Commercial health insurers income plummets 90% last year

Commercial health insurers suffered a 90% decrease in underwriting income last year as fewer people signed onto group health and instead moved into individual coverage on an exchange or a Medicaid program, and COVID care requirements far exceeded expectations.

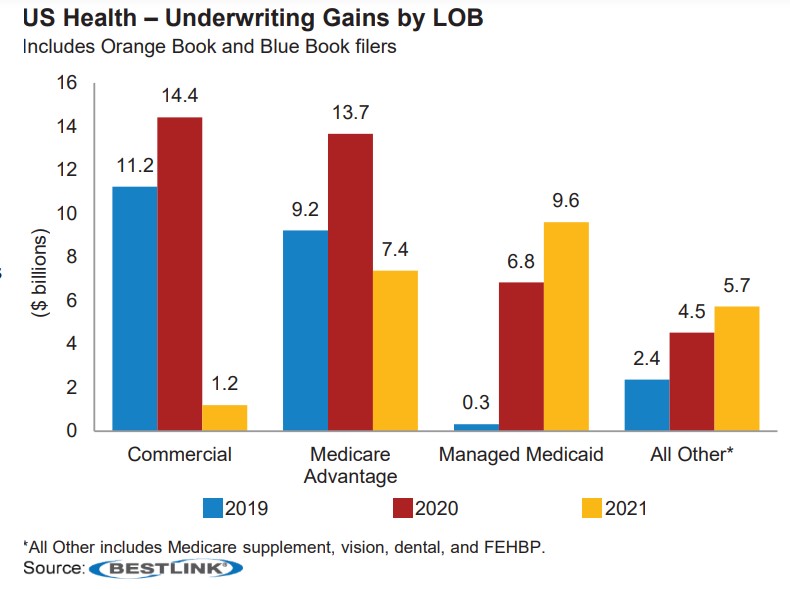

Those are two key factors in the commercial health insurance industry’s dismal performance in a down year for health insurance overall, which saw a 65% decrease in underwriting income, according to AM Best’s report on health insurance performance in 2021.

The industry’s difficulty was not overall premium growth, which was up 6.8% across all lines, but systemic shifts in coverage, particularly the migration from commercial to Medicaid and individual lines, which led to a slight premium decline for commercial lines.

“The last time the commercial segment was subject to a similar degree of earnings volatility was in 2014, the first year of the Patient Protection and Affordable Care Act (ACA) and the exchanges,” according to the report. “In 2021, COVID-related expenses — including treatment, testing, and vaccinations — were the main driver for the earnings decline. The cost of these claims significantly exceeded projections across the industry.”

Health carriers were slammed with unexpectedly high COVID expenses that were required by the federal government. For example, more people got tested as the technology became more accessible in 2021. Insurers were required to cover the cost but could not direct consumers to lower cost providers, such as pharmacies, and people were free to use more expensive urgent care centers. COVID testing and treatment were more expensive for working age adults, according to the report, which hit commercial insurers hardest as they also saw consumers return to routine and elective care.

The lines doing best in premium growth were Managed Medicaid, up 14.2%, and Medicare Advantage, up 10.5%, year over year.

“Medicaid carriers benefited from the membership growth, better health status of the new enrollees, and states’ inability to dis-enroll individuals from the program as part of the Public Health Emergency (PHE),” according to the report.

Commercial health is usually the stronger line in the industry, offsetting public programs, such as Medicaid, and the individual market. But last year, it was the expanse of individual business through ACA exchanges that offset commercial, which did not see increased premium despite a surge in hiring. ACA enrollment grew to 12 million in 2021, up from 11.4 million. The leap has been even greater this year, up to 14.5 million so far.

Smaller carriers with concentrations in the commercial business found themselves in an especially difficult position.

— Antonietta Iachetta, AM Best senior financial analyst

“Historically, the commercial segment has generated the larger portion of earnings for the health insurance industry, but over the past few years, the membership and revenue of government programs, typically with lower margins, started to grow, becoming an integral source of health insurers’ earnings and operations,” according to the report. “In 2021, Medicaid and MA combined generated much higher earnings than the commercial segment and helped strengthen overall results for the industry.”

Although Medicare Advantage had increased premium, those carriers also saw more consumers using medical services. Although MA accounted for 26% of total underwriting earnings, its underwriting results were 46% lower than 2020. Claims were up 32% for hospital and medical services, but the report showed that MA did not get hit as hard by COVID expenses because older people were being more cautious about exposure.

Large, diversified carriers fared best, according to Antonietta Iachetta, AM Best senior financial analyst.

“Smaller carriers with concentrations in the commercial business found themselves in an especially difficult position — more than half of insurers with capital and surplus under $50 million posted underwriting losses in 2021, the highest share of companies with losses for that group since 2012,” Iachetta said.

NAIC has a warning

The National Association of Insurance Commissioners also noted the industry’s discombobulated year in its annual review.

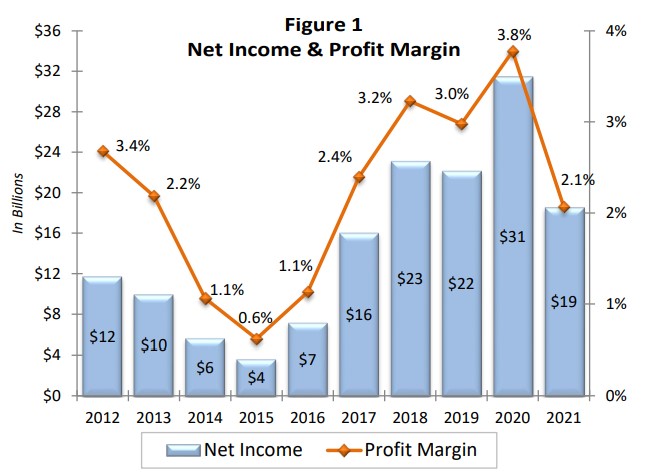

“The health insurance industry continued its tremendous growth trend, but it experienced a significant (41%) decrease in net earnings to $19 billion and a decrease in the profit margin to 2.1% in 2021 compared to net earnings of $31 billion and a profit margin of 3.8% in 2020,” according to the annual report. “The combined ratio increased to 98% from 96%.”

The NAIC attributed the decrease in underwriting results to a 14% increase in total hospital and medical expenses, which was offset by an 8% increase in premium, 7% decrease in claims adjustment expense and general administrative expenses.

The increase in medical expenses was due to pent-up demand for services deferred from 2020. Although more people got delayed treatment last year, the NAIC expressed concern about the long-term effects of that delayed care.

“It should be noted that going forward, there is also the potential that delayed treatments could lead to worsening health conditions, resulting in further escalated claims expenses,” according to the report. “There is also the potential that Medicare/Medicare Advantage, and Medicaid writers as well as comprehensive writers serving older and higher risk populations could be adversely affected.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Acrisure wins naming rights for the Pittsburgh Steelers’ home stadium

Americans age 50+ worry about inflation, recession, health care costs in retirement

Advisor News

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

- Emergency Preparedness: How advisors can prepare clients for hurricanes

- Federal employees: An emerging market for advisors

- The financial advisor’s guide to creating an effective value proposition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Medicaid overhaul proves to be politically perilous proposition

- Worries persist about CVS Health

- Cigna commercial health plans may go out-of-network at large local hospital group

- The Medicaid Asset Protection Trust (MAPT)

- Lawmaker seeks coverage for menopause

More Health/Employee Benefits NewsLife Insurance News

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

More Life Insurance News