Athene earnings come up short in Q2 despite monster annuity sales

Main takeaway: Athene Life & Annuity came up short on earnings during the second quarter despite dominating the industry in annuity sales.

Apollo Global Management CEO Marc Rowan pointed to conservative hedging for the reduced earnings. Apollo opted to be conservative in factoring in potential interest rate cuts, Rowan explained to Wall Street analysts during a conference call Thursday morning.

Those rate cuts never materialized. In addition, the roll off of strong business also impacted Athene’s profitability, Rowan said.

“The roll off of this business and hedging essentially cost us growth for the quarter, and will cost us growth for Q3,” he explained. “We expect by Q4 the business to grow and to be back on trend.”

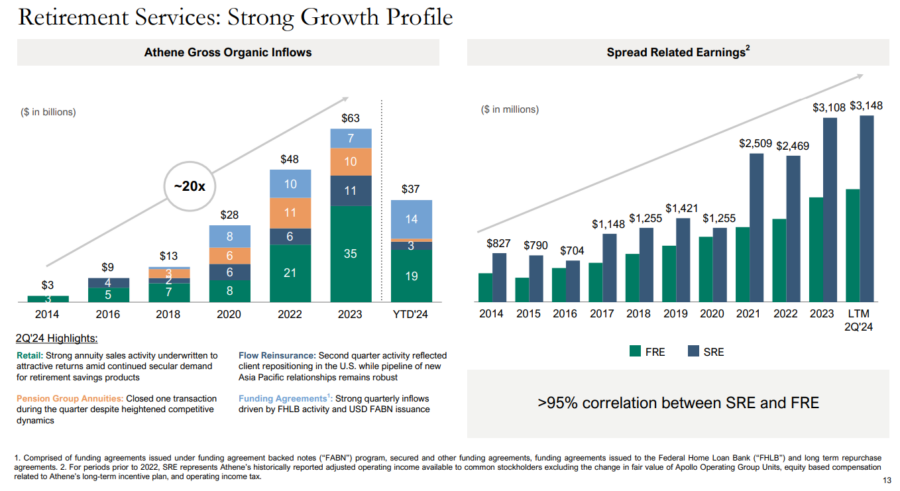

Rowan predicted “mid-single digits” growth for the year, with Athene returning to double-digit growth next year. Athene dominated LIMRA’s annuity sales charts in recent quarters, selling $9.7 billion in first-quarter sales, the most recently available numbers.

“For the [second] quarter, Athene hit every operating metric,” Rowan assured analysts. “New business volumes, underwritten returns, credit quality, expenses, surrenders [and] capital.”

Apollo reported a quarterly record in fee-related earnings of $516 million in the quarter, a 16.7% rise from the year-earlier period, for asset management and arranging financing for deals. That was offset by a 12.5% decline in spread-related earnings, a performance metric for its Athene business segment.

Additional takeaways

Apollo completed three transactions in recent weeks. The firm agreed to buy British parcel delivery company Evri for 2.7 billion pounds, or $3.47 billion. Apollo-managed funds acquired The Travel Corporation, a privately owned travel company with a storied history. The deal includes 18 of TTC's brands, such as tour operator Trafalgar, Uniworld Boutique River Cruises, and youth travel specialist Contiki.

Finally, Apollo reached a deal to acquire International Game Technology's (IGT.N), opens new tab gaming division alongside Everi Holdings, a gambling machines company, for a combined $6.3 billion.

Apollo also made a $700 million investment in Sony Music Group.

“The team is working around the clock,” Rowan said.

Management Commentary

“Essentially, what we have done is we have modernized existing products. The opportunity now exists for the entire next generation of products to serve retirees, whether they are in the traditional insurance sector, or they are in the vast pool of 401(k), which heretofore, has been off limits to most alternative assets providers."

– Marc Rowan

Financial Overview

Adjusted Net Income: $1.01 billion ($1.01 billion in Q2 2023)

Earnings Per Share (EPS): $1.64 ($1.70 in Q2 2023)

Assets Under Management: $696 billion ($617 billion in Q2 2023)

Fee-Related Income: $516 million ($442 million in Q2 2023)

Dividend: $46.25 per share

Segment Performance

Retirement Services:

Spread-Related Earnings: $710 million ($799 million in Q2 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Key trends shaping the life insurance industry in 2024

Allstate reports significant turnaround in Q2 from prior year quarter

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News