Considerations for defusing the coming explosion in succession planning

By John Troncoso

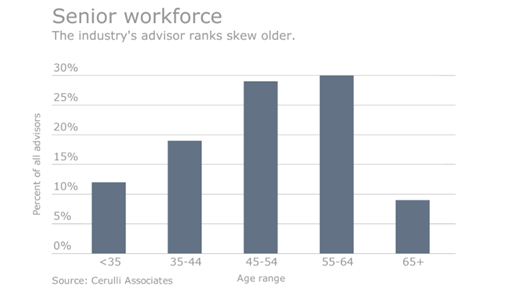

In the realm of financial services, it is widely acknowledged that many financial advisors are approaching retirement age, with a sparse representation from younger demographics.

A 2019 J.D. Power study reveals that the average age of financial advisors is 55 years old; Moreover, 20% are 65 or older, while only about 10% are under 35, according to Cerulli Associates. Efforts to recruit younger advisors have not yet yielded the desired results. This will pose a larger problem as the advisor profession becomes increasingly gray and there are fewer young people becoming advisors further exasperating the issue.

This column does not intend to belabor a well-accepted phenomenon but rather to discuss its implications from the perspectives of your clients, yourself, and your business and some considerations for optimizing outcomes in an exceedingly difficult process.

Client concerns

Consider that, like many advisors, your client demographics likely mirror your own: numerous clients in their sixties who are retired or nearing retirement. As they embark on their new journey, what does their advisor's retirement timeline look like? Imagine a 60-year-old advisor counseling a similarly aged couple.

In a decade, the couple is coasting into a comfortable retirement, and their advisor is contemplating the same. If this advisor is among the few with a succession plan, who takes over? If the successor is another 60-year-old (very probably given the above) who decides to retire at 70, who follows? Should one of the clients live to 100, they might see up to five different advisors.

How likely is it that they will harmonize with each successive advisor, avoiding a game of telephone with their financial strategies at their most vulnerable? The advisor musical chairs must be planned for but is increasingly a complex ask given the demographic imbalance.

Further, clients' expectations are broadening while you might be looking to scale back. The industry has evolved from a phone call and stock sale model to requiring deeper planning and a more comprehensive touch. If you are unwilling to engage where the clients are, attrition may increase.

The next generation of clients is also more hesitant to engage with advisors, a trend underscored by the rise of platforms like Robinhood. Are you at risk of losing clients to intra-life gifting or as part of an estate plan? Undoubtedly, the above could impact multiyear revenue…thus valuation or ease of finding a home for your practice.

As you reduce your involvement in your practice, what will happen to attrition rates if you start taking more vacations or spending more time with grandchildren, making you less available for calls? How will this impact valuation? You've spent a lifetime cultivating relationships with clients, many of which are family members. The last thing you want to do is hand them off to an inexperienced advisor or worse an ambivalent advisor.

Your perspective

One of the biggest challenges in modern succession planning is the disconnect between seasoned advisors and younger generations of colleagues. The difficulty in filling junior-level positions over the past five years highlights this issue. While you might overlook some flaws in your succession planning partner, will your clients?

There are few young financial advisors out there and of that group most don’t blend well with seasoned advisors. Most don’t have the work ethic, the values, or the desire to put others first as this profession requires. When hiring for a junior position the questions interviewees asked me were troubling and alarmed me of this fact. “How many vacation days are there?”, “How often can I work from home?”, “Is there drug testing?” to name a few.

Finding a successor that shares your values, your passion for clients and has a similar philosophy and competency may take years. Furthermore, while your plans may be etched in stone to retire at a certain age, what happens when your successor decides its time to try a different career path as the younger generation are apt to do?

Some advisors, observing current market trends, might assume they can quickly implement a succession plan at top dollar. However, industry M&A is subject to fluctuations in supply and demand. What if personal, professional, or health reasons force you to step down sooner? What if you find yourself needing to sell during a market downturn? We counsel on these subjects all the time but too many advisors don’t plan for themselves.

We must hope for the best and plan for the worst when it comes to our succession plan. Our clients futures are at stake as is the business we have potentially built for decades.

Business implications

The operational landscape of the industry has transformed dramatically since the late 1980s, shifting from a commission-based model to financial planning and fee-only services. The regulatory landscape has also become more complex. Social media, websites, and technology have become essential for ongoing business operations.

The younger generation, born with technology at their fingertips, will demand capabilities that may be beyond your current scope. If you are not willing to significantly adapt with the times, are you disadvantaged? If this continues for a few years are you creating significant value impairment when you end up retiring?

More and more institutions are moving upstream. To get the highest payouts you are more likely to need hundreds of millions of assets and there are more substantial minimum household size. To find an appropriate partner you’ll have to spend more time than ever looking for a fit. I have found that transitions to new shops are becoming more difficult to accomplish successful for all but the biggest and most successful team.

Needless to say, if you have a complicated compliance history, a succession plan becomes even more difficult. Interestingly, the mid sized advisor I think has the most difficult time finding a succession plan. The $25 million to $150 million AUM book tends to have a boutique feel to it that cannot just plug right into any operating model in my view.

What to do about it?

Plan early; retirement might come unexpectedly, and like all forecasting in our profession, it requires preparation. Often, financial planners neglect their own succession planning and are forced into a shotgun marriage when their plans unexpectedly change. Given industry trends, this may disproportionately affect smaller advisors when it comes to finding a succession plan.

Consider a gradual retirement over 1-3 years to ensure clients are comfortable with the transition. We all knew that this wasn’t your average 9-5 job when we signed up. Afterhours calls and bear market stresses made us aware of that fact over the years. Similarly, when it comes to retirement, 2 weeks notice isn’t sufficient. To improve outcomes for, your clients, yourself and your successor you must plan ahead and not rush things!

Prioritize value and fit over financial considerations when selecting a successor. Just as we choose investments that meet specific needs rather than merely opting for the highest growth, selecting a succession partner should focus on fitting into the established client relationship and maintaining continuity in communication styles and expertise. So many advisors take the highest dollar to then regret it for years to come as their adoring clients become disenchanted with their new advisors.

Exploring a variety of options is essential, particularly as more institutions impose stricter conditions. To me the perfect way to sail off into the sunset is with a firm that is not too big and not too small that has operational abilities to accommodate a variety of styles and ways of doing business.

In today’s financial services industry that is less and less common. I’ve seen advisors go to institutions then say they regret fitting the square peg in a round hole. You’ll have to love your successors and trust them to do right for your clients and you for many years to come.

John Troncoso, CFP, CPWA, CRPC is an Investment Advisor Representative, Partner, and part of the leadership team of Tampa-based RIA Jaffe Tilchin Wealth Management. He specializes in wealth management, retirement and financial planning, estate and asset protection, tax minimization and business monetization. He is an expert in advisor transitions including succession planning and buyouts.

Where does U.S. stand with public long-term care? States to watch

Beltway lawmakers seek a Congressional block on DOL fiduciary rule

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News