Athene remains king of annuity sales, but others catching up, LIMRA finds

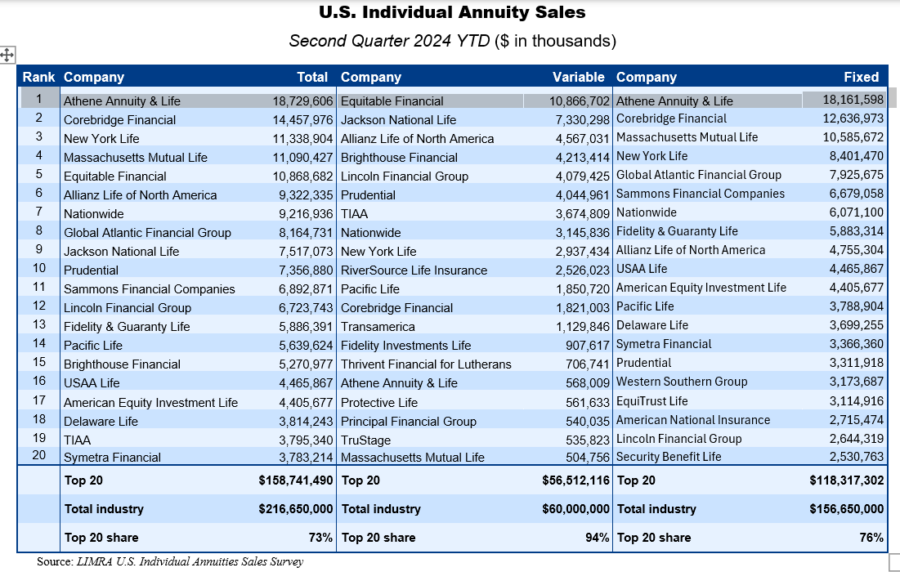

Athene Life & Annuity remained king of the annuity sales mountain during the first half of 2024, but their pursuers are more numerous and closing the gap, LIMRA reports.

Athene sold more than $18.7 billion worth of annuities during the period, bettering its 2023 pace, LIMRA announced today. Athene, a wholly owned subsidiary of Apollo Global Management, sold $35.5 billion in a triumphant 2023.

But other annuity sellers are doing even better. Four other insurers are on pace to top $21 billion in sales this year: Corebridge Financial, New York Life, MassMutual and Equitable Financial. Two other companies topped $20 billion in 2023.

Overall, LIMRA’s final annuity sales numbers were even better than projected last month.

Total annuity sales grew 26% year over year to $109.9 billion in the second quarter of 2024, according to LIMRA’s U.S. Individual Annuity Sales Survey.

In the first half of 2024, total annuity sales were $216.6 billion, increasing 20% from prior year’s results. This is a new sales record for the first six months of a year. Every product line except fixed immediate annuities posted double-digit gains.

“The U.S. annuity market continues to break sales records as the need for guaranteed retirement income grows,” said Bryan Hodgens, senior vice president and head of LIMRA research. “In addition, favorable economic conditions, product innovation and the number of Americans turning 65 (PEAK65) have expanded financial professionals’ interest in talking about these products to their clients. As a result, annuity sales have experienced 15 consecutive quarters of strong growth and LIMRA is forecasting record sales in 2024.”

LIMRA provided a sales breakdown by annuity category.

Fixed indexed annuities

Fixed indexed annuity sales had another record quarter. FIA sales totaled $30.7 billion, 21% higher than prior year. Year-to-date, FIA sales were $59.3 billion, up 23% year over year.

“Over the past few years, the equity markets have experienced quite a bit of volatility, and interest rates have remained high. Consequently, investors have been interested in a solution that offers downside protection with upside growth potential, which FIAs offer,” noted Hodgens. Regardless of possible rate cuts later this year — FIA sales should remain strong through 2024, and are expected to exceed the record set in 2023.”

Registered index-linked annuities

For the fifth consecutive quarter, registered index-linked annuities saw record quarterly sales. In the second quarter of 2024, RILA sales were $16.4 billion, 44% higher than prior year. In the first half of 2024, RILA sales jumped 41% to $30.8 billion. Independent broker dealers, career agents and bank distribution logged double-digit growth, driving the record sales. LIMRA is forecasting RILA sales to surpass $50 billion in 2024.

Fixed-rate deferred

Total fixed-rate deferred annuity sales were $40.7 billion in the second quarter, 33% higher than second-quarter 2023 sales. YTD, FRD annuity sales totaled $83.7 billion, up 16% year over year.

“FRD crediting rates, on average, continue to outperform CD rates, making them an attractive, short-term solution for risk-adverse investors,” noted Hodgens. “While a potential cut in interest rates may dampen the remarkable growth experienced over the past two years, there is a significant amount in FRD contracts coming out of surrender this year and LIMRA expects a portion of those assets to be reinvested in FRD products driving total FRD sales to another strong year.”

Traditional variable annuities

Strong equity markets drove the double-digit sales growth in the traditional variable annuity market. Traditional VA sales were $15.4 billion in the second quarter, up 16% year over year. YTD, traditional VA sales were $29.1 billion, an 11% gain year over year.

Income annuities

Single premium immediate annuity sales were $3.4 billion in the second quarter, level with prior year results. In the first six months of the year, SPIA sales improved 3% to $7 billion. Despite the second quarter results, SPIA sales are on track to meet or exceed the record sales set in 2023.

Deferred income annuity sales rose 21% to $1.3 billion in the second quarter. YTD, DIA sales jumped 30% to $2.5 billion.

Second-quarter 2024 annuity industry estimates are based on monthly reporting. A summary of the results can be found in LIMRA’s Fact Tank.

LIMRA’s survey, which represents 92% of the total U.S. annuity market, has been tracking sales since the 1980s.

Correction: This story reflects updated numbers provided by LIMRA after the article was initially published.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Appeals court upholds $524 million judgment against Greg Lindberg

Advisors are key to a positive annuity purchase experience

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

- Judge rules against loosening receivership over Greg Lindberg finances

- KBRA Assigns Rating to Soteria Reinsurance Ltd.

More Life Insurance News