Annuity Sales Soar In Flight To Safety

Fixed-rate deferred annuity sales spiked in March, rocketing 57% over the previous month as a flight to safety took off, according to early figures from the Secure Retirement Institute.

In March, agents and advisors were anecdotally reporting a high level of engagement with prospects and clients eager for safer options with their money. Sellers were also scrambling to sign clients for annuities before carriers could pull products or lower rates, which companies did at a record clip.

LIMRA data confirms the jump in fixed-rate deferred annuity sales and fixed indexed annuities also had a bump at a respectable 22% month over month, according to Todd Giesing, SRI’s annuity research director.

The rush to safety reversed direction for annuities, which were struggling in the strong headwinds from historically low interest rates, Giesing said.

“We started the year [2019] with a 3% 10-year treasury,” Giesing said. “We ended the year somewhere around 1.9%. So, sales were steadily falling for products like fixed-rate deferred and indexed annuities throughout 2019 and as we looked at the first quarter of 2020, we expected that slide to continue.”

And sales were in fact sliding early in the first quarter, so much so that even the exceptionally strong March sales could not overcome the drag on the entire quarter.

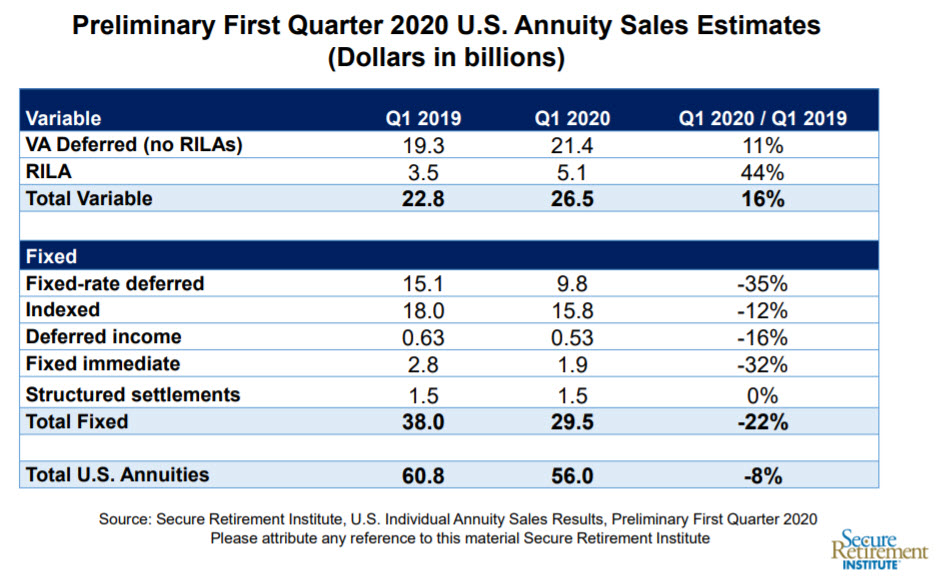

Total fixed annuity sales were $29.5 billion in the first quarter, 22% lower than first quarter ot 2019, according to preliminary results from SRI’s Individual Annuity Sales Survey.

“We are now in a different universe than just three months ago,” Giesing said.

Variable annuities had a steady 2019 with the strong equities market, with registered index-linked annuities charting large increases in sales. That momentum continued into 2020.

Total variable annuity sales rose 16% in the first quarter, marking the fourth consecutive quarter of sales increases. RILA sales were $5.1 billion in the first quarter, up 44% from prior year. This is the highest quarterly sales recorded for RILAs since their introduction to the market in 2010.

Geising said he expected that the volatile equities market and corresponding consumer anxiety will depress VAs for the rest of the year. But the environment might be just right for RILAs to shine.

“They do have a unique value proposition of that downside protection of whether it's a buffer or a floor in the product itself,” Giesing said. “The interesting part is RILAs were introduced to the market in 2010 so they haven't really seen a significant downturn in the [equities] market until now. So we don't have any historical backstops to say what happened in ’09 because they weren't in the product lineup at that point. Our opinion is that they're set up to do well in this environment. And what seeing is that the pricing on these products is maintaining itself out there. So the interest rates aren't having a significant impact to the pricing of these products.”

But that can’t be said for many other annuity products. Interest rates are likely to suppress sales across the board, even fixed indexed annuities, which had spiked after the 2008 crash. But Geising projects that the flight to safety will push fixed-rate deferred annuities to continue doing better than other products.

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at smorelli@innfeedback.com.

© Entire contents copyright 2020 by InsuranceNewsNet. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Fixed Annuity Sales Fall, VAs Rise In First Virus-Affected Sales Data

How Sequence Of Returns Can Crash Your Client’s Retirement

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

More Annuity NewsHealth/Employee Benefits News

- CommunityCare names Josiah Sutton new president and CEO

- Strengthening Roots, Shaping the Future: Josiah Sutton Appointed CEO of CommunityCare

- Artificial intelligence was hot topic at Kentucky Chamber’s inaugural Healthcare Innovation Summit

- Cancer coverage for firefighters clears Senate

- New lawsuit challenges Connecticut Medicaid eligibility rules

More Health/Employee Benefits NewsLife Insurance News

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News