Brighthouse Boosts Sales On Growing VA, SmartCare Sellers

Brighthouse Financial had a record year in sales of life insurance and some annuities as the company expanded distribution, a trend the company expects to continue, according to executives on Brighthouse’s fourth-quarter earnings call on Friday.

“We continue to expand our distribution footprint and enhance the way we support financial professionals and the clients they serve,” said CEO Eric T. Steigerwalt. “We also added more life insurance wholesalers, rolled out SmartCare to more firms, selectively expanded into the brokerage general agency or BGA distribution channel, and rolled out enhancements to our Shield Level annuities and SmartCare.”

The company added 13 distributors with access to 14,000 advisors midyear to sell SmartCare, an indexed universal life product with a long-term care component. The addition builds on the company’s access to 50,000 advisors.

Although Brighthouse had a strong year in variable annuities, that gain was offset by up losses due mainly to interest rates and non-VA annuity sales, leading to an overall loss of $300 million on the year.

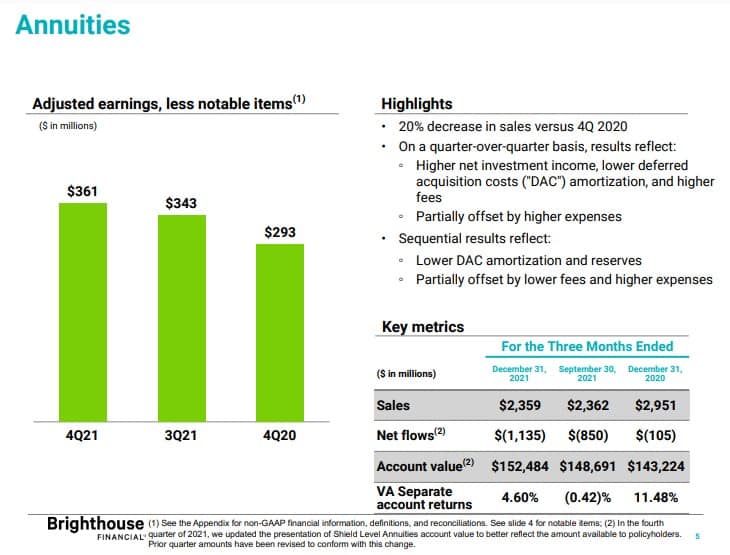

Annuity sales decreased 20% quarter-over-quarter, driven by lower sales of fixed deferred annuities, and partially offset by a 14% increase in total sales of variable and Shield Level annuities. Annuity sales were flat year-over-year, with record total sales of variable and Shield Level annuities, which increased 36% over 2020.

Life insurance sales increased 133% quarter-over-quarter, 30% sequentially and 98% year-over-year, driven by sales of SmartCare.

Brighthouse is completing a platform conversion as it implements its State Operations and Technology Platform, said Edward Spehar, executive vice president and chief financial officer.

“This is movement away from multiple valuation systems and customized models to one valuation platform, and more standardized models,” Spehar said. “This has created and will continue to create more time for value-added analysis, more flexibility and also a better control environment. The fourth quarter was a busy quarter for this, and we had three models that were fully put into production.”

The company is still working on adjusting its scenario generator to reflect regulatory reform, he said.

“I think it's going to be a long process,” Spehar said. “As you can imagine, it's extremely complicated. It's going to take time, and I'm optimistic that the industry and regulators will come to a good framework.”

The company has proved that it can work with VA reform and would continue to do so, Spehar said. The company has multiple systems that it plans to distill into a single environment for all its products to provide ease of use.

Brighthouse returned $1.5 billion to its shareholders in 2021. During the fourth quarter of 2021, the company repurchased $158 million of its common stock. For the full year, it repurchased $499 million of its common stock, representing approximately 12% of shares outstanding compared to 2020. The company has repurchased $57 million of its common stock as of Feb. 8.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

The 3 Buckets To Attract And Retain Minority Job Candidates

Ohio National Pays $1.5B In Dividends To Policyholders In 2021

Advisor News

- 4 things every federal worker should do to safeguard their benefits

- Six steps to turn HNW friends into clients

- The two-bucket investment approach to making money last

- Republicans confront difficult Medicaid choices in search of savings to help pay for tax cuts

- Economy showing momentum despite uncertainty

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Senate passes bill capping medical insurance coverage

- Targeted by Trump, Medicaid funding stirs debate as CT changes rules for hospitals

- Studies from University of Occupational and Environmental Health Provide New Data on COVID-19 (Avoiding the Use of Outpatient Rehabilitation Services Under Long-term Care Insurance During the Covid-19 Pandemic): Coronavirus – COVID-19

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- This West Linn house, birthplace of Oregon prepaid health plans, is on National Historic Register

More Health/Employee Benefits NewsLife Insurance News

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

More Life Insurance News