Excess mortality for 65+ adults dropping after COVID-19 peak

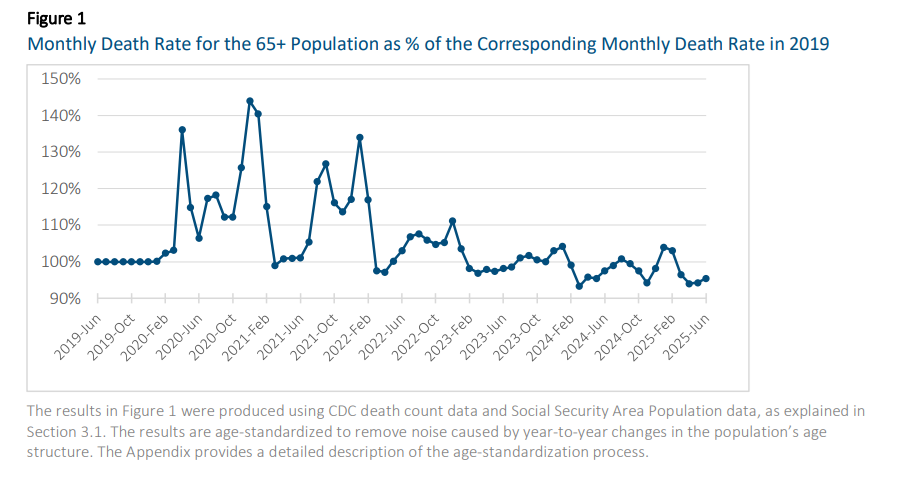

Excess mortality for Americans aged 65 or older dropped from more than 20% at the peak of the COVID-19 pandemic to only 1.3% in the past year – according to a new analysis from the Society of Actuaries Research Institute.

Using the latest data from the Centers for Disease Control and the Social Security Administration, the research institute’s Retirement Plans Experience Committee 2025 Mortality Improvement Update examined how U.S. retirement-age populations are faring in the aftermath of the pandemic.

Spikes in mortality persisted through early 2022, driving up the overall average excess mortality for the year, the analysis said. However, since that time, U.S. population mortality rates have returned to levels more consistent with 2019, and have exhibited the seasonal pattern usually seen in the U.S.

The updated excess mortality data shows that “COVID-19 is still out there, but its effect on mortality is significantly diminished,” said Patrick Weise, lead modeling researcher, SOA Research Institute and one of the study’s authors.

Weise said that when comparing to current mortality levels against 2019, “We are below mortality levels that were observed in 2019, so we are fully recovered from the pandemic. That’s true across all age groups with the exception of ages 35-44.”

For RPEC’s report, Social Security Area Population data was obtained from the 2024 Old-Age, Survivors, and Disability Insurance Trustees report. The report shows some small shifts to SSAP estimates for the 65-and-older population. For the period from 2019 through 2022, the estimated 65+ population decreased slightly, while for 2023 and 2024 it increased slightly.

RPEC is aware that some actuaries and pension plan sponsors would like somehow to reflect the potential lingering effects of the COVID-19 pandemic in an adjusted mortality assumption. It continues to be RPEC’s opinion that it would not be appropriate to publish an MP scale reflecting a COVID-19 adjustment given the uncertainty regarding the effects of the pandemic on future mortality levels.

However, RPEC also continues to believe that an actuary could reasonably use the information in this report and other sources to develop their own “COVID-adjusted” mortality improvement scale reflecting their opinion and their clients’ opinions on the potential future effects.

Weise said the data shows that mortality rates “have recovered from the shock of COVID-19.”

“While we certainly had many deaths, going forward, we’re back to mortality rates that existed prior to the pandemic for those 65-plus.”

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

How AI is reshaping the insurance industry

Why fiduciary liability insurance is necessary as PE enters the 401(k) space

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News