investigative reporter and author.

The head of the Federal Drug Administration, Dr. Robert M. Calif, recently acknowledged the chilling numbers and the concurrent drop in U.S. life expectancy, calling for an “all hands on deck” alarm on the matter.

“We are facing extraordinary headwinds in our public health with a major decline in life expectancy,” he wrote. “The major decline in the U.S. is not just a trend. I’d describe it as catastrophic.”

The government, industry, and the public all have a role to play in improving life expectancy, Calif said. “Let’s get to it,” he wrote.

Whether this is a temporary phenomenon, or perhaps a new normal when it comes to mortality rates is a looming question.

'These are big numbers'

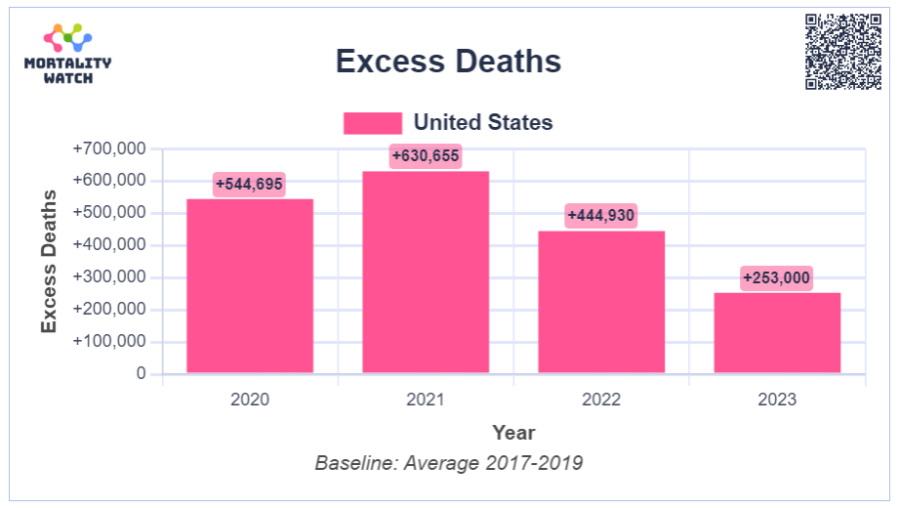

The numbers for excess mortality luckily, in 2022, declined,” said Josh Stirling, founder and president of the Collaboration. “But you're still rates like 10%, 12%, 11%, 14% higher than normal. These are big numbers.”

Stirling began the presentation with the latest chart from usmortality.com, dramatically showing that numbers have declined post-pandemic. But nowhere near back to normal.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

BlackRock, Equitable product offers retirement security, predictable ‘paycheck’

Retirement ‘fluency’ linked to retirement confidence, study finds

Advisor News

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

More Advisor NewsAnnuity News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

More Annuity NewsHealth/Employee Benefits News

- AM Best to Host Briefing on Negative Pressures on U.S Health Insurance Segment and Whether an Inflection Point has Arrived

- Long-Term Care Insurance: A lifeline or a financial nightmare for seniors?

- New CEO at major health insurer with 3K CT employees. ‘Excited to build on our strong foundation’

- What Florida Blue members in Broward should know about billing, ER and other care

- Best’s Market Segment Report: US Health Insurers Seek to Improve Underwriting Performance in 2026 Amid More-Pronounced Pressures

More Health/Employee Benefits NewsLife Insurance News

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

More Life Insurance News