Brighthouse reports strong product news to offset poor Q4 results

Brighthouse Financial executives reported strong product developments and solid sales today during its quarterly earnings report.

The insurer's Q4 financial numbers were not as rosy. Brighthouse reported a loss of $917 million in its fourth quarter. The Charlotte, North Carolina-based company said it had a loss of $14.70 per share. Earnings, adjusted for non-recurring costs, were $2.92 per share.

The results fell short of Wall Street expectations. The average estimate of five analysts surveyed by Zacks Investment Research was for earnings of $3.83 per share.

CEO Eric Steigerwalt assured analysts that Brighthouse is on track with its priorities.

"Looking back on 2023, I'm proud of the progress we made as we continued to execute on our strategic priorities, bought back a substantial amount of common stock, delivered strong sales results, enhanced and grew our core products sweet and nicely controlled expenses, all while maintaining our strong balance sheet and robust liquidity," Steigerwalt said.

In the fourth quarter, Brighthouse implemented a new statutory requirement under which all future hedges must be reflected in reserves and required capital, Steigerwalt explained.

"While this had a negative impact on statutory combined total adjusted capital, the new statutory requirement also led to a material decrease in required capital," he added. "After paying $350 million of subsidiary dividends to the holding company in the quarter, our estimated combined RBC ratio remains strong at approximately 420% and our holding company liquid assets increased to $1.3 billion."

Brighthouse is coming off a strong third quarter, when the insurer posted revenue of $1.17 billion and adjusted revenues of $2.09 billion.

Brighthouse gets back to life

Brighthouse primarily thrived off annuity sales since it split off from MetLife in 2017. Life insurance sales lagged while company executives repeatedly vowed to recharge to its life portfolio. That finally began to happen during the second half of 2023.

The insurer launched Brighthouse SmartGuard Plus, its first registered index-linked universal life insurance product. It offers clients guaranteed distribution payments that can be used to supplement income in retirement and a guaranteed death benefit.

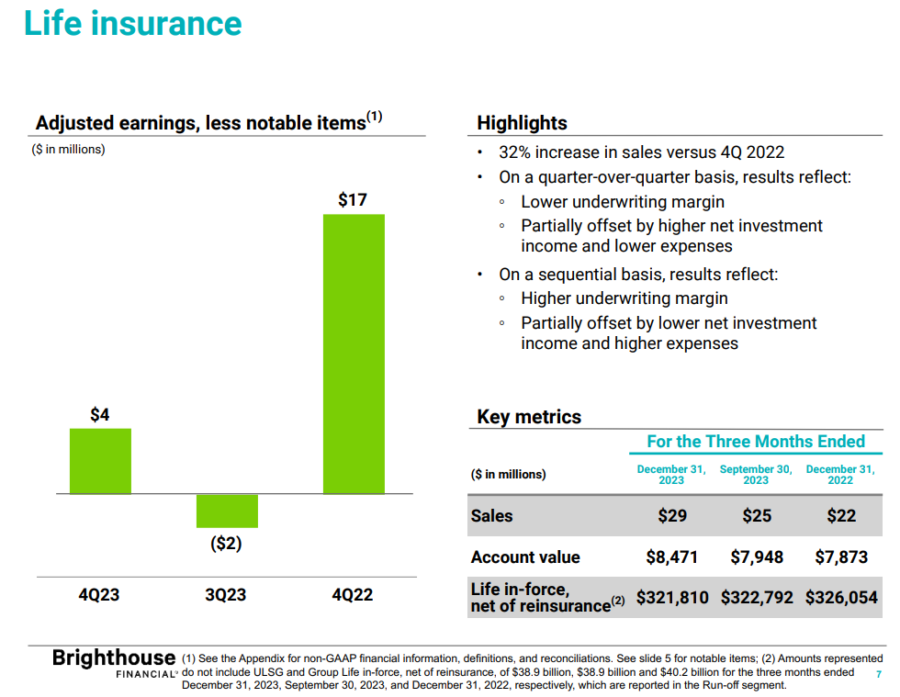

In Q4, the life segment posted a 32% sales increase over the year-ago quarter and 28% year over year.

On a quarter-over-quarter basis, adjusted earnings, less notable items, reflect a lower underwriting margin, partially offset by higher net investment income and lower expenses, Brighthouse said in a news release. On a sequential basis, adjusted earnings, less notable items, reflect a higher underwriting margin, partially offset by lower net investment income and higher expenses.

Shield sales set a record

For the full-year 2023, Brighthouse sold $10.2 billion in annuities.

"Contributing to the strong total annuity sales results for the full year 2023 was a record sales year for our flagship Shield Level annuity products," Steigerwalt said. "Shield sales total totaled $6.9 billion, an increase of 17% on a full-year basis. ... In May, we introduced new enhancements to our Shield Level annuities product suite as we continue to be a leader in the buffered annuity marketplace that we helped to create."

Brighthouse fixed-rate annuity sales totaled $2.7 billion in 2023, down from $3.7 billion in 2022.

"In November, we launched Brighthouse SecureKey fixed-indexed annuities, expanding our distribution footprint in the fixed-indexed annuity market," Steigerwalt said.

Adjusted earnings in the annuities segment were $245 million in Q4, compared with adjusted earnings of $194 million in the fourth quarter of 2022 and adjusted earnings of $319 million in the third quarter of 2023, the release said.

Annuity sales decreased 15% quarter-over-quarter and 8% year-over-year, driven by lower fixed deferred annuity sales, the release said. Annuity sales increased 5% sequentially, driven by higher fixed deferred annuity sales.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Ponzi scheme losses to Ohio bank are insurable, court rules

Army counselor accused of defrauding Gold Star families faces an April trial

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- Insurer ends coverage of Medicare Advantage Plan

- NM House approves fund to pay for expired federal health care tax credits

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

- Students at HPHS celebrate 'No One Eats Alone Day'

- Bloomfield-based health care giant Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News