AM Best will be ‘all over’ life insurers if high-risk assets escalate

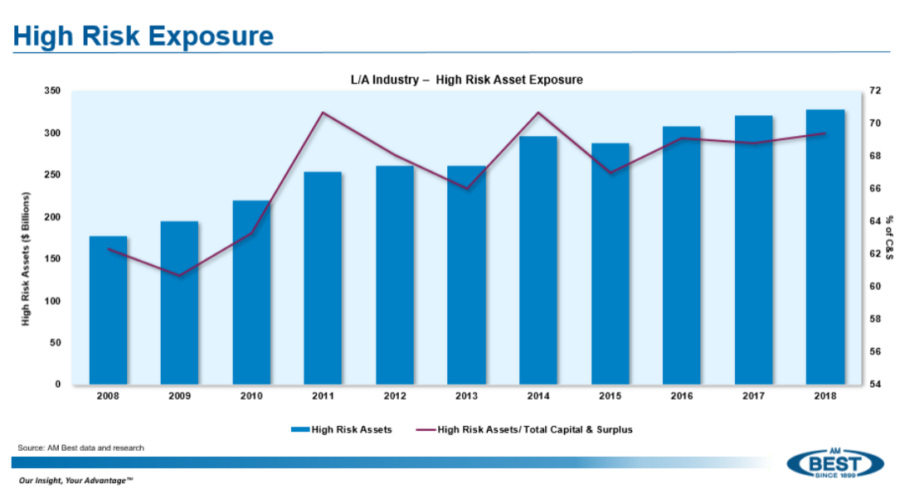

Life insurers are increasingly compiling high-risk assets and AM Best is watching closely, two directors assured a federal Department of the Treasury committee Wednesday.

The exposure to high risk assets "is something that could be problematic for these companies and the first signs that we see, we're going to be all over these companies. Absolutely," said Mike Porcelli, director for AM Best.

AM Best issues financial-strength ratings measuring insurance companies' ability to pay claims. It also rates financial instruments issued by insurance companies, such as bonds, notes, and securitization products. Its ratings are a crucial measure of insurers' financial stability and reputation.

Porcelli and Ken Frino, managing director and AM Best, appeared before the Federal Advisory Committee on Insurance to give an update on market developments and trends.

Two trends have regulators and some legislators concerned about life insurers taking on higher risk. For starters, a long low-interest-rate environment forced insurers to seek out riskier investments in order to make a return. Relatedly, some life insurers are making deals with private equity to manage those investments. Some private equity firms are buying life insurers outright, attracted to the large capital in the form of policyholder premium.

A CNBC report today points to insurers' risky investments in failed banks such as Silicon Valley Bank as reasons why underwriting losses are soaring.

Birny Birnbaum, executive director of the Center for Economic Justice, and Doug Heller, director of insurance for the Consumer Federation of Insurance, both raised alarm bells at insurers' high-risk assets with policyholder dollars.

Birnbaum noted the shift from protection-focused life insurance products to more investment-focused products. That shift is leading to more creative hedging programs that could ratchet up risk, he said.

"There's now a concentration instead of a diversification in terms of the risk associated with those products, because everything is now concentrated on the market," Birnbaum explained.

"The companies at the higher rating levels are still very well diversified between both life and annuity type products," Frino explained. "As companies shift to more retirement and interest rate sensitivity type products, it does raise our level of concern, but we lean on the company's enterprise risk management program to see what they're doing in terms of managing that risk, and what they have at their disposal during times of stress, or concerns within the marketplace."

AM Best does get information from companies on their hedging programs, he added, and has "pretty extensive" conversations about those programs.

"But certainly we're not auditing that and we're not opining on that particular strategy," Frino said. "What we want to see is does it fit their risk profile? And how well are they managing risk that they've been putting on the books?"

Risk-based approach

Every single rating meeting begins with a look at the company's risk profile, Porcelli added, and conversations with the company's chief risk officer about stress testing and so on.

"I think we're always putting a challenge on companies and I will tell you that in every conversation that we have about a company that could potentially have a downgrade, we're always asking about their risk management," he said. "In any situation that we see where we see something that is not going right, we emphasize it over and over again. Let's just circle back to risk management practices."

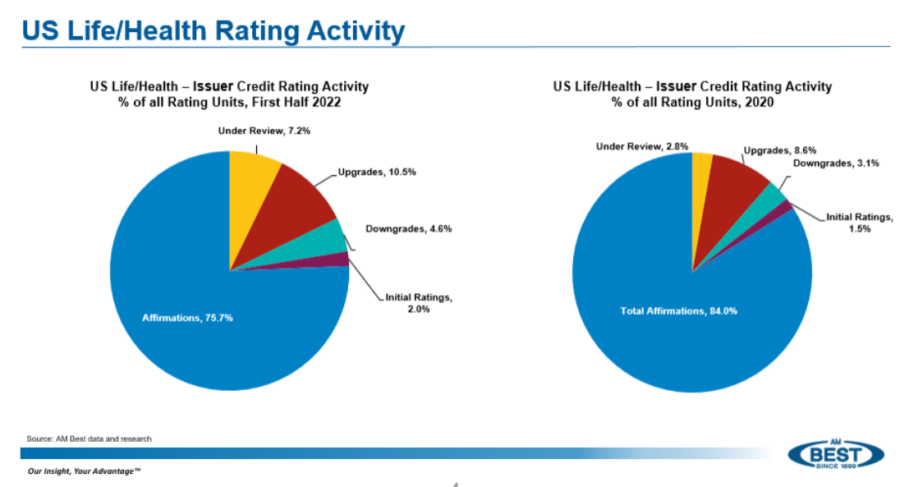

Ratings adjustments is another growing trend as AM Best monitors the industry.

The changing ratings is typically a reflection on the number of transaction happening, Frino said, as a life insurer acquisition normally triggers a rating review. In response to a question from a committee member, Frino said AM Best expects the transactions to continue.

"We have been in conversations with companies that are looking to move annuity business, older blocks of business," he said. "So there is a potential for more of that riskier, older business to be moving off the company's balance sheet. We expect that trend to continue."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Health panel: How to improve prescription drug prices, accessibility

ACA ruling hits preventive care, but ‘isn’t a fatal blow,’ analyst says

Advisor News

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

- Study: key gaps advisors miss in retirement planning conversations

More Advisor NewsAnnuity News

Health/Employee Benefits News

- DHS deputy secretary named to Medicaid board

- Plan would give Ohio farmers health care coverage option

- PA's Medicaid program costs under concern

- Two health insurers ordered by Va. SCC to reimburse hundreds for overcharges

- Virginia SCC orders two big health insurers to reimburse hundreds

More Health/Employee Benefits NewsLife Insurance News