Annuities And Unmarried Couples: The Right Planning Can Avoid Headaches

Annuities provide many advantages to clients, but those advantages are especially geared toward the individual.

Annuities are often tailored to clients of retirement age, and those most often are seeking a predictable income stream or a guarantee of investment return. Choosing the right annuity, based on goals and risk tolerance, is a personal decision.

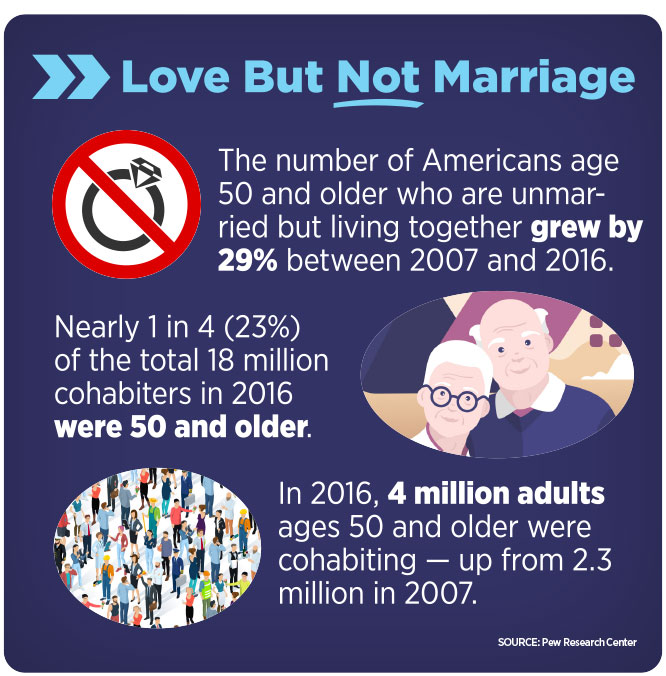

Despite this individual focus, there are ways that marital status might factor into annuity selection, as any non-spousal beneficiary may face complications that spousal beneficiaries do not. As of 2018, 45% of the 47.5 million Americans aged 65 and older are unmarried, LIMRA reports. Knowing that, there are factors that advisors can consider for clients — such as those who are partnered but not married — seeking an annuity. In those conversations, advisors can address the following topics to educate clients, and better position and clarify the benefits of annuities.

Considerations For Unmarried Couples

The idea of buying an annuity may be attractive for unmarried couples, but there are considerations that need to be communicated. The tax law currently allows for “spousal continuation” of an annuity payable to a surviving spouse, if the spouse is named the beneficiary. This means that in cases where a surviving spouse is the beneficiary of a qualified or nonqualified annuity, the surviving spouse can continue the contract in their own name, as though they were the original owner. While the income received from an annuity can be used however the couple decides, designating a non-spousal beneficiary is much more complicated if the owner of the annuity dies.

Unmarried couples, though, may face complicated tax hurdles based on current tax laws. Inherited annuities — when the beneficiary inherits the annuity upon the annuitant’s death — are considered taxable income, unless the annuity is from a state-recognized spouse. Unlike spousal beneficiaries, non-spouse beneficiaries cannot simply assume ownership, making the transfer of funds challenging. The non-spousal beneficiary will also have to pay income tax on the gain of the contract, based on the individual’s tax rate. Without planning beforehand, those taxes can drain a sizable portion of the assets.

If an advisor is working with an unmarried couple early in the annuity purchasing stage, it is in your client’s best interest to help the named beneficiary understand the limited death benefit payment and distribution options available, if the couple decides to go this route. By providing clients with all of the considerations and likely challenges they will face by having a non-spousal beneficiary, advisors can help them avoid unpleasant financial ramifications and unnecessary costs.

Positioning Annuity Benefits

This is also an opportunity for advisors to help clients understand that any annuity is really intended for the living person. Annuities are a tax-deferred method designed to grow money safely, creating a lifetime income stream for the annuity owner. Focusing on the true intent and benefits of annuities can refocus the conversation.

Advisors can help explain that fixed annuities are a long-term savings plan for clients, with a built-in future income stream that can supplement retirement income. Clients’ needs may either match with a fixed immediate or a fixed deferred annuity — with deferred having an option for multiyear guarantee annuities or fixed indexed annuities.

By thinking about each of these as matching a target client, advisors can better identify which annuities pair best with the particular client’s situation — and each person in the relationship might have a different situation. It is an opportunity to demonstrate how they can benefit from individual annuities.

Because there is no annual contribution limit of a nonqualified annuity, clients can save more money for retirement and could make up for lost time on other traditional retirement plans, such as 401(k)s and individual retirement accounts, if they started saving later in life. This factor may be of value to a couple who had disparate career paths, with one potentially seeking a way to make gains to more closely reach their partner’s saving level.

The many other benefits associated with annuities, such as security in building savings, ensuring a lifetime income stream, tax deferred status, and others, can all be positioned to unmarried couples to address individual needs.

After reminding clients that it is difficult for anyone other than a spouse to take over an annuity contract seamlessly, and communicating the benefits around annuities, advisors can help unmarried clients select the right annuity to match their financial needs.

Selling To The Individual

Advisors can approach a conversation with an unmarried couple by selling to each individual. In these conversations, it is imperative to help the clients understand the challenges as noted previously. Although it may be easier to be married when it comes to naming the partner as the beneficiary, finding the right annuity fit for each of the individuals is key.

Advisors can help clients purchase two individual contracts, with each annuity specifically tailored to each client’s preferences and goals. This means each person is receiving an investment option that is personalized. It can be explained much like if they were to each purchase their own vehicle. Yes, the car serves a similar purpose, but it possesses the qualities and characteristics preferred by each person.

During these conversations, advisors seek to understand each client’s long-term financial planning goals, as well as the goals they have as a couple, to help them select two annuities. As each annuity has its own benefits, clients will prioritize those benefits differently. Advisors can recommend the right fit based on when clients want payments to begin, for how long, their tolerance for risk and their expected contribution — which might not be the same in a single partnership.

Annuities offer a secure way to build savings into retirement. Their key features provide many benefits that support clients’ goals, regardless of their marital status. But if unmarried life partners seek an advisor’s guidance about annuities, advisors can help by providing information, context and clarity around the purpose of annuities and how they work best.

John Williams is regional sales director, individual annuities, at The Standard. He may be contacted at [email protected].

How To Solve The Remote Hiring Challenge

COVID-19 Forced Advisors To Adapt In The Midst Of Disruption

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Local lawmakers, advocates talk about BadgerCare expansion

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News