32% Of Americans Are ‘Highly Stressed’ Over Finances, LIMRA Finds

More than 19 months into the pandemic, fewer than 2 in 5 Americans say their lives are mostly back to what they were pre-pandemic.

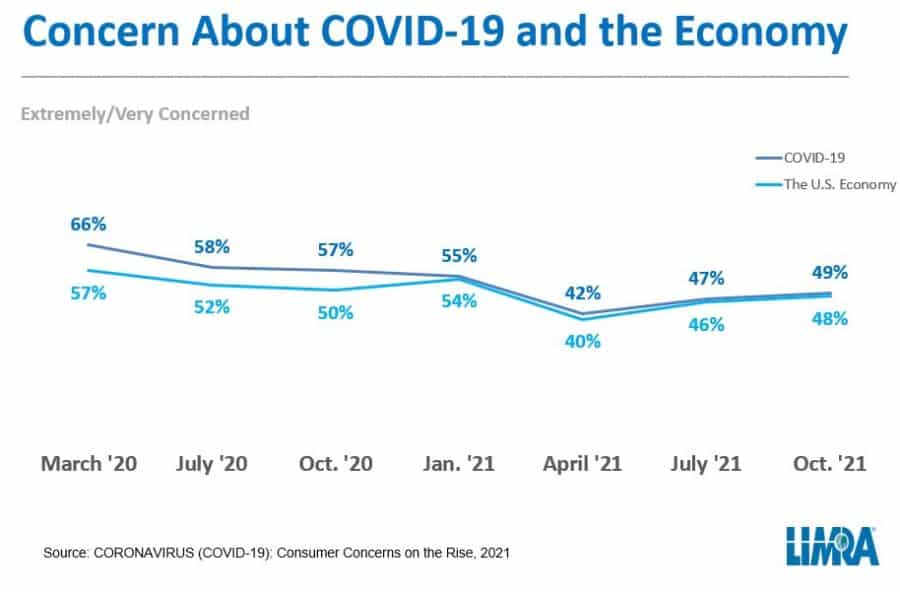

In LIMRA’s October 2021 Consumer Sentiment Study, Americans’ unease about the pandemic and the economy have increased in the last six months.

Consumers are also concerned about their household finances, with 32% of adults saying they are highly stressed over them, up from 25% six months ago.

“Some consumers are feeling financial stress to a higher degree than others,” says Jennifer Douglas, research director at LIMRA. “Understandably, younger adults, women with children under the age of 18, and those with lower household incomes express the highest levels of financial stress.”

Women with children under 18 expressed the highest levels of financial stress at 50%, followed by non-retirees who were not working (44%), those under age 50 (42%), and those with household incomes under $50,000 (42%).

According to the 2021 Insurance Barometer Study, conducted by LIMRA and Life Happens, overall financial concern rose 20% over the past two years, including a 4% rise in 2021.

The study revealed the top four financial concerns are:

• Having enough money for a comfortable retirement (43%)

• Being able to save money for an emergency fund (37%)

• Being able to support themselves if they are unable to work due to a disabling illness or disability (37%)

• Paying for long-term care services if they become unable to take care of themselves (37%)

Other financial concerns that are top-of-mind for consumers include paying for medical expenses in the case of an injury or illness (35%), job security or maintaining a steady income (33%) and paying monthly bills (32%).

Despite the increased concerns about the economy and COVID-19, confidence in insurance companies is the highest seen since October 2008 (when LIMRA began this survey). According to the study, 86% of consumers say they are at least somewhat confident in insurance companies with more than a third (35%) reporting ‘quite a bit’ or ‘extreme’ confidence in insurance companies.

“Our research shows the pandemic raised consumers’ awareness about the importance of having adequate life insurance coverage,” said Douglas. “Our industry did a remarkable job pivoting at the start of the pandemic to enable financial advisors to continue serving their customers in a virtual environment.”

Small And Medium Businesses Gaining Strength Financially

California Man Faces 15 Counts Of Insurance Fraud For Payroll Issues

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News