A dynamic market requires continuous learning for financial advisors

Advisors operate within an environment where there are constantly shifting compliance regulations and tax laws, as well as evolving new technologies. The need to keep up with these changes can be especially vital for the work conducted with their pre-retired and recently retired clients. These clients are in the process of making major — sometimes irrevocable — financial decisions in the context of complicated rules governing securities, insurance and retirement systems.

To what extent are advisors seeking training that will enhance their retirement income-related services and will help them remain competitive and meet their clients’ needs?

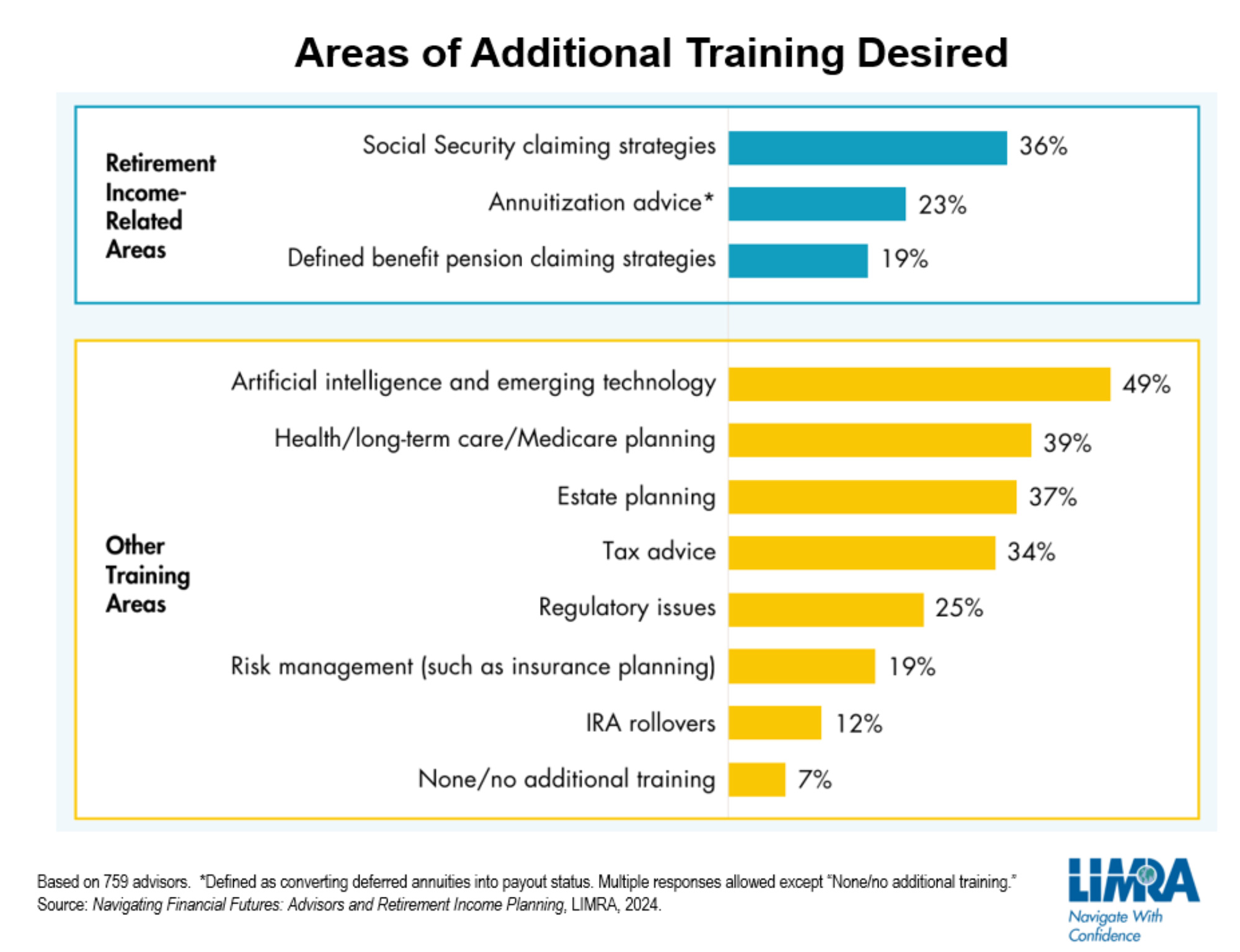

» Income-related training areas. Advisors were asked to identify specific areas where they felt they would benefit from additional training. Of the three training topics specific to retirement income — Social Security claiming strategies, annuitization advice and defined benefit pension claiming strategies — advisors were most likely to cite Social Security planning as a priority.

Optimal claiming can be complicated, particularly for married couples, and the rules are adjusted periodically over time. Advisors with a deep understanding of Social Security benefits will be in a better position to build a successful income plan for their clients. For many of their clients, Social Security represents both a major source and their only lifetime-guaranteed, inflation-adjusted source of income in retirement.

The conversion of deferred annuities into payout status (including the termination of the deferred contract and purchase of an immediate annuity) was mentioned by about 1 in 4 advisors as a topic for which they want additional training. It may be that the continuous rise in the amount of their time spent on income planning, and the shift in clientele from those with generous defined benefit pensions to those without them, has raised awareness about the role of alternative forms of protected income.

While annuitization itself remains rare, the activation of lifetime-guaranteed income benefits within deferred annuities and the issuance of immediate annuities are far more common. This makes it vital for the 7 in 10 advisors offering annuitization advice to keep up with what’s available in the market. In contrast, fewer advisors seek additional training on DB pension claiming strategies. Not only are DB pensions of decreasing relevance for future retirees, but also their claiming rules are they are less complex than those of Social Security, and they are certaintly less complicated.

As a result, while future retirement income conversations will increasingly center around lifetime-guaranteed income, they likely will include far less discussion of traditional pensions, making it essential for advisors to gain expertise in income-

generating investments and products.

» Other training areas. Among the other training areas, artificial intelligence and emerging technology were the most cited topics. AI will have profound effects across the financial services industry, requiring advisors to keep up to speed on recent developments and begin incorporating new AI models and other technologies into their practices. The future of retirement income planning will involve heavy use of AI in areas such as investment selection, client assessments, customer service and practice management.

Many advisors also recognize the need to stay abreast of the rules and regulations governing health, long-term care and Medicare planning, as well as estate and tax planning. While less directly connected with retirement income, mastery of these topics can improve the value of the formal written plans financial professionals develop, as well as other services they provide.

Financial professionals who are “coasting” on past training would benefit from adopting a mindset of continuous learning. The most effective advisors will put their recent education and training to work. Pursuing professional development and training opportunities related to retirement planning can help them improve the breadth and depth of their practices and provide more value to their clients, as well as give them an edge on slower-to-adjust competitors.

Matthew Drinkwater, Ph.D., FSRI, FLMI, AFSI, PCS, is corporate vice president, LIMRA and LOMA. He may be contacted at [email protected].

Retirement: Planning for the third half of life

Holistic solutions to grow an advisor’s business

Advisor News

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- ‘Egregious’: Idaho insurer says planned hospital’s practices could drive up costs

- D.C. DIGEST

- Medicaid agencies stepping up outreach

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- State employees got insurance without premiums

More Health/Employee Benefits NewsLife Insurance News