Annuity sales ignore all disruptions in another strong quarter, Wink finds

Annuity sales paid no heed to regulatory pressure in the second quarter. Sales were not stunted by impending interest rate cuts. Not even the summer doldrums prevented a nearly 4% increase in Q2 sales, Wink, Inc. reported.

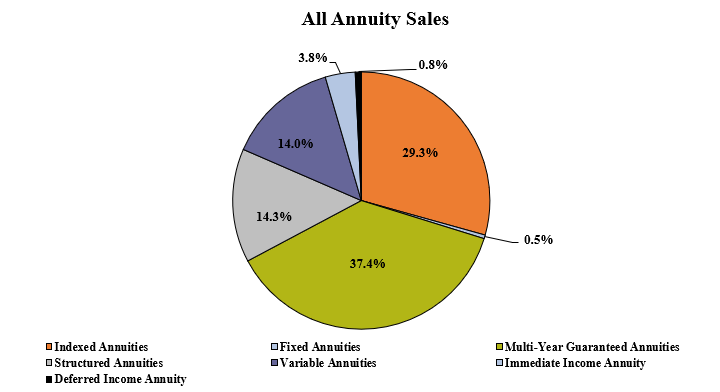

Sales for all annuities were $109.6 billion when compared to the previous quarter, according to Wink’s Sales & Market Report. All annuities include the multi-year guaranteed annuity, traditional fixed annuity, indexed annuity, structured annuity, variable annuity, immediate income, and deferred income annuity product lines.

Noteworthy highlights for all annuity sales in the second quarter include Athene USA ranking as the No. 1 carrier overall for annuity sales, with a market share of 8.2%. Massachusetts Mutual Life Companies came in second place, while Corebridge Financial, Equitable Financial, and Nationwide rounded out the top five carriers in the market, respectively.

The strong second quarter follows an equally good Q1, Wink reported.

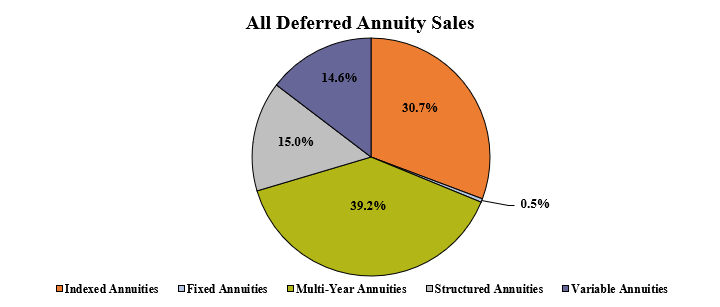

Total second-quarter sales for all deferred annuities were $104.6 billion, up 4.1% when compared to the previous quarter and up 31.2% compared to the same period last year. All deferred annuities include the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity, and variable annuity product lines.

Noteworthy highlights for all deferred annuity sales in the second quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.6%. Massachusetts Mutual Life Companies moved into second place, while Corebridge Financial, Equitable Financial, and Allianz Life rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the quarter.

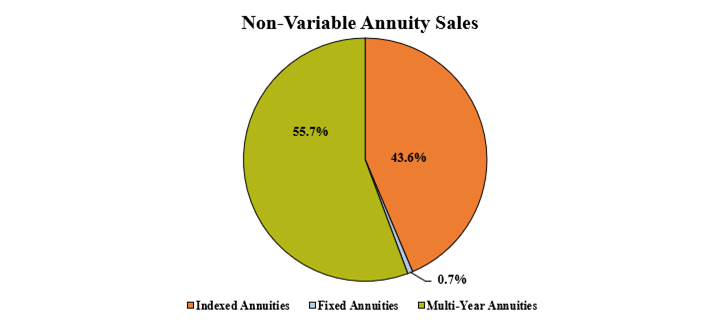

Total second quarter non-variable deferred annuity sales were $73.6 billion, up 0.3% compared to the previous quarter and up 31.2% compared to the same period last year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Noteworthy highlights for non-variable deferred annuity sales in the second quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 11.9%. Massachusetts Mutual Life Companies took second place while Corebridge Financial, Global Atlantic Financial Group, and Sammons Financial Companies completed the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the quarter.

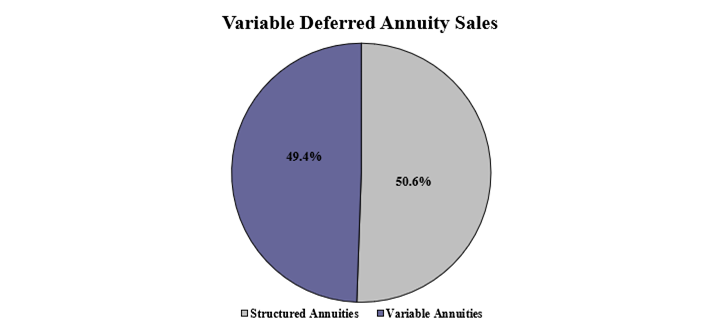

Total second-quarter variable deferred annuity sales were $30.9 billion, up 14.3% compared to the previous quarter and up 31.2% compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the second quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 18%. Jackson National Life continued in the second-place position, as Allianz Life, Prudential, and Brighthouse Financial concluded as the top five carriers in the market, respectively.

Equitable Financial’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall

sales for the quarter.

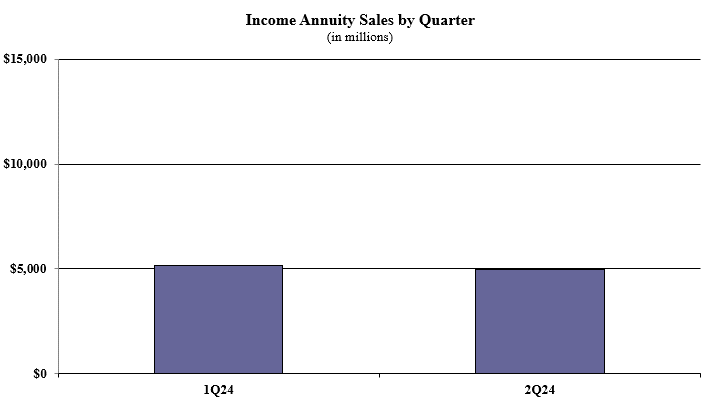

Total second-quarter income annuity sales were $4.9 billion, down 4.1% compared to the previous quarter. Income annuities include immediate income annuity (SPIA) and deferred income annuity product lines.

Noteworthy highlights for income annuity sales in the second quarter include Nationwide ranking as the No. 1 carrier overall for income annuity sales, with a market share of 36.4%. New York Life continued in second, as Massachusetts Mutual Life Companies, Western-Southern Life Assurance Company, and Penn Mutual concluded as the top five carriers in the market, respectively.

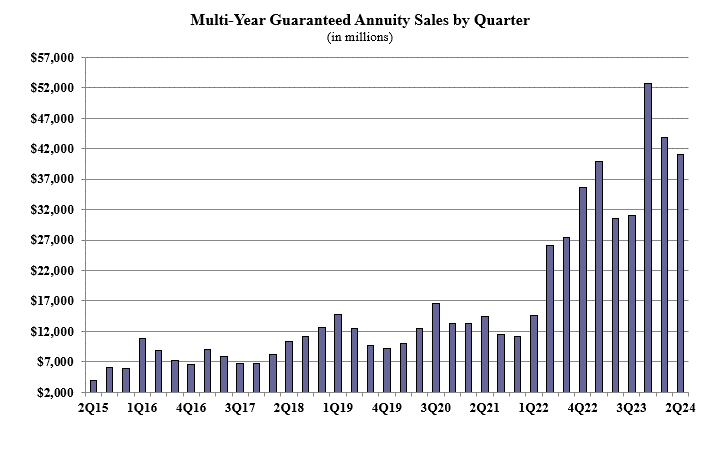

Multi-year guaranteed annuity sales in the second quarter were $41 billion, down 6.2% compared to the previous quarter, and up 34.7% compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the second quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier, with a market share of 14%. Athene USA moved into the second-ranked position, while Corebridge Financial, New York Life, and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the quarter.

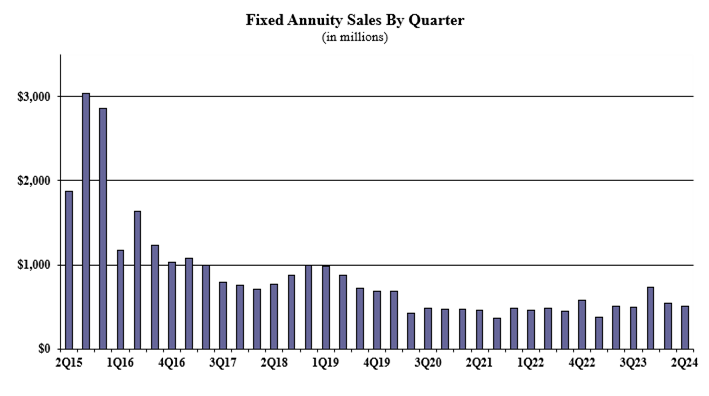

Traditional fixed annuity sales in the second quarter were $506.6 million, down 7.3% compared to the previous quarter, and up 0.6% compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the second quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 17.1%. EquiTrust ranked second while CNO Companies, CL Life, and National Life Group completed the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the sixteenth consecutive quarter.

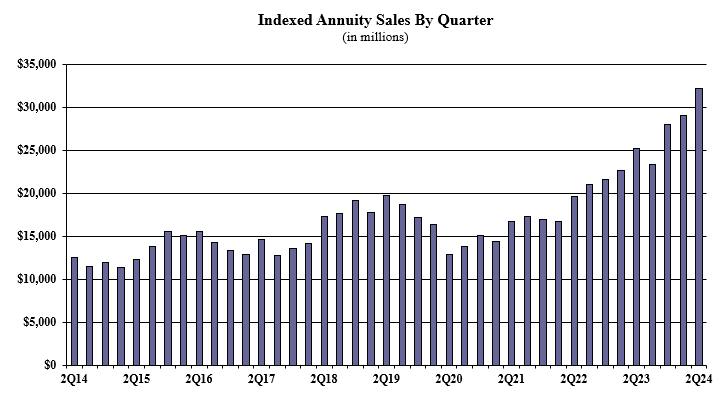

Indexed annuity sales for the second quarter were $32.1 billion; sales were up 10.4% compared to the previous quarter, and up 27.7% compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500. This was a record-setting quarter for indexed annuity sales, topping the prior first quarter 2024 record by 10.4%.

Noteworthy highlights for indexed annuities in the second quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 10.7%. Sammons Financial Companies moved into the second-ranked position, while Allianz Life, Corebridge Financial, and American Equity Companies completed the top five carriers in the market, respectively. American Equity’s IncomeShield 10 was the No. 1 selling indexed annuity, for all channels combined, for the quarter.

Sheryl Moore, CEO of both Wink, Inc.: “It was a record-setting quarter for indexed annuity sales. Rates on these products haven’t been this attractive since I’ve been in the business.”

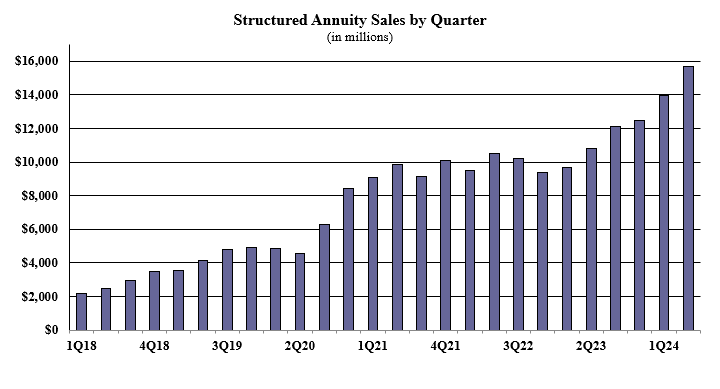

Structured annuity sales in the second quarter were $15.6 billion; up 12.2% compared to the previous quarter, and up 44.6% compared to the same period the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts. This was a record-setting quarter for structured annuity sales, topping the prior first quarter 2024 record by 12.2%.

Noteworthy highlights for structured annuities in the second quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 22.1%. Allianz Life ranked second, while Prudential, Brighthouse Financial, and Jackson National Life completed the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the quarter.

“No surprise that structured annuity sales set a record this quarter,” Moore said. “These products are definitely the ‘it girl’ of life insurance right now.”

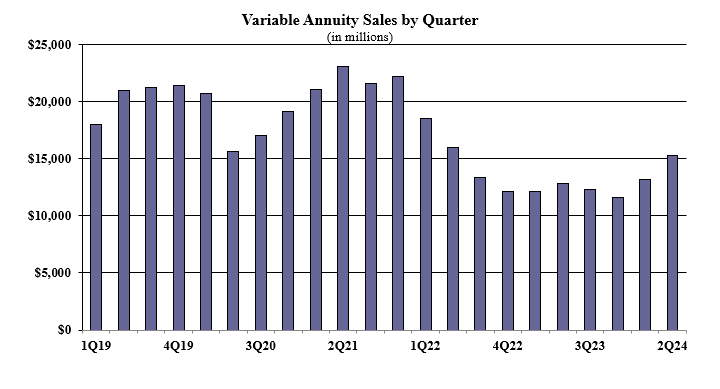

Variable annuity sales in the second quarter were $15.3 billion, up 16.5% compared to the previous quarter, and up 19.8% compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the second quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 17.4%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twenty-first consecutive quarter, for all channels combined.

“The steadily upward trending market in the second quarter, lent to a rebound in VA sales,” Moore said.

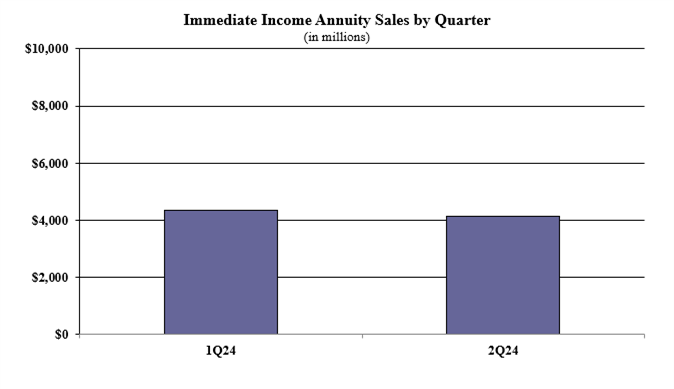

Immediate income annuity sales in the second quarter were $4.1 billion; down 4.9% compared to the previous quarter.

Noteworthy highlights for immediate income annuities in the second quarter include Nationwide ranking as the No. 1 carrier in immediate income annuities, with a market share of 43.7%. New York Life ranked second, while Massachusetts Mutual Life Companies, Penn Mutual, and Pacific Life Companies finished as the top five carriers in the market, respectively.

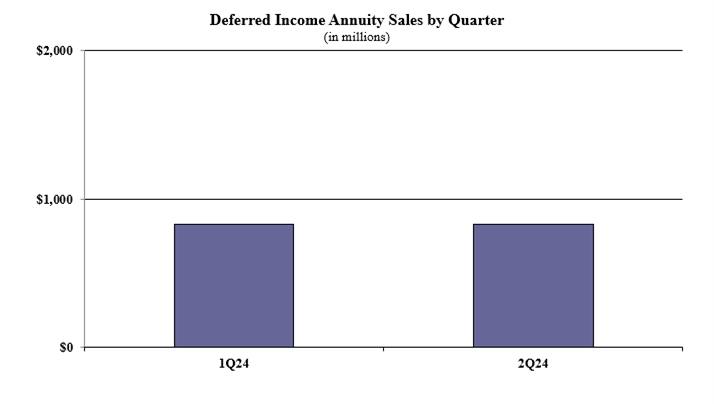

Deferred income annuity sales in the second quarter were $830 million, down 0.07% compared to the previous quarter.

Noteworthy highlights for deferred income annuities in the second quarter include New York Life ranking as the No. 1 carrier in deferred income annuities, with a market share of 48.8%. Western-Southern Life Assurance Company ranked second, as Massachusetts Mutual Life Companies, Integrity Life Companies, and Symetra Financial finished as the top five carriers in the market, respectively.

One hundred and thirty-four annuity providers participated in the report. Wink now reports sales on all annuity lines of business, as well as all life insurance product lines.

Lawsuit revived for man who lost $16M in life policies on a missed payment

Time ‘to adjust’ on interest rates, Powell says, hinting at cuts to come

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsHealth/Employee Benefits News

- With federal backing, Wyoming's catastrophic 'BearCare' health insurance plan could become reality

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

- NEW YEAR, NEW LAWS: GOVERNOR HOCHUL ANNOUNCES AFFORDABLE HEALTH CARE LAWS GOING INTO EFFECT ON JANUARY 1

- Thousands of Alaskans face health care ‘cliff in 2026

- As federal health tax credits end, Chicago-area leaders warn about costs to Cook County and Illinois hospitals

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance NewsProperty and Casualty News

- Judge OK's attorney general intervention in State Farm lawsuit with sweeping implications

- 2025 Top 5 P&C Stories: From fraud to wildfires

- Too little, too late, too weak: Critics react to proposed insurance legislation

- Q&A on revised FEMA flood insurance maps

- Commercial auto insurance eligibility for nonbusiness owners: A 50-state overview

More Property and Casualty News