Economists predict ‘brief and shallow’ recession

A global recession isn’t in the forecast, but a “brief and shallow” recession is expected to occur in the U.S. and Europe, an economist said Friday.

Dana M. Peterson, chief economist with The Conference Board, said at a webinar that Russia and Ukraine are already in a recession, the U.S. and Germany are predicted to experience recession, and “we are expecting very slow growth in China.”

Peterson listed the trends that are moving the global economic outlook downward. They include:

- The continuing COVID-19 pandemic and the war in Ukraine dominate the global economic outlook.

- Supply chain disruptions and inflation are key drivers of weaker economic growth.

- Central banks are tightening monetary policy to combat inflation.

- Demographics and lingering pandemic effects are buffeting the labor markets.

The key risks to the global economic outlook, Peterson said, are:

- Geopolitics and the escalation of the war in Ukraine.

- Higher inflation.

- Monetary and fiscal policy mistakes,

- Recession

- Shortages of labor and raw materials.

- War and climate events disrupting food production and leading to food inflation.

- Industrial policies

- The transition to a “green economy,” which she said is disruptive but expected not to contribute to inflation in the long run.

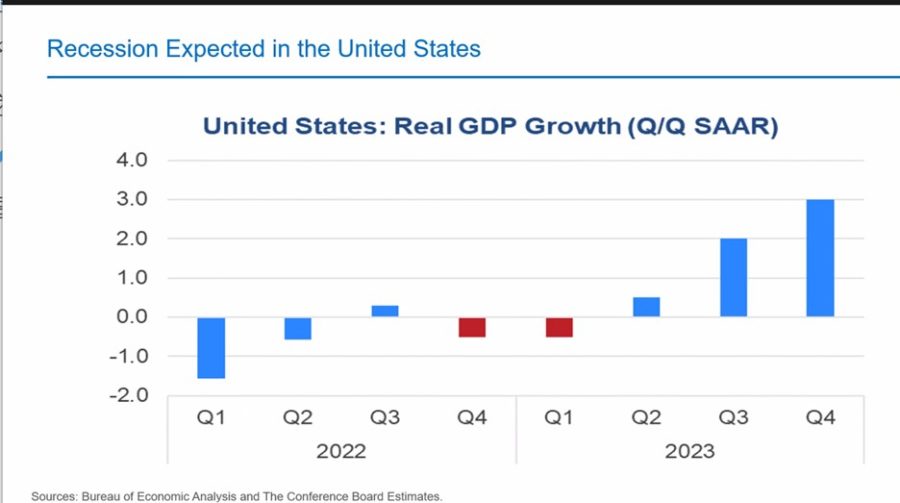

Peterson predicted “a brief but shallow recession” in Europe, beginning in fourth-quarter 2022 and lasting through first-quarter 2023. Fueling that recession is the escalation of the war in Ukraine leading to an energy crisis in Europe. The collapse of the housing market in China, as well as continued COVID-19 lockdowns, are leading to an economic slowdown in that country. In the U.S., a recession is expected as a result of the Federal Reserve attacking inflation by increasing interest rates. She also noted that consumer spending in the U.S. is shifting from goods toward services.

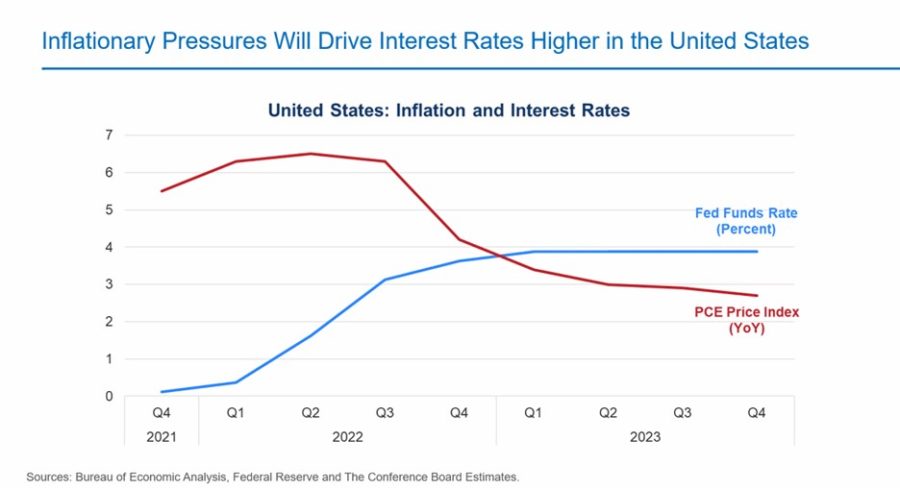

Inflationary pressures drive higher US interest rates

The U.S. “is making some progress on the inflation front,” said Erik Lundh, The Conference Board principal economist. However, he added he does not expect the Fed to realize its goal of meeting its target of 2% annual inflation rate. Lundh predicted inflation will slow gradually from 4Q 2022 through 2023.

Consumer spending in the U.S. continues to slow and contract, Lundh said. Spending “is holding up but we are concerned about 4Q 2022 and 1Q 2023 – envisioning a brief and mild recession. Once that period elapses, the U.S. economy will start to expand again in second half of 2023.”

Lundh said he is concerned about several factors impacting the U.S. economy, including increased interest rates, continued inflation, the housing market and government spending on the Infrastructure Investment and Jobs Act that was passed in November.

As the infrastructure bill is rolled out, Lundh said, “We expect to see more of those dollars hitting roads, bridges and rails, boosting economic growth. If there are delays getting shovels in the ground, that will delay our growth forecast. As for inflation – as these programs get rolled out, they do have potential to drive costs up for materials, commodities and labor. There is the potential if these projects are postponed, that could impact our inflation forecasts and bring them down a touch.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Advisors, tax pros weigh in on best year-end tax planning tips

6 ideas for insurance industry talent attraction and retention

Advisor News

- 4 things every federal worker should do to safeguard their benefits

- Six steps to turn HNW friends into clients

- The two-bucket investment approach to making money last

- Republicans confront difficult Medicaid choices in search of savings to help pay for tax cuts

- Economy showing momentum despite uncertainty

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Senate passes bill capping medical insurance coverage

- Targeted by Trump, Medicaid funding stirs debate as CT changes rules for hospitals

- Studies from University of Occupational and Environmental Health Provide New Data on COVID-19 (Avoiding the Use of Outpatient Rehabilitation Services Under Long-term Care Insurance During the Covid-19 Pandemic): Coronavirus – COVID-19

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- This West Linn house, birthplace of Oregon prepaid health plans, is on National Historic Register

More Health/Employee Benefits NewsLife Insurance News

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

More Life Insurance News