Brighthouse Sees Strong Annuity Sales, But Expects Decline In 2021

While Brighthouse Financial fixed annuity sales were great in the fourth quarter, the company does not expect that to continue into 2021, said Conor Murphy, executive vice president and chief operating officer.

Fixed annuities represent a small share of the Brighthouse annuity line, but was a recent bright spot for sales. However, rates decreased from about 1.5% to around 1% in the fourth quarter, Murphy said.

"We don't expect the market will be as hot necessarily [in 2021]," he explained. "The rate decreases will impact that as well."

Brighthouse's core annuity product is its Shield index annuities, which make up the largest portion of product sales. Executives hinted at new features on the Shield line by mid-summer.

The fourth-quarter annuity and life insurance sales provided Brighthouse with some good news amid tough conditions.

The annuity and life insurance company posted revenue of $131 million in the period. Its adjusted revenue was $2.15 billion. Under tough questioning from analysts this morning, president and CEO Eric Steigerwalt pointed to strong sales and said the company is sticking to its plan.

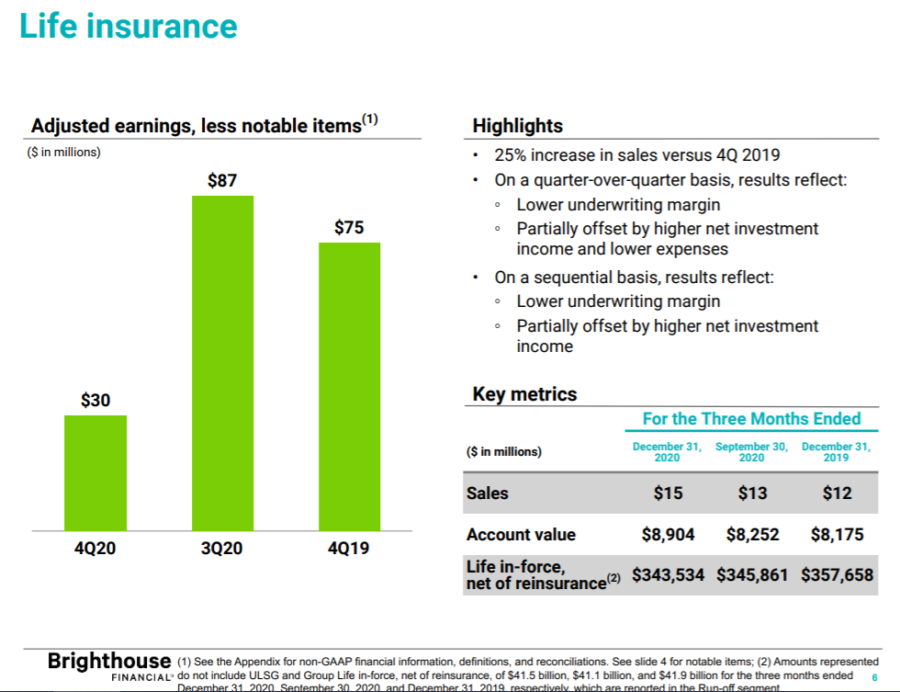

Brighthouse annuity sales increased 58% over the fourth quarter of 2019 and 25% for full year 2020. Life sales increased 25% over the fourth quarter of 2019 and 124% for full year 2020.

Brighthouse reported a $1.03 million loss for the quarter, and $1.06 billion, or $11.58 per share, for the year. Revenue was reported as $7.99 billion.

The company announced the repurchase of up to $200 million of its common stock. That is in addition to the $500 million stock repurchase authorization announced by the company in February 2020, under which $53 million remains as of February 9, 2021.

Product Features

Brighthouse executives teased additional "product features" on its top-selling Shield index-linked annuity line.

"Our focus next year will be growing our core business as relates to our annuity franchise," said Myles Lambert, chief distribution and marketing officer. "We will focus on Shield sales and we are looking to introduce some new product features with our shield products sometime around mid-year next year."

But executives sidestepped an analyst's question on whether new features might include guaranteed living benefits or other riders.

"Shield is our core product and we expect it will continue to be a core product," Murphy said. "And while we will continue to tweak the product a little bit and add enhancements and so on, we will do it by maintaining our expectations in terms of the the economics as well."

Looking Beyond MassMutual

In 2017, MetLife created Brighthouse Financial to be a separate entity. Headquartered in Charlotte, N.C., Brighthouse Financial now represents MetLife’s retail segment for life insurance and annuities.

Prior to that separation, in July 2016, MetLife completed the sale of MetLife’s U.S. retail advisor force to MassMutual. As part of the deal, MetLife and MassMutual entered into a product development agreement under which Brighthouse exclusively develops certain annuity products that are issued by MassMutual.

But the proportion of annuities sold through MassMutual has been declining and is not a majority of Brighthouse sales any longer, Lambert said.

"We've done a lot as far as expanding distribution both within certain product categories, bringing on new firms and we successfully launched a new FIA product into the traditional IMO channel this year, SecureAdvantage 6-Year," Lambert said. "Mass Mutual represents a smaller portion of our sales and that's been consistent over the last few years, but they remain a very important relationship of ours. We provide dedicated wholesaling to them and our focus is still to provide them the same level of support and continue to grow sales there in the future."

On the life insurance side, Brighthouse continued steps to reenter the life insurance market with new products and broadening distribution. In 2019, the company offered SmartCare, an indexed universal life with a long-term care benefit.

Brighthouse reported a risk-based capital ratio of 485%, higher than even its own target, with company liquid assets of $1.7 billion. This prompted several questions from analysts on why the insurer is holding on to so much capital and what plans are for it.

"Over the past three and a half years, we've created quite a franchise, and we're very proud of that," Steigerwalt said. "You can see our sales in the fourth quarter. And we've been able to repurchase almost 28% of the company, which we think is is a a value-creating positive exercise and will pay off over time. So so that's the strategy."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Karim Hill To Lead The American College’s Center For Economic Empowerment And Equality

Biden’s DOL Will Allow Investment Advice Rule To Take Effect

Advisor News

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsHealth/Employee Benefits News

- Solano County Supervisors hear get an earful from strikers

- How Will New York Pay for Hochul's State of the State Promises?

- As the January health insurance deadline looms

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

- Virginia Republicans split over extending health care subsidies

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- What drivers pay for auto insurance in every state: A monthly cost snapshot

- MONEY IN YOUR POCKETS: GOVERNOR HOCHUL PROPOSES MEASURES TO BRING DOWN CRUSHINGLY EXPENSIVE AUTO INSURANCE RATES

- Allstate homeowners rate hike sparks debate over Illinois insurance oversight

- The Baldwin Group Completes Acquisition of Obie, a Leading Investment Property Insurance Platform

- Best Bail Bondsmen in Forsyth County, NC

More Property and Casualty News