Apollo shakes off loss of ‘Goldilocks’ economy, keeps making money

Markets worldwide might be destabilized by ongoing tariff wars initiated by the United States, as well as aggressive military activity in the Middle East and Ukraine. But Apollo Global Management will continue making money.

That message was sent by Apollo’s confident executive team while meeting with Wall Street analysts Friday morning.

The numbers back up their confidence. The firm’s total assets under management hit $785 billion at the end of Q1, a 17% year-over-year increase. Fee-related earnings grew to $559 million in the quarter, up 21% from the same period last year.

“The conditions we saw in December and in the first quarter were not, in my opinion, healthy competitive conditions to put risk on the books,” CEO Marc Rowan said. “What we chose to do was to massively increase our use of funding agreements, which are the least competitive channel for us, and to pile up cash in Q1.”

Rowan interviewed with President Donald Trump’s transition team and was briefly considered a leading candidate to become Secretary of the Treasury. That position ultimately went to Scott Bessent.

The Trump economic team is pursuing high tariffs, claiming the strategy will boost U.S. manufacturing and protect jobs. But the world economy has been thrown into chaos, and prices are expected to rise. The International Monetary Fund cut its global growth forecast because of the tariff war, and says it expects the U.S. to be hit the hardest.

Apollo is navigating the turbulent waters just fine, executives said.

“They want to revitalize American industry,” said James Zelter, president and director of Apollo. “Bring back manufacturing, focus on domestic energy production, and stimulate the industrial global renaissance. Tariffs, taxes and regulation are the three-legged stool to support these objectives.

“While the tariffs should not have come as a surprise, the scope and approach clearly rattled markets. At Apollo, we've been preparing for this environment … with dry powder and liquidity to thrive.”

In Other News:

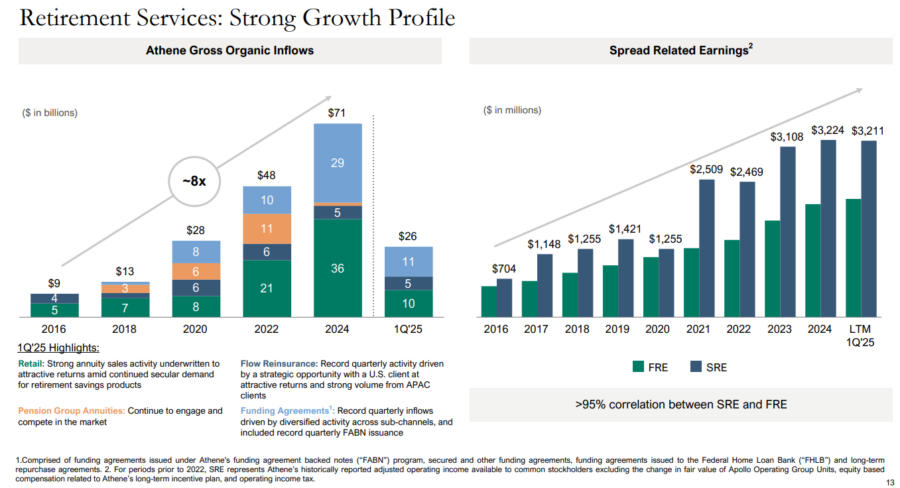

Athene Life & Annuity. Apollo continues to reap big profits from Athene Life & Annuity’s industry-leading annuity sales operations. Athene finished 2024 atop annuity sales charts again with nearly $36 billion in sales. The sales train did not slow down during the first quarter, Zelter said.

“Athene had an outstanding order … with $26 billion of organic flows, the highest results on record,” he said. “By channel, inflows were driven by $10 billion from retail, $11 billion from funding agreements and $5 billion in flow reinsurance."

Quarterly Snapshot:

- Management fees increased 18% year-over-year, driven by record growth from Retirement Services clients and strong levels of third-party asset management inflows.

- Acquired Bridge Investment Group Holdings Inc. in an all-stock transaction with an equity value of approximately $1.5 billion.

- Capital solutions fees grew 9% year-over-year, with more than 90 transactions across debt- and equity-related activity during the quarter.

- Spread-related earnings of $804 million, reflecting record organic growth and increased alternative net investment income.

Management Perspective:

“We've lived in this Goldilocks period of time of hyper-exceptionalism that we're just not used to things going in reverse. But they do. In terms of our own business, on the margin, will we see certain pockets of limited partners where there's government pressure not to allocate to [the] U.S. until there's political resolution? I'm sure. Do I expect it to have a major impact on the business? No, I do not.”

– CEO Marc Rowan

By The Numbers:

- Adjusted Net Income: $1.12 billion ($1.06 billion in Q1 2024)

- Total Assets Under Management: $785 billion ($671 billion in Q1 2024)

- Earnings Per Share: $1.82 ($1.72 in Q1 2024)

- Share Repurchases: $722 million

- Dividend Declared: $0.51 per share

- Stock Price Movement: Stock declined about 1% to 136.48 at midday Friday

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

CVS reports strong Q1 earnings, will exit Aetna’s ACA plans

Cigna reports strong Q1, completes Medicare divestiture

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News