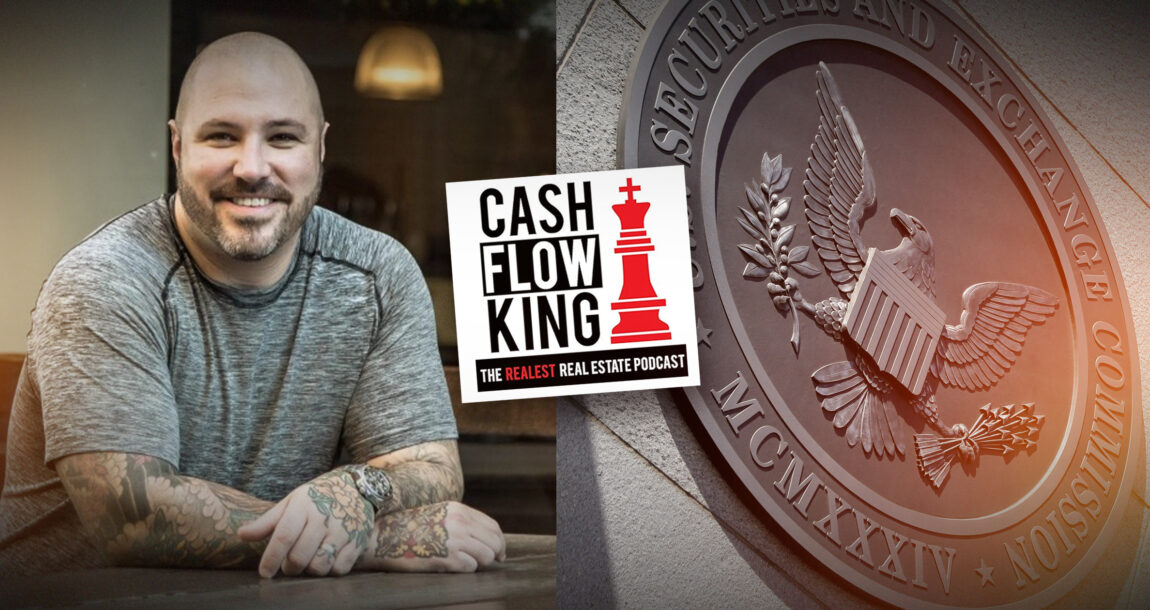

‘Cash Flow King’ says plea deal is imminent to resolve Ponzi fraud case

Matthew Motil, host of the podcast, "The Cash Flow King," has reached a plea agreement with federal investigators to resolve a criminal investigation into an alleged $11 million Ponzi scheme, his attorneys say.

Motil has not been charged criminally, but faces a civil action brought by the Securities and Exchange Commission. In a status report filed Monday in that case, his attorneys revealed the criminal probe by the U.S. Attorney’s Office for the Northern District of Ohio

"Mr. Motil anticipates the written plea agreement should be finalized within thirty days or earlier," the update reads. "Once the plea agreement is finalized, defendants anticipate being in a position to move promptly towards an agreed resolution in this matter."

In the civil action, the SEC seeks financial penalties, disgorgement of gains and to bar Motil from being allowed to sell securities in the future.

According to the complaint, Motil scammed "Investor A" out of more than $577,000, "virtually all of Investor A’s life savings and retirement funds." At one point, "Investor B" told Motil that "he needed to receive his overdue payments because he was being deployed to Afghanistan and would not be able to communicate from there." "Victim C" was a cancer researcher in Florida.

The SEC claims Motil told investors that he would pay the investors returns on their investments from profits from renovating, reselling, refinancing, and renting the properties. Motil allegedly promoted the same investment properties to multiple investors, telling each of them that they held the "first position" lien.

In one instance, Motil allegedly sold more than $1 million of promissory notes to 20 investors, each note supposedly collateralized by the same property he had acquired for $47,000. Rather than renovate the properties, Motil allegedly used investor money to make Ponzi payments to previous investors and to fund an extravagant lifestyle.

Life of luxury

Motil, 42, and his wife Amy, 35, allegedly spent over $107,000 on a seven-month rental of a lakeside mansion; over $73,000 for courtside seats to the Cleveland Cavaliers; over $45,000 to repay student loans; over $37,000 on purchases from Best Buy; over $23,000 on “Leeny’s Lean Body”; over $22,000 on iTunes, over $14,000 at Starbucks; and over $13,900 at numerous pizzerias. Amy Motil is named as a relief defendant.

Motil ran a website for prospective investors on which he claimed have “investment opportunities ranging from $10,000 to $10 million,” and invited those who visited the website to “Be a Real Estate Investing Badass!” and to “fire [their] boss, quit [their] 9 to 5, and build a business/lifestyle [they] love earning a passive income from real estate investments.”

The website and Motil’s social media accounts offered links to podcasts on Apple and YouTube entitled “The Cash Flow King, The Realest Real Estate Podcast,” hosted by “Doctor Motil.” Motil released approximately 147 episodes of the podcast, court documents say.

"Motil used podcasts and social media platforms to bolster his reputation as an investing expert while fraudulently targeting investors' hard-earned retirement assets, including, in at least one instance, almost the full balance of an investor's self-directed IRA," said Mark Cave, associate director of the SEC Division of Enforcement. "We are committed to holding those who prey on others accountable for their unlawful conduct."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Why insurers’ banking relationships matter in AML compliance

Winning the war for the highest share of consumer wallet

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News