Consumers Looking To Buy Life Insurance

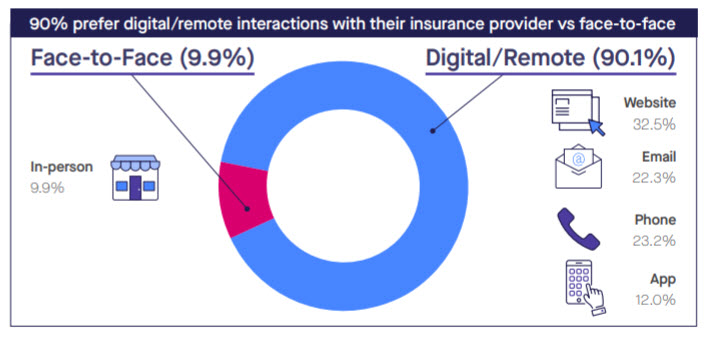

Half of all consumers are interested in increasing or buying life insurance, but they are 90% certain that they don’t want to do business face-to-face.

That is according to a survey conducted at the end of March, as COVID-19 and lockdowns were spreading nationally.

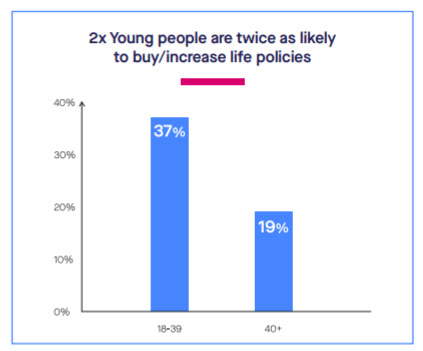

Young people were also more interested in life insurance. With 37% of respondents age 18 to 39 likely to buy or increase life insurance, they doubled the percentage of those 40 and over who were interested in buying or increasing at 19%.

Nearly nine out of 10 consumers of all ages did not want to go to an agent’s office, with 89% saying they would shop online.

But when it came to filling out documents, only 8.95% of the respondents said they were OK with going to an office.

Consumers at that time were already cutting expenses, with 64.5% trimming their personal spending. Even at that point, they were not likely to have many spending opportunities, considering 82% were afraid to leave their homes. More than half (56%) were worried about their finances.

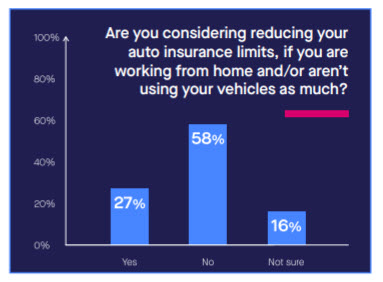

In that first month of lockdowns, 24% contacted insurance across all lines with concerns about coverage. Only 27% were considering reducing their auto coverage because they were not using their vehicles as much.

The survey of more than 1,000 consumers was conducted on March 29 by Lightico, in partnership with Sapiens.

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

A Different Recession For Young Advisors

Stay Motivated In The Midst Of The Pandemic

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- NM fills gap after Congress lets ACA tax credits expire

- Congress takes up health care again − and impatient voters shouldn’t hold their breath for a cure

- On the hook for uninsured residents, counties now wonder how to pay

- Bipartisan Senate panel preparing ACA subsidies bill

- CT may extend health insurance sign-up amid uncertainty over future of ACA subsidies, Lamont says

More Health/Employee Benefits NewsLife Insurance News