Advisors must help clients plan for rising health care costs in retirement

Government spending on health care for older Americans has been flat but that doesn’t mean health care spending has remained the same. In fact, while government spending on Medicare has been stable, the program’s beneficiaries continue to see their out-of-pocket health care costs increase – and those costs will keep going up.

In a recent brief, HealthView Services revealed that while the average annual cost to the government per Medicare beneficiary has not significantly increased since 2010, demographic changes are driving health care costs upward.

The first baby boomers started to retire in the late 2000s, and have been turning age 65 at a rate of around 10,000 a day since. Driven by this demographic wave, the number of Medicare recipients has increased by 39.8% since 2010 (from 47.2 million to 65.8 million) and the proportion of the 65-and-over population has skewed younger and healthier, compared to more than a decade ago.

Since health care costs are highest toward the end of retirement as health declines, the average annual cost per retiree under Medicare will be lower for a younger population. Looking forward, aging boomers will make for an older and less healthy retiree population. This will result in significantly higher average per beneficiary expenses, assuming all else remains equal.

Improvements in health care, the more efficient service delivery, higher out-of-pocket costs due to increased cost-shifting to retirees, and the ability of the government to negotiate expenses with providers have played a modest role in slowing the pace of rising health-care costs, HealthView said.

Although Medicare Advantage enrollment has increased dramatically over the last decade – which was expected to reduce costs to the government – industry data indicates that this too, has not had a particularly beneficial impact on government costs, HealthView said. In fact, there is evidence that the opposite may be true. Advisors and retirees need to focus on the big picture.

“Health care cost increases are happening in pre-retirement and in retirement as well,” said Ron Mastrogiovanni, HealthView Services president. “We are taking more responsibility for total health care costs whether you are in retirement or pre-retirement.”

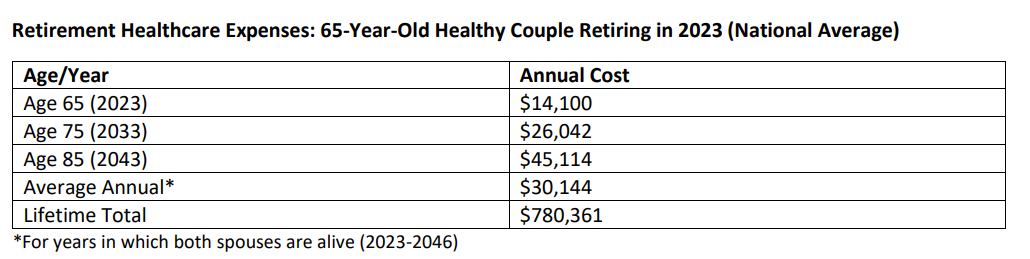

Medicare costs have increased 73% since 2011, from $522.9 billion to $905.2 billion in 2022. HealthView’s actuarial data, which is based on 530 million actual health care claims, shows that annual total health care costs for 65-year-old retirees have increased by 60% since 2011. A healthy 65-year-old couple would have spent $8,900 in 2011 on Medicare Part B and D premiums, supplemental insurance, dental insurance and out-of-pocket costs for hospitalization, doctor visits, tests, prescription drugs, dental, vision and hearing. Today, a 65-year-old couple will spend $14,100 – an increase of $5,200.

Lifetime health care costs for a 65-year-old couple starting Medicare in 2023 will be substantial, HealthView said, with the decades-long trend of health care costs rising at 1.5–2 times consumer price inflation expected to continue. For all premiums and out-of-pocket expenses, HealthView’s data shows this hypothetical couple should expect more than $780,000 (future value) in total retirement health-related expenditures. This assumes they live to actuarial life expectancy of 88 (male) and 90 (female). To address these expenses, they will need to have saved $260,995 at retirement, assuming a 6% return on their portfolio, annual withdrawals to fund all costs less Medicare Part B (funded via Social Security), and a balance at longevity of zero.

HealthView expects that Medicare premiums will continue to increase, and retirees should anticipate picking up more of the cost of health care. Changes to the Social Security Full Retirement Age and benefit payouts based on claim age are also likely.

In preparing clients for retirement, advisors must “make them aware of the reality of health care costs,” Mastrogiovanni said.

“Health care costs become important from a financial planning perspective. People need to understand what that total number will be, just like the total number for housing, food and transportation.

“The consumer who works with an advisor has choices. They can use insurance products, they can use capital market products, they can use a combination of the two to address the problem of covering health care costs. The advisor can guide them on what's the best solution for them.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Whatever happened to Medicare For All?

Business owners worry about gaps in insurance coverage, survey finds

Advisor News

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

More Advisor NewsAnnuity News

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- CVS Health CEO David Joyner fires back at AOC’s monopoly criticism

- When UCare shuts down, there might $84M left

- Arizona faces lawsuit over Medicaid cuts to therapy for autism kids

- When health insurance costs more than the mortgage

- HHS NOTICE OF BENEFIT AND PAYMENT PARAMETERS FOR 2027 PROPOSED RULE

More Health/Employee Benefits NewsLife Insurance News