Drop in M&As ‘a return to normal,’ OPTIS exec. says

Although acquisitions and mergers in the insurance agency have just experienced the largest decline ever, this is not a signal that activity is taking a turn for the worst. Rather, Steve Germundson, partner at OPTIS Partners, says it's a "return to normal."

After several years of strong M&As, activity has dropped 27% for the first three quarters of 2023. However, Germundson said the prior period of increased activity was an "aberration" that is now beginning to even out.

"We're back to an environment where interest rates are closer to historic norms," he said. "The cost to borrow money is closer to historic norms, and so is the volume of deal activity… That cycle that we've lived through was an aberration."

Germundson added that this balancing out of M&A volumes is likely to continue in 2024. While buyers may be more selective from this point on, M&A activity could still be driven by sellers concerned about economic uncertainty.

The M&A 'bubble burst'

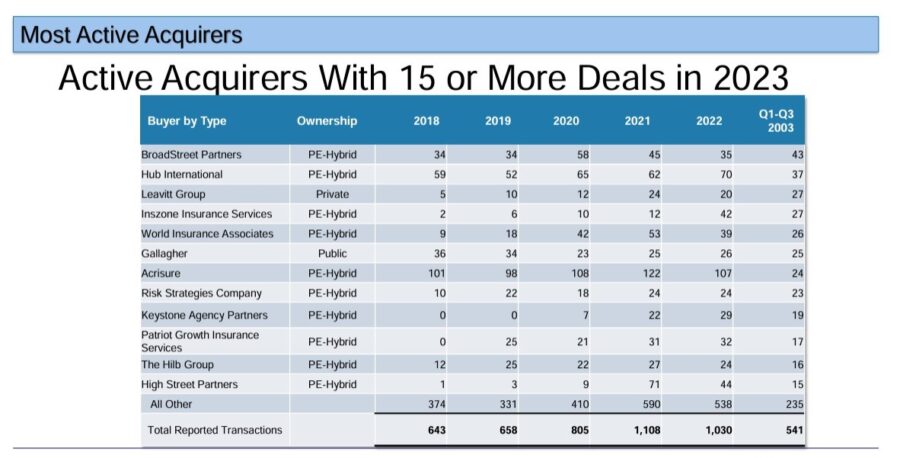

OPTIS, an investment banking and financial consulting firm, reported 534 M&As by Q3 2023, as compared to 729 by Q3 2022. It noted that this was "the largest decline through the third quarter ever reported." Experts are calling it a "burst" of the previous "bubble" of booming activity.

"We saw several regular buyers really either really step out of buying completely or really draw back," Germundson said. "In general, I think many, many buyers are a little bit more selective about the firms they're going to pursue."

For example, major acquisition firm Acrisure went from hundreds of acquisitions per year since 2018 to just 24 by Q3 2023.

According to OPTIS, the cooldown in activity could be due to factors like rising costs of capital and an increase in leverage, among others. Higher interest rates, in particular, could have blocked activity from private equity buyers reliant on debt financing.

On the other hand, other firms like BroadStreet Partners and Hub International are maintaining relatively high volumes of deals, potentially balancing the gap.

Larry Lineker, Hub International executive vice president and executive management team member, said the firm attributes its growth to ongoing investments in industry and product specialization and expansion into new areas such as retirement, private wealth and risk and international solutions, among other strategic activities.

"With the recent successful debt refinancing, sizable increase to revolving credit facility and a substantial minority investment from funds managed by Leonard Green & Partners, Hub continues to be a strong player in the M&A space," Lineker said.

For BroadStreet Partners, the focus has been more on consistency.

"There's obviously been some changes in the macro environment in terms of what's been happening in M&A, but I think we've been steady as she goes," Mike O'Connor, BroadStreet Partners CEO, said. "That's our absolute principled approach to how we run the business, which is we want to be very consistent about how we think about recruiting and investing in partners and continuing to support their ongoing acquisitions."

Future M&A projections

OPTIS expects deal volumes to return to pre-2019 levels unless there's an economic change for the worse, such as if inflation and interest rates start to rise.

"We're going to see a continuation of mergers and acquisitions at a more normal pace. There are still plenty of good firms out there that will, at some point, be sold," Germundson said.

Hub International, for instance, plans to continue investing in the areas that it believes brought it success in the M&A space during a period where many other major players saw a downturn. It also plans to explore new initiatives at the same time.

"HUB remains bullish on its acquisition strategy and growing its geographic footprint," Lineker said.

BroadStreet likewise expects to maintain its consistent approach heading into 2024.

"There's nothing on the horizon that would cause us to have any sort of change in approach or appetite," O'Connor said. "We continue to have the same sort of mindset. We want to find great firms to bring together and bring into the BroadStreet family and support our partners in M&A, and that's what we're going to do going into next year."

Economic uncertainty could drive sales

Germundson suggested that fears about inflation or political uncertainty could spur business owners to sell, possibly driving deals.

"There are still a lot of deals being done because so many people have just realized now [they] also have some economic uncertainty, like will inflation grab a hold [or] will there be any political or global uncertainty," he said.

At the same time, business owners may want to carefully weigh their options and not be spooked by the drop in M&A activity. Germundson said that not only is having one's own business "the best investment you can have," but an owner who sells at this moment may have difficulty finding a "home for the proceeds from the sale."

Rayne Morgan is a Content Marketing Manager with PolicyAdvisor.com and a freelance journalist and copywriter.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Advisors should see digital tools, apps as opportunity, J.D. Power says

Longtime consumer advocate Birny Birnbaum to retire from NAIC duties

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Wyoming's catastrophic 'BearCare' health insurance plan could become reality

- Duckworth pushes military IVF coverage as critics warn taxpayers could pay

- House to consider extension for expired ACA subsidies

- Health insurance costs spike after key ACA subsidies end

- Veterans defend nonprofit exec accused of theft

More Health/Employee Benefits NewsLife Insurance News