2018 Annuity Sales Smash Records Across The Board, Wink Reports

From Staff and Wire Reports

Total fourth-quarter non-variable deferred annuity sales were $32.6 billion, up more than 10.1 percent over the previous quarter and up more than 54.4 percent over the same period last year, according to Wink's Sales & Market Report.

Total non-variable deferred annuities sales for 2018 were $113.6 billion, an increase of 29.1 percent over 2017. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

The industry leader in indexed annuity sales data since 1997, Wink is in its third year of reporting on all deferred non-variable annuities. This is the first year for Wink to report on structured annuities, (indexed-variable annuities, collared annuities, or buffered annuities).

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 9.8 percent.

Allianz Life moved into second place, while Global Atlantic Financial Group, Athene USA and Massachusetts Mutual Life Companies rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined, in overall sales.

Sixty indexed annuity providers, 54 fixed annuity providers, 68 MYGA providers, and ten structured annuity companies participated in the 86th edition of Wink’s Sales & Market Report for the fourth quarter, 2018.

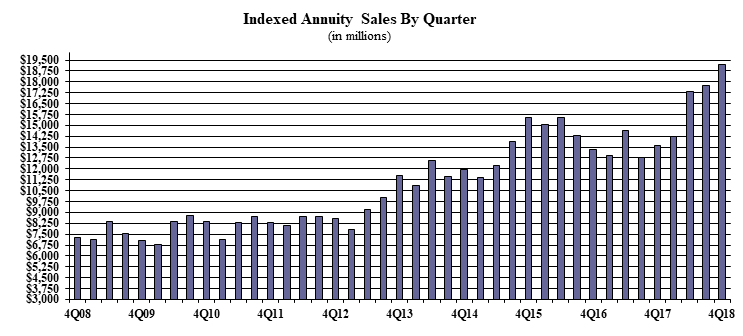

Booming Indexed Annuity Sales

Indexed annuity sales for the fourth quarter were $19.2 billion, up more than 8.4 percent compared to the previous quarter, and up 40.9 percent compared with the same period last year.

Total indexed annuity sales for 2018 were $68.4 billion, an increase of over 26.8 percent from the previous year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

“Indexed annuity sales beat their prior record by nearly 18%!” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. “While sales were down for 2017 because of the Department of Labor, this year’s sales have more than made-up for last year’s loss in sales.”

Noteworthy highlights for indexed annuities in the fourth quarter include Allianz Life retaining their No. 1 ranking in indexed annuities, with a market share of 13.6 percent. Athene USA held the second-ranked position while AIG, Pacific Life Companies, and Nationwide rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity was the No. 1 selling indexed annuity, for all channels combined, for the eighteenth consecutive quarter.

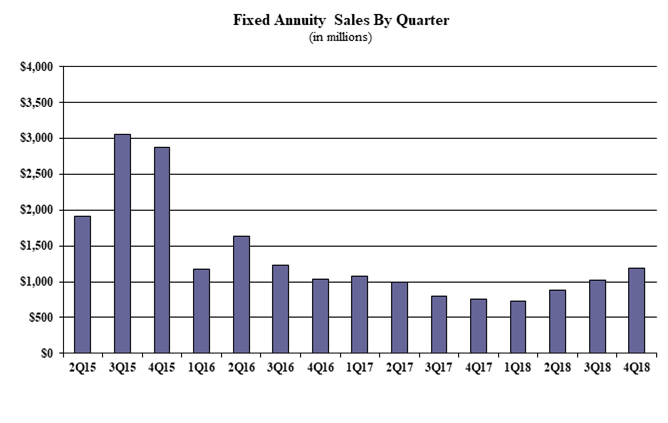

Strong Fixed Annuity Numbers

Traditional fixed annuity sales in the fourth quarter were $1.1 billion, up 15.9 percent compared to the previous quarter, and up more than 56.8 percent compared with the same period last year.

Total traditional fixed annuity sales for 2018 were $3.8 billion, an increase of 5.1 percent over the previous year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include AIG ranking as the No. 1 carrier in fixed annuities, with a market share of 13.1 percent. Jackson National Life ranked second and Modern Woodmen of America, Global Atlantic Financial Group, and Great American Insurance Group rounded-out the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity for the quarter, for all channels combined, for the eleventh consecutive quarter.

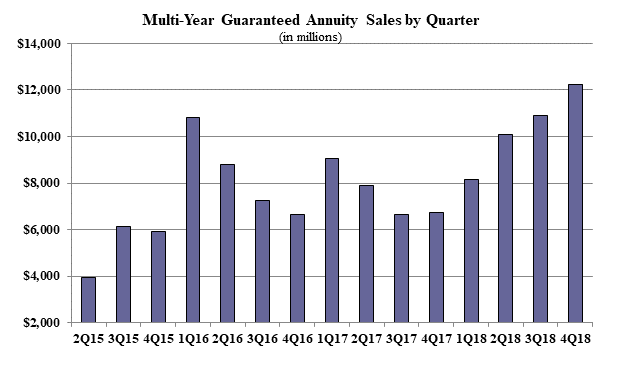

'Unprecedented' MYGA Sales

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $12.2 billion, up over 12.3 percent compared to the previous quarter, and up more than 81.3 percent compared to the same period last year.

Total MYGA sales for 2018 were $41.3 billion, a 36.1 percent increase over the previous year. MYGAs have a fixed rate that is guaranteed for more than one year.

“Every single company in the top 15 experienced increases in MYGA sales; that is unprecedented!” Moore said.

Noteworthy highlights for MYGAs in the fourth quarter include New York Life ranked as the No. 1 carrier, with a market share of 13 percent. Global Atlantic Financial Group continued in the second-ranked position, while AIG, Massachusetts Mutual Life Companies, and Symetra Financial rounded-out the top five carriers in the market, respectively.

Massachusetts Mutual Life Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for the quarter, for all channels combined.

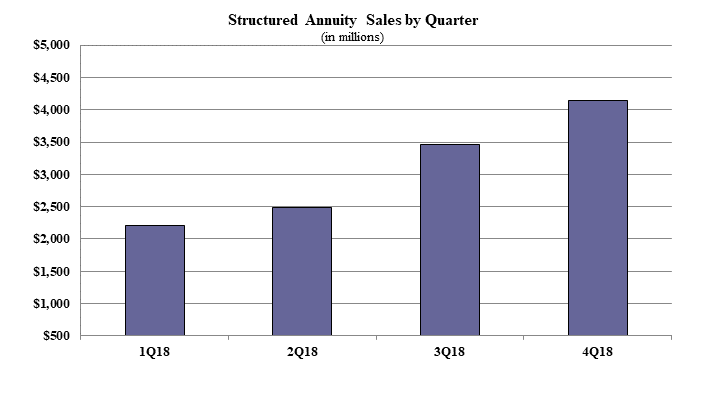

Structured Annuities

Structured annuity sales in the fourth quarter were $4.1 billion, up more than 19.4 percent compared to the previous quarter. Total structured annuity sales for 2018 were $12.2 billion; this is the first year that Wink has reported on structured annuity sales.

Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the fourth quarter include AXA US ranking as the No. 1 carrier in structured annuities, with a market share of 40.8 percent. Brighthouse Life Shield Level Select 6-Year was the No. 1 selling structured annuity for the quarter, for all channels combined for the fourth consecutive quarter.

While Wink currently reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, and multiple life insurance lines’ product sales, the firm looks forward to reporting on variable annuity sales beginning in the first quarter of 2019, Moore said.

Sales reporting on additional product lines will follow at some point in the future.

‘There’s More Work To Be Done:’ Reg BI Faces Criticism At Congressional Hearing

The Fed Holds The Line On Interest Rates

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

More Annuity NewsHealth/Employee Benefits News

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- Iowa insurance firms warn bill would make health costs rise

- Farmers among many facing higher insurance premiums

- Mark Farrah Associates Analyzed the 2024 Medical Loss Ratio and Rebates Results

- PID finds violations by Aetna Insurance

More Health/Employee Benefits NewsLife Insurance News

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

More Life Insurance News