Do Investors Want The Bengals Or Rams To Win?

By Ryan Detrick

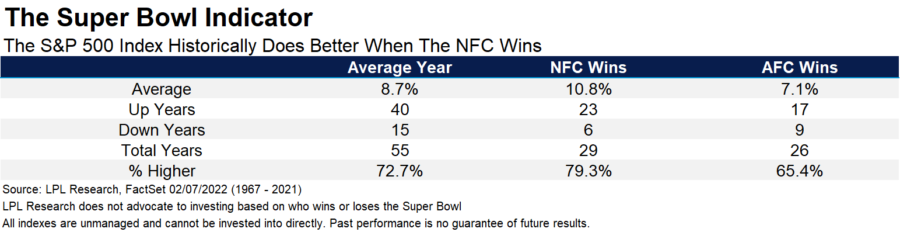

The Super Bowl Indicator suggests stocks rise for the full year when the Super Bowl winner has come from the original National Football League (now the NFC), but when an original American Football League (now the AFC) team has won, stocks fall.

We would be the first to admit that this indicator has no connection to the stock market, but “data don’t lie”: The S&P 500 Index has performed better, and posted positive gains with greater frequency, over the past 55 Super Bowl games when NFC teams have won.

It was originally discovered in 1978 by Leonard Kopett, a sportswriter for the New York Times. Up until that point, the indicator had never been wrong.

A simpler way to look at the Super Bowl Indicator is to look at the average gain for the S&P 500 when the NFC has won versus the AFC—and ignore the history of the franchises. As shown in the LPL Chart of the Day, this similar set of criteria has produced an average price return of 10.8% when an NFC team has won, compared with a return of 7.1% with an AFC winner.

An NFC winner has produced a positive year 79% of the time, while the S&P 500 has been up only 65% of the time when the winner came from the AFC.

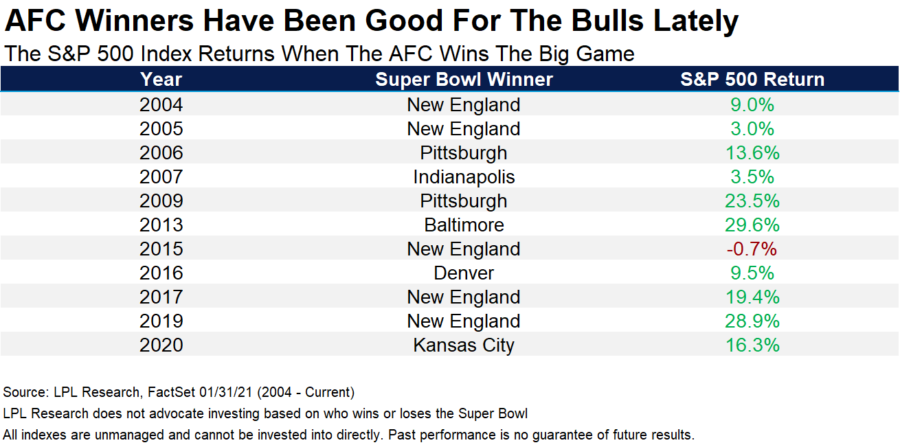

So should the bulls be rooting for the Rams? Maybe not. Stocks have actually done just fine lately when the AFC has won. In fact, the S&P 500 Index gained 10 of the past 11 years after an AFC Super Bowl champ.

“Interestingly, there have been 55 Super Bowl winners, yet only 20 teams account for those wins,” said LPL Financial Chief Market Strategist Ryan Detrick. “Of course, we’d never suggest investing based on this, but history would say that lately AFC teams have been quite good for stocks, but I’m also a Bengals fan, so I’m clearly biased.”

Here’s a breakdown of the 20 Super Bowl winners and how the S&P 500 has done following their victories. The author’s favorite team, The Cincinnati Bengals, isn’t on this list just yet. Hopefully that changes this time next week.

Lastly, Tom Brady won’t be in this Super Bowl and won’t be in any more now that he has retired. He played in a record 10 Super Bowls and won a record 7 of them. Maybe something he should be known for is the Brady Indicator, as when he won the big game stocks did well and when he lost, they didn’t.

LPL Research would like to reiterate that in no way shape or form do we recommend investing based on this data, but here’s to a great game and safe Super Bowl weekend everyone!

For more on the Bengals and Rams, earnings, and a look at the global economy, please watch the latest LPL Market Signals podcast with Jeff Buchbinder and Ryan Detrick, as they break it all down.

Ryan Detrick is chief market strategist for LPL Financial

Sell More With Less: Using A Virtual Assistant

Americans More Likely To Work For An Employer Offering Voluntary Benefits

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- PALLONE REMARKS AT HEALTH AFFORDABILITY HEARING

- The Health Care Cost Curve Is Bending up Again

- Republicans can make healthcare affordable by focusing on insurance reforms

- Governor Stitt strengthens regulations for Medicare Advantage Plans

- Health insurance CEO can't commit to safe AI practices in Congressional hearing

More Health/Employee Benefits NewsLife Insurance News