Americans More Secure, But Retirement Not So Much

Americans are more secure about covering their expenses and are more optimistic about the future than they were a year ago, but they are neglecting to build the foundation for that security, according to recently released surveys.

A year ago, just as COVID-19 was winding up to become a pandemic, Americans were already uneasy with their finances, according to a New York Life Wealth Watch survey.

Last March, only 53% of respondents were confident in their ability to pay their monthly bills. This year’s survey showed 73% were confident.

Last year, only 42% of Americans were confident they could pay for a personal emergency; this March 55% said they could handle it.

Most of adults (67%) said they received a stimulus check in the past year, with nearly half of respondents (45%) putting this extra income most often toward daily expenses.

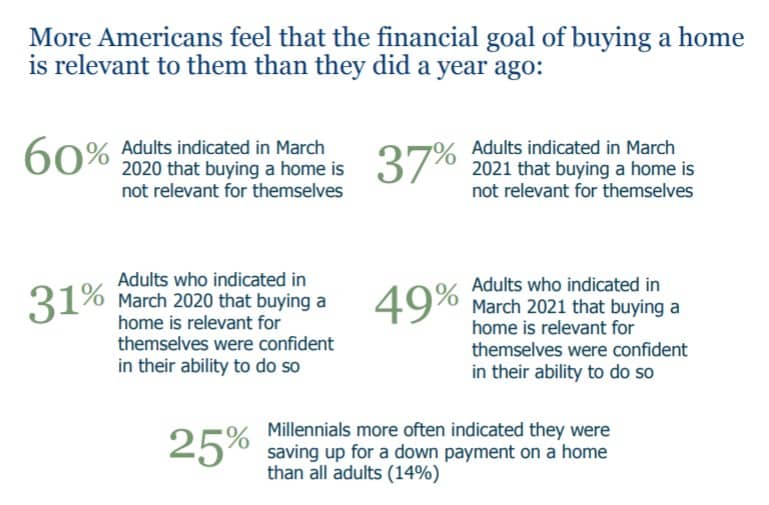

People were especially positive about buying a home, even with the feverish housing market. Last year, only 60% of respondents said buying a home was “not relevant” for themselves, and only 31% said buying a house was “relevant.” This year, 31% said it was not relevant and 49% said buying a house was relevant.

Millennials were particularly house hopeful, with 25% saving for a down payment. That was the largest percentage of all demographic groups – 14% of all adults said they were saving for a down payment.

More people are also feeling more confident that their retirement savings will last their lifetime, although it was still less than half of the respondents who said they felt very or somewhat confident.

Beyond the late pandemic glow of hope, people were still falling short of taking care of the long term.

More than half of respondents (53%) stopped or reduced their student debt payments during COVID-19, and half of these respondents (49%) shifted the money previously allocated to student loan payments toward daily living expenses. Only 35% of adults who indicated paying off student debt as a goal are confident in their ability to do so.

Gen Xers, who have been burdened by student loan debt for decades, particularly do not feel confident in being able to ever pay it off. A third of all adults are worried about their student loan debt.

Relatively few adults have long-term savings goals, with 22% having none. Although retirement confidence may be higher, only 28% have being “on track for retirement at my desired age.”

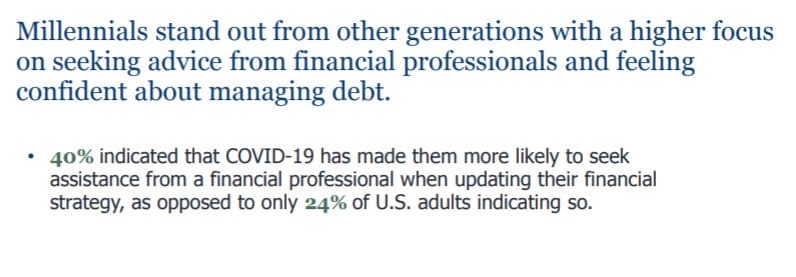

The good news for financial professionals is that millennials would really like to talk to them, at least 40% of them do.

Another survey done at the end of 2020 found retirement security results that were similar to those in the New York Life study. More than half of working age adults surveyed said they were concerned about their ability to achieve retirement security in a study done by the National Institute on Retirement Security.

Respondents cited several factors in their struggle to prepare for retirement, according to the NIRS survey.

The escalating cost of healthcare (59 percent) and long-term care top the list (56 percent). Other factors include longer life spans (53 percent), stagnant salaries (51 percent), fewer pensions (51 percent), debt (47 percent) and “do-it-yourself ” retirement plans (45 percent).

Whatever the reasons, it is clear that Americans do not believe they can save for retirement, with two-thirds of respondents saying that workers cannot save enough on their own for retirement security.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Planning Isn’t Comprehensive Without Mitigating Risk, NAIFA Members Told

How Social Determinants Can Impact Health Benefits

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

More Annuity NewsHealth/Employee Benefits News

- CommunityCare names Josiah Sutton new president and CEO

- Strengthening Roots, Shaping the Future: Josiah Sutton Appointed CEO of CommunityCare

- Artificial intelligence was hot topic at Kentucky Chamber’s inaugural Healthcare Innovation Summit

- Cancer coverage for firefighters clears Senate

- New lawsuit challenges Connecticut Medicaid eligibility rules

More Health/Employee Benefits NewsLife Insurance News

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News