Coming DOL fiduciary rule likely pushing annuity sales higher, Wink says

Deferred annuity sales were up nearly 19% in the first quarter over the same period last year, Wink, Inc. reported today.

Spiking sales have annuities on pace to crack the $400 billion sales barrier for the first time this year. If the first quarter is any indication, producers are motivated by the impending fiduciary rule going into effect starting Sept. 23, said Sheryl Moore, founder and CEO of Wink.

"I think there's kind of a fire-sale mentality that's going on," she said. "The carriers know that this fiduciary rule is going to have an impact on their sales. And the insurance agents know that things are going to change coming in September."

Officially known as the Retirement Security Rule, it will allow the Department of Labor to extend fiduciary duty to a majority of annuity sales.

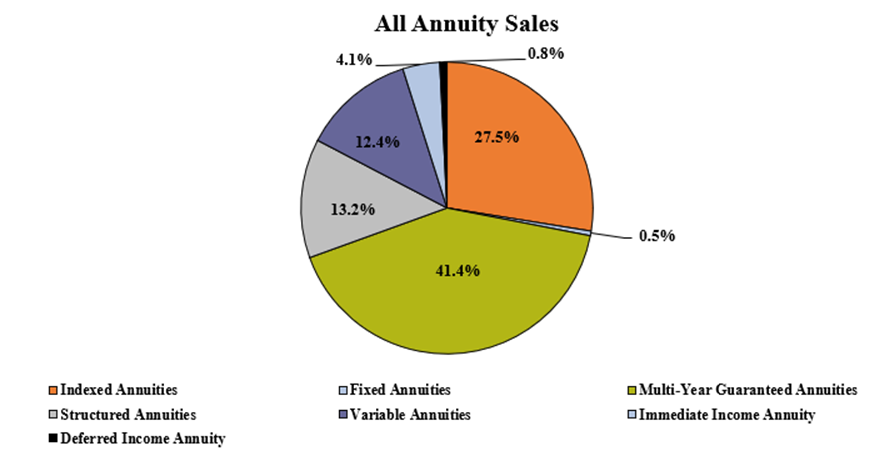

The deferred annuity family includes the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity, and variable annuity product lines. Total first-quarter sales for all annuities, which include immediate income and deferred income annuities, were $105.7 billion, according to Wink’s Sales & Market Report.

Wink began collecting data on income annuity sales in Q1, and comparisons of these products will be available in future quarters, Moore said.

Noteworthy highlights for all annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 9.2%. Nationwide came in second place, while Corebridge Financial, New York Life, and Equitable Financial rounded out the top five carriers in the market, respectively.

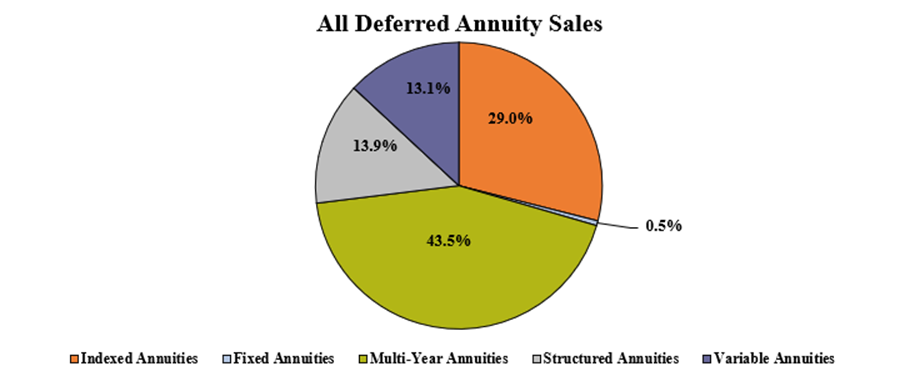

Total first quarter sales for all deferred annuities were down 3% compared to the previous quarter and up 18.6% when compared to the same period last year.

Noteworthy highlights for all deferred annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 9.7%. Corebridge Financial moved into second place, while Equitable Financial, Nationwide, and Allianz Life rounded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the quarter.

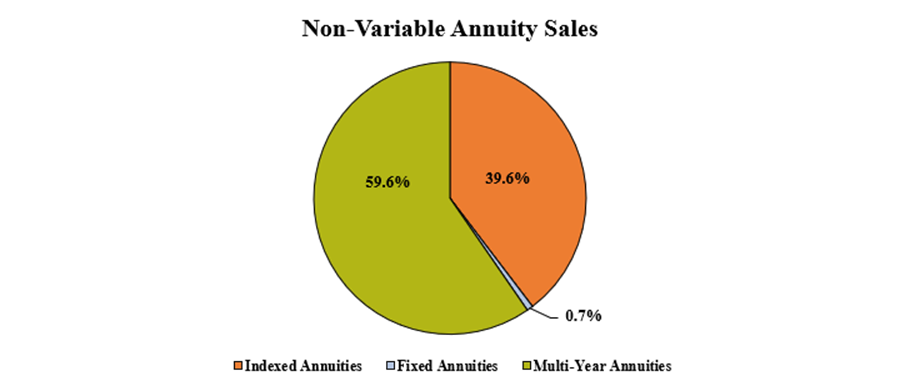

Total first quarter non-variable deferred annuity sales were $73.4 billion, down 7.6% when compared to the previous quarter and up 16.7% when compared to the same period last year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 12.9%. Corebridge Financial took second place while Global Atlantic Financial Group, Nationwide and Massachusetts Mutual Life Companies completed the top five carriers in the market, respectively.

Forethought Life’s SecureFore 3 Fixed Annuity, a MYG annuity was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the second consecutive quarter.

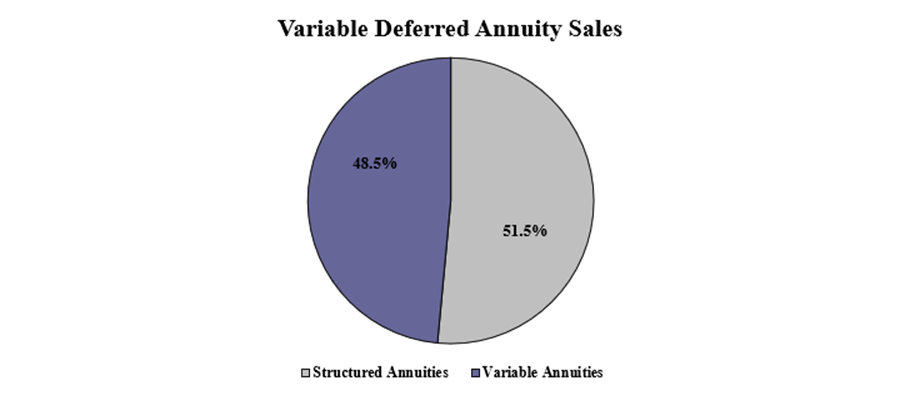

Total first-quarter variable deferred annuity sales were $27 billion, up 12.2% compared to the previous quarter and up 24.1% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 19.5%. Jackson National Life continued in the second-place position, as Allianz Life, Brighthouse Financial, and Lincoln National Life concluded as the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

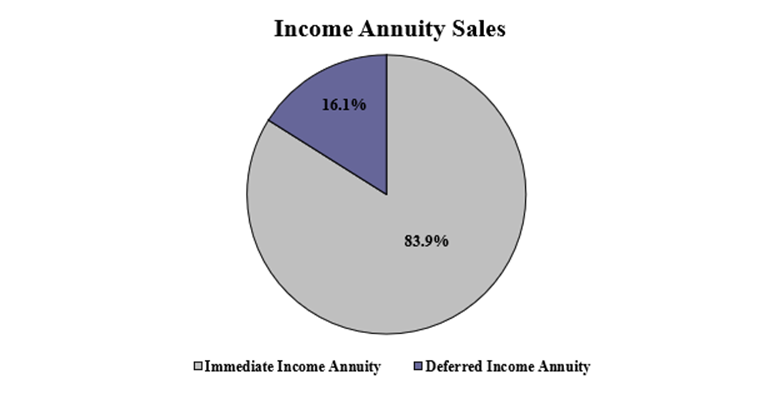

Total first-quarter income annuity sales were $5.1 billion. Income annuities include immediate income annuity (SPIA) and deferred income annuity product lines. Given that this is the first quarter that Wink has collected data on income annuity sales, comparisons will be available in future quarters, Moore said.

Noteworthy highlights for income annuity sales in the first quarter include Nationwide ranking as the No. 1 carrier overall for income annuity sales, with a market share of 37.9%. New York Life came in second, as Massachusetts Mutual Life Companies, Western-Southern Life Assurance Company and Penn Mutual concluded as the top five carriers in the market, respectively.

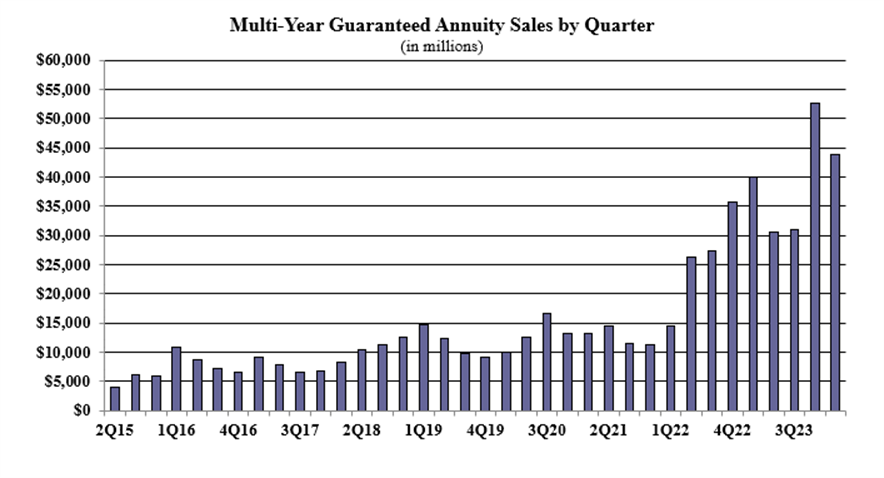

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $43.7 billion, down 16.8% when compared to the previous quarter, and up 9.6% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the first quarter include Athene USA ranking as the No. 1 carrier, with a market share of 12.1%. Corebridge Financial moved into the second-ranked position, while Global Atlantic Financial Group, New York Life and Delaware Life rounded out the top five carriers in the market, respectively. Forethought Life’s SecureFore 3 Fixed Annuity product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the second consecutive quarter.

“There is no way that MYGA sales were going to top the record-setting quarter they had last quarter,” Moore said.

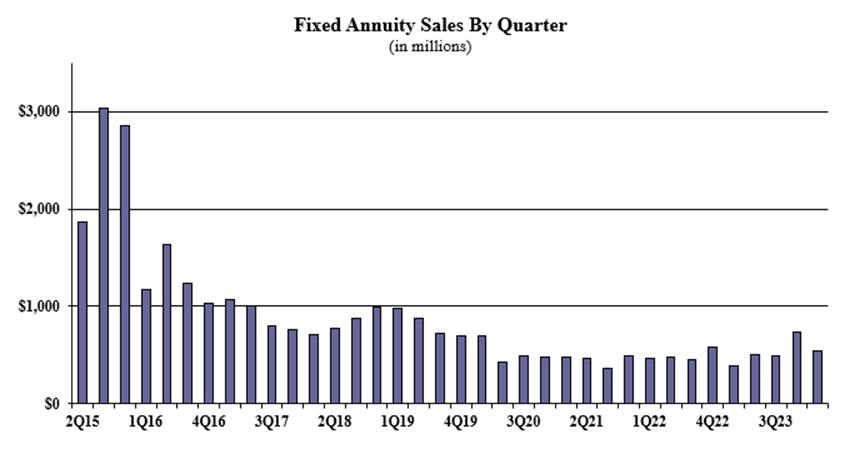

Traditional fixed annuity sales in the first quarter were $546.7 million, down 25.1% when compared to the previous quarter, and up 42.7% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 15.2%. Modern Woodman of America ranked second while EquiTrust, CNO Companies, and Nationwide completed the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the fifteenth consecutive quarter.

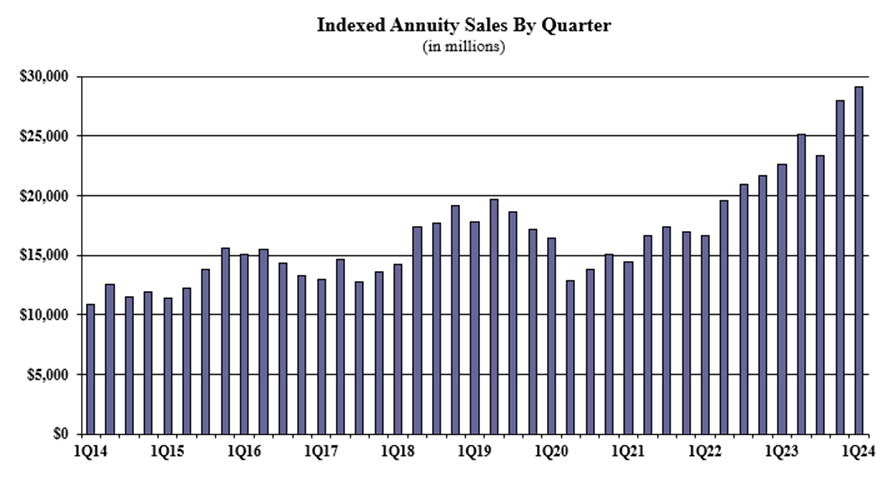

Indexed annuity sales for the first quarter were $29.1 billion, up 4% when compared to the previous quarter, and up 28.7% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500. This was a record-setting quarter for indexed annuity sales, topping the prior 4th quarter 2023 record by 4%.

Noteworthy highlights for indexed annuities in the first quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 14.4%. Allianz Life moved into the second-ranked position, while Sammons Financial Companies, Corebridge Financial, and Nationwide completed the top five carriers in the market, respectively. Nationwide Life and Annuity’s Nationwide New Heights Select 9 was the No. 1 selling indexed annuity, for all channels combined, for the quarter.

“Indexed annuities have now sold over a trillion dollars, since their introduction in 1995," Moore noted. "Not too shabby for a product line that isn’t yet 30 years old.”

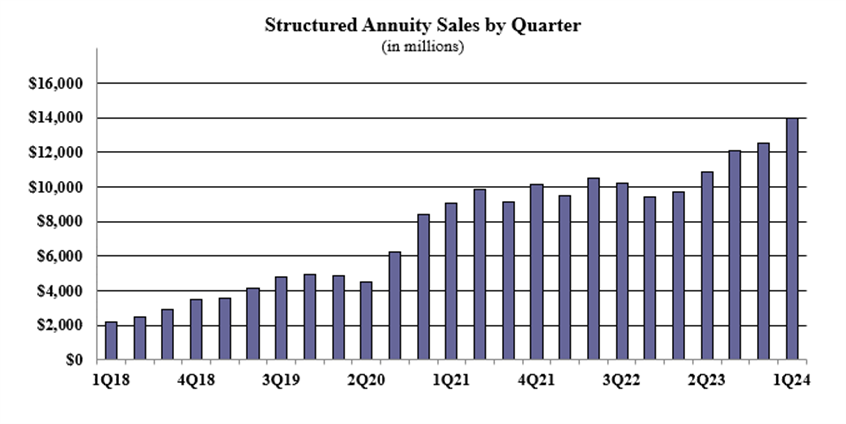

Structured annuity sales in the first quarter were $13.9 billion, up 11.7% as compared to the previous quarter, and up 44.2% as compared to the same period last year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts. This was a record-setting quarter for structured annuity sales, topping the prior 4th quarter 2023 record by 11.71%.

Noteworthy highlights for structured annuities in the first quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 24.4%. Allianz Life ranked second, while Brighthouse Financial, Prudential and Jackson National Life completed the top five carriers in the market, respectively. Pruco Life’s Prudential FlexGuard Indexed Variable Annuity was the No. 1 selling structured annuity, for all channels combined, for the second consecutive quarter.

“Structured annuities are the fastest-growing segment of the annuity market,” Moore said. “I look forward to more growth, as there are new entrants soon to pop-in.”

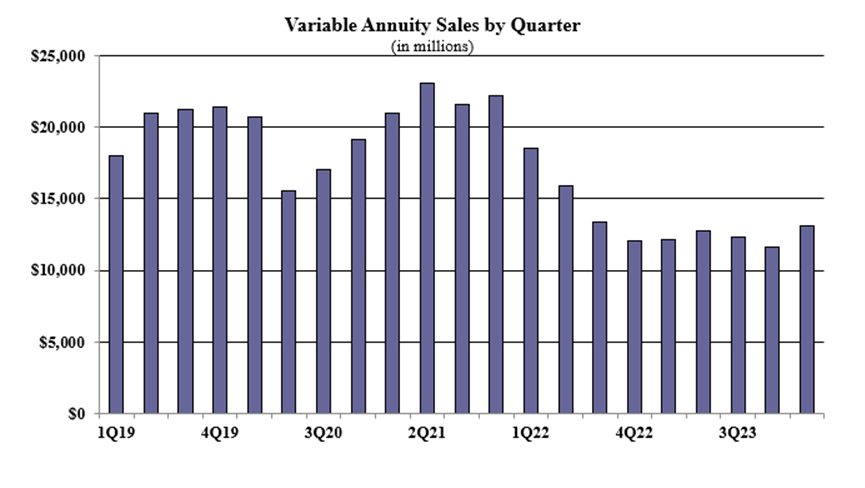

Variable annuity sales in the first quarter were $13.1 billion; up 12.9% as compared to the previous quarter, and up 8.1% as compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 18.1%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twentieth consecutive quarter, for all channels combined.

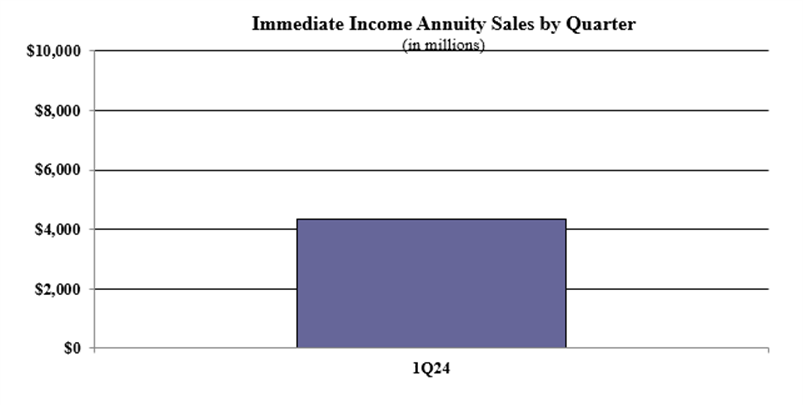

Immediate income annuity (SPIA) sales in the first quarter were $4.3 billion. Given that this is the first quarter that Wink has collected data on immediate income annuity sales, comparisons will be available in future quarters.

Noteworthy highlights for immediate income annuities in the first quarter include Nationwide ranking as the No. 1 carrier in immediate income annuities, with a market share of 45.2%. New York Life ranked second, while Massachusetts Mutual Life Companies, Penn Mutual, and Western-Southern Life Assurance Company finished as the top five carriers in the market, respectively.

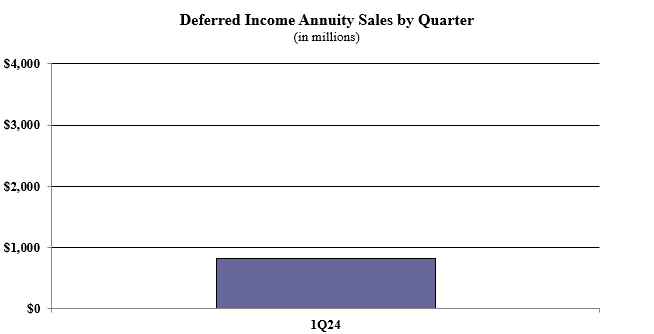

Deferred income annuity sales in the first quarter were $830.5 million. Given that this is the first quarter that Wink has collected data on deferred income annuity sales, comparisons will be available in future quarters.

Noteworthy highlights for deferred income annuities in the first quarter include New York Life ranking as the No. 1 carrier in deferred income annuities, with a market share of 38.5%. Massachusetts Mutual Life Companies ranked second, as Western-Southern Life Assurance Company, Symetra Financial, and Integrity Life Companies finished as the top five carriers in the market, respectively.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Annexus partners with John Hancock to bolster IUL product

Cover Genius ‘actively investing’ in AI as part of customer satisfaction strategy

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

More Health/Employee Benefits NewsLife Insurance News