Advisors, Consumers Didn’t See COVID-19 Coming: Study

Despite growing attention to the coronavirus in the run up to the March stock market crash, the sixth annual Guaranteed Lifetime Income Study (GLIS) by Greenwald & Associates and CANNEX, finds that few clients or advisors believed a market downturn was very likely in 2020. Similar to findings from previous periods of market volatility, the study shows higher client interest in guaranteed lifetime income compared to 2019.

These are among the Top 10 Findings of the GLIS surveys of 1,000 Americans between the ages of 55 and 75, with at least $100,000 in investable assets, and 302 financial advisors with at least $15 million in assets under management. The research, fielded mid-February in the days before the market crash, provides comprehensive insights into client and advisor perceptions of guaranteed lifetime income products and their role in the retirement planning process.

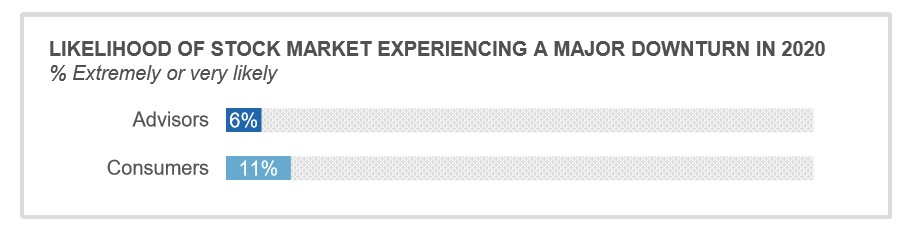

The study shows 11% of clients considered a market downturn was very or extremely likely in 2020, although 29% considered a downturn at least somewhat likely. A third (35%) of surveyed clients considered a downturn very or extremely likely within 5 years. Surprisingly, even fewer advisors were anticipating a downturn in 2020, with only 6% saying it was very or extremely likely and 17% at least somewhat likely. The majority of advisors considered a market downturn very or extremely likely (60%) within five years.

“Following a 10-year bull market, the research shows clients largely optimistic about the outlook for the market in the days before the collapse and confident they would be able to weather a downturn,” said study director, Doug Kincaid of Greenwald & Associates. “Although it will take some time to evaluate the impact of the crisis on retirement plans, the research findings underscore the importance of having a solid retirement planning process that takes into account unforeseen events.”

Over the last six years, GLIS studies have shown that guaranteed lifetime income generally becomes more attractive during market downturns and volatility. This year is no different. There was increased interest in guaranteed lifetime income in 2020 with 71% of clients stating it was a highly valuable addition to Social Security, up from 67% a year ago.

“A black swan event, COVID-19, has upended lives, the economy, and financial markets in ways that are likely to drive demand for guaranteed lifetime income in retirement,” said Tamiko Toland, head of Annuity Research at CANNEX. “The research demonstrates the critical role advisors play in communicating the value of these products in retirement plans, but also that they generally underestimate clients’ interest in guaranteed lifetime income.”

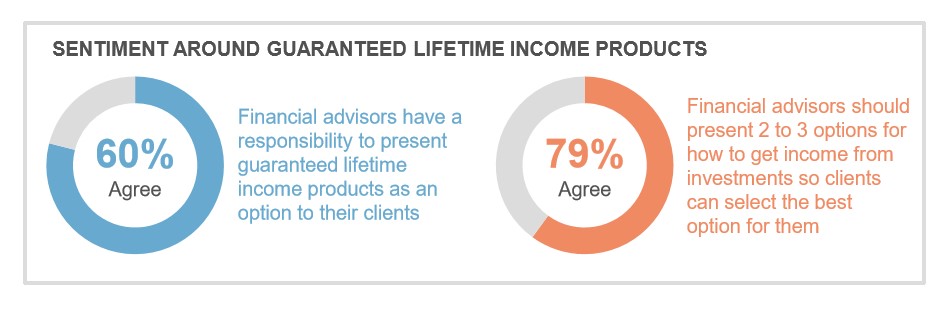

In fact, only 14% of advisors believe their average client is highly interested in guaranteed lifetime income, while 42% of consumers say they are highly interested or already own a GLI product. Three in five clients say advisors have a responsibility to present guaranteed lifetime income products as part of a retirement income strategy. Eight in ten believe advisors should present two or three options for producing income in retirement.

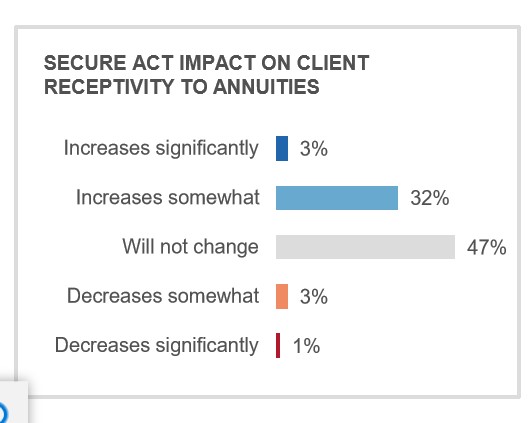

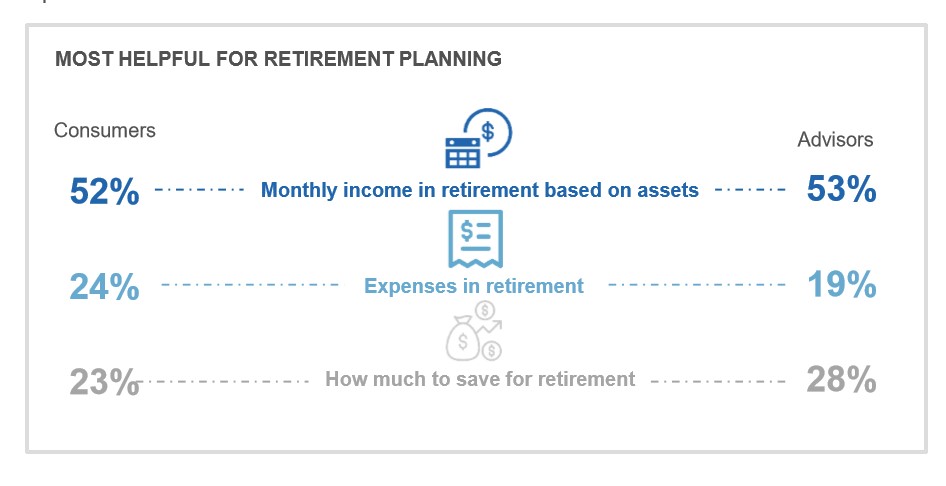

The research also sheds light on advisor perceptions of the SECURE Act. Three in ten advisors believe the increased availability of annuities in 401(k) plans will increase the number of annuities they sell and 35% believe it will increase client receptivity to annuities. Importantly, it highlights consumers’ and advisors’ belief that estimates of monthly retirement income, mandated by the Act, are more helpful for retirement planning than savings goals or estimates of retirement expenses.

Here are the Top 10 findings in the study.

- Consumers and advisors missed the mark around the likelihood of a market downturn in 2020. On the eve of the market’s falling in late February, just 11% of consumers and—even more surprisingly—6% of advisors thought it highly likely there would be a major downturn in 2020. These misestimations highlight how difficult black swan market events are to predict, even for professionals, and that many common solutions for risk protection, such as diversification, can be insufficient on their own.

- Guaranteed lifetime income appeal remains high in varied market conditions. Consistent with previous periods of market volatility, consumers see a high value in guaranteed lifetime income. Up from 67% in 2019, 71% of consumers say guaranteed lifetime income in addition to Social Security is highly valuable. Six in ten advisors report higher client interest in annuities with guaranteed lifetime income during previous market downturns, and 42% say the same about low interest rates. Given the events in 2020, it seems likely that consumer demand for guaranteed lifetime income will only increase heading into 2021.

- Advisors see the SECURE Act as a positive context for annuities. While the SECURE Act does not have a direct impact on advisor annuity sales, 35% of advisors believe it will increase client receptivity to annuities and very few foresee a decrease in receptivity. The SECURE Act requiring plan sponsors to provide an estimate of monthly income in retirement presents advisors with an opportunity to convert these estimates into reality with the purchase of an annuity.

- Estimates of monthly income in retirement are most helpful. Consumers and advisors agree that estimates of retirement income are more helpful for retirement planning than savings goals or estimates of retirement expenses, even though all are clearly linked. Unfortunately, only 38% of consumers say a financial advisor provided them with this estimate.

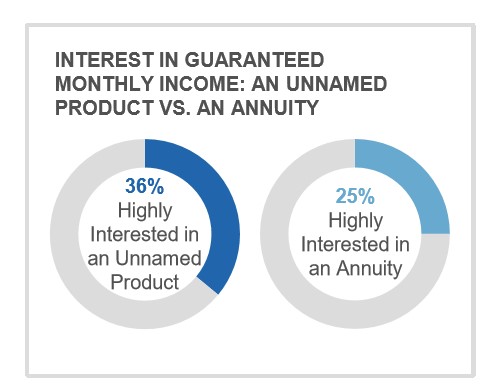

- Stigma around the name “annuity” remains. The gap between the appeal of an unnamed product and a guaranteed lifetime income annuity remains, with a third of consumers decreasing their level of interest when the word “annuity” is used. Finding ways to rehab the “annuity” name should be a priority, starting with framing it as part of a broader retirement income strategy.

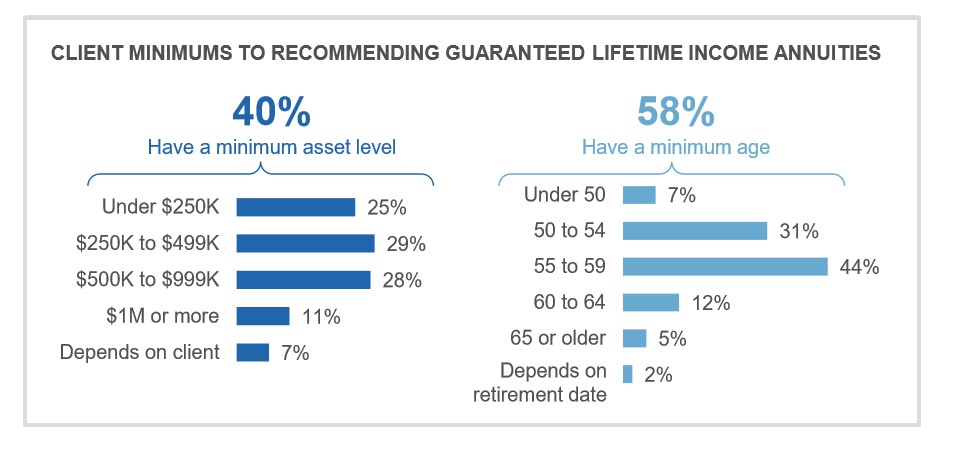

- Advisors dramatically underestimate consumer interest in guaranteed lifetime income products. Advisors appear to have a target market in mind for recommending guaranteed lifetime income annuities: those between $250K and $999K in assets. This target is guided by asset and age minimums that need to be met before considering an annuity for their clients. This contributes to a significant underestimation of interest: while only 14% of advisors think their average client is highly interested in guaranteed lifetime income annuities, 42% of consumers say they are (or already own one). While some of this interest lies with consumers who are below these minimums, interest appears broader for consumers at higher asset levels as well.

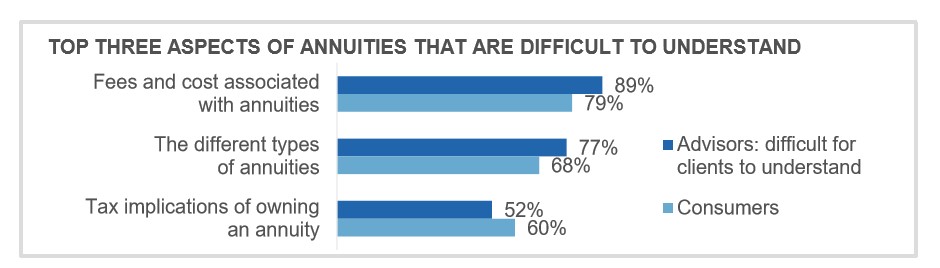

- Three areas of confusion around guaranteed lifetime income products stand out. About half of consumers express difficulty understanding guaranteed lifetime income products, and at the heart of this confusion are three issues:

- Fees and costs

- Navigating the variations of annuities

- Product tax implications

For those who do not own the products, only a quarter say their advisor has explained these issues well. Also troubling is that half of those who own a guaranteed lifetime income annuity say their advisor did a poor job explaining the amount to invest in an annuity, the tax implications, and the fees and costs.

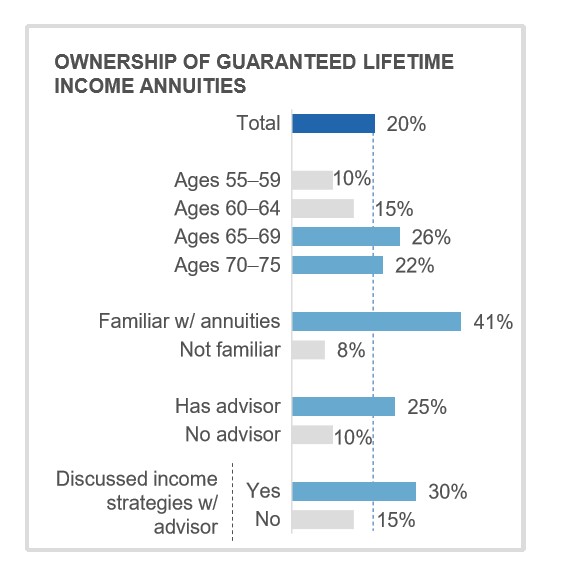

- Advisors are critical in driving ownership. Based on a regression analysis, the study identified four factors that drive guaranteed lifetime income annuity ownership:

- Familiarity with annuities

- Having an advisor

- Discussing income strategies with an advisor

- Age

It is impossible to overstate the role of the advisor; those who have discussed income strategies with an advisor are twice as likely to own a guaranteed lifetime income annuity.

- Consumers believe advisors have a responsibility to present guaranteed lifetime income products. Six in ten consumers say advisors have a responsibility to present guaranteed lifetime income products as part of a retirement income strategy. Having a choice among strategies is also important, as the majority of consumers believe advisors should present clients with two or three options for producing income in retirement so that they can select the best option for themselves.

- Advisors continue to underestimate the importance retirees place on achieving high returns. 60% of consumers are looking for both protection and growth at the same time. Although most are satisfied with their advisor on these fronts, satisfaction is higher for guaranteed lifetime income annuity owners. Three-quarters of advisors say it is difficult to manage expectations of achieving both goals at once.

7 Ways LTCi Can Keep Your Client Out Of The Nursing Home

Advisors Provide Continuity For Clients In The Face Of COVID-19

Advisor News

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

- Tariffs alter Q2 economic outlook downward, Morningstar says

- Women need an advisor who’s also a coach

More Advisor NewsAnnuity News

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

More Annuity NewsHealth/Employee Benefits News

- Health care costs bill signed by Lujan Grisham

- Friday roundtable in Rochester to focus on possible Medicaid cuts

- Studies from University of Southern California (USC) Yield New Information about Military Medicine (Health Insurance Coverage and Hearing Aid Utilization In Us Older Adults: National Health Interview Survey): Military Medicine

- Pritzker's Proposed Budget Will Take Away Health Coverage From Immigrants Without Legal Status

- A fifth of Americans are on Medicaid. Some of them have no idea.

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Symetra Partners with Nayya to Introduce Digital Leaving Planning Solution

- Krispy Kreme's owner is seeking approval to buy Shenandoah Life

- Krispy Kreme owner to acquire Roanoke-based Shenandoah Life

- Directors' Report and Financial Statements 31 December 2024

More Life Insurance News