Americans setting up for retirement failure, surveys show

Americans are setting themselves up for less-than-golden years if the economy slides into recession, according to findings from a few surveys.

As people adjust to higher inflation and prepare for difficult times, more of them are putting off retirement and reducing retirement savings, thinking they will work into the customary retirement years.

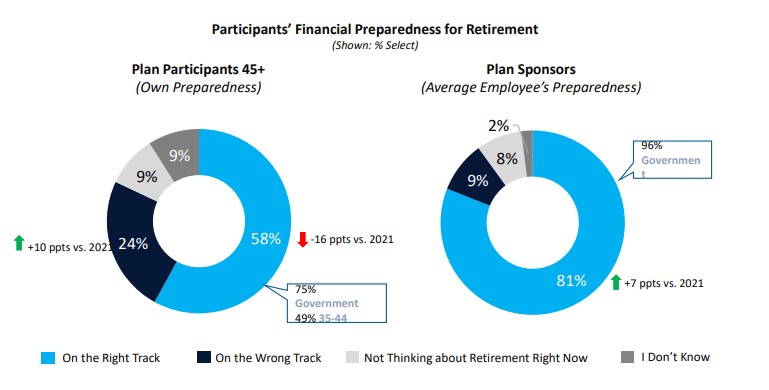

A Nationwide Retirement Institute study found that 40% of workers plan to postpone retirement because of increasing costs of living, double the number of people saying so a year ago. Fewer people have confidence in their retirement plan, with 58% feeling confident vs. 72% last year.

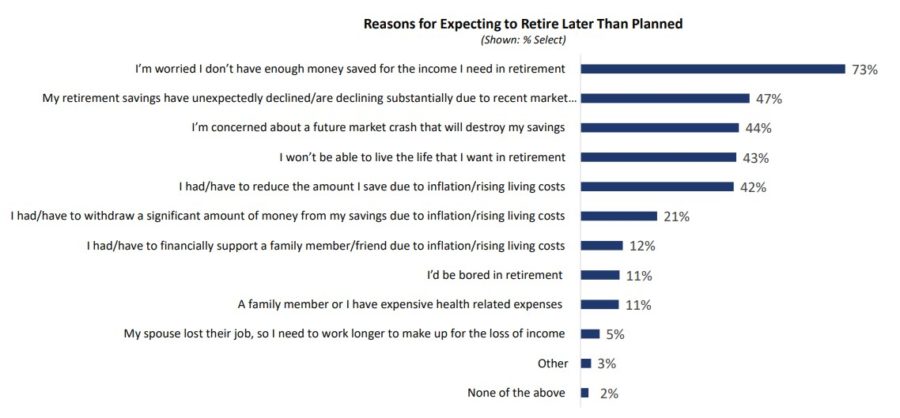

A majority of employees (66%) said inflation is their top retirement concern. Nearly three-quarters of workers said they expect to retire later because they don’t have enough money saved.

Another survey showed that inflation is causing a majority of Americans (54%) to reduce or stop their retirement savings. According to the Allianz Life Q3 Quarterly Market Perceptions Study, most respondents (80%) said they were worried about inflation having a negative impact on their income’s purchasing power.

The reduction in retirement savings is hitting younger generations, setting themselves up for difficulties later. Millennials were the most likely to say they have stopped or reduced retirement savings due to inflation (65%), with 40% of boomers and 59% of Gen Xers saying so.

Even if they have not cut their savings, Americans are worried inflation will damage their retirement plans, with Gen Xers the most anxious at 80%, while 76% of millennials and 73% of boomers agreed.

It isn’t just inflation they are worried about, with 62% concerned that a major recession is right around the corner.

Able to work?

Postponing retirement would seem to be a natural consequence of the anxiety around savings and income. But people are probably overestimating their ability to remain at work.

Even before the COVID shutdown, people in their 50s were being forced out of their long-term jobs, with 56% leaving involuntarily, according to a ProPublica/Urban Institute study.

If You’re Over 50, Chances Are the Decision to Leave a Job Won’t be Yours

“This isn’t how most people think they’re going to finish out their work lives,” said Richard Johnson, an Urban Institute economist. “For the majority of older Americans, working after 50 is considerably riskier and more turbulent than we previously thought.”

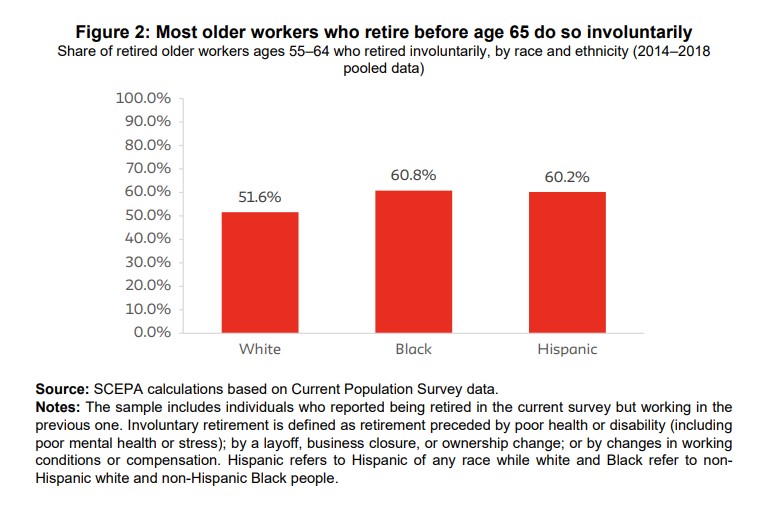

Another meta-analysis also found that half of the people who retired between 55 and 64 did so involuntarily, according to the Schwartz Center for Economic Policy Analysis. This is particularly true for workers in physically demanding jobs – a key reason why more Black and Hispanic people are forced into early retirement.

Less health, more demands

A recent book from two researchers showed that more than half of Americans don’t work consistently through their 50s, even before they reach their more challenging years.

“Many people won’t be able to work even into their 60s, never mind through them,” according to one of the editors, Lisa Berkman of Harvard’s Center for Population and Development Studies.

The book, Overtime: America’s Aging Workforce and the Future of Working Longer, listed three reasons for early retirement, according to a Forbes article on the research.

Health is the top reason, even though people are living longer. They aren’t necessarily living healthier.

“Major sections of the cohorts turning 40 or 50 now – especially groups with lower levels of education or income — are actually in worse health than their counterparts who were born two or three decades earlier were when they were in their 40s and 50s,” according to the book.

Care is another primary reason, particularly women. If people are out of work caring for their parents in their 50s, it can affect the rest of their working lives. Workplaces are no better are providing flexibility for older employees to care for their relatives any more than they are for younger people caring for their children.

Work itself drains employees. The physical and mental stress are grinding employees as they deal with the realities of aging.

The book also has some sobering news for people in their 50s who tried retirement during COVID – if they want to return to work, it’s tough to get back to the level of career that they left. Only one in 10 ever earn as much again.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

GOP couldn’t ‘close the deal’ on midterm opportunity, analyst says

Integrity Marketing Group to acquire The Milner Agency

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Kontoor updates executive severance package

- AZ ACA enrollment drops 65,000 as tax credits expire

- Two health care bills advance to Evers' desk

Assembly passes breast cancer screening, postpartum Medicaid bills

- Obamacare sign-ups drop

- NJ DEPARTMENT OF BANKING AND INSURANCE PROVIDES GET COVERED NEW JERSEY OPEN ENROLLMENT UPDATE

More Health/Employee Benefits NewsLife Insurance News