Insurance industry ads continue to be among top watched

You can be forgiven if you are among those who grow weary of the incessant auto insurance commercials on broadcast and streaming channels featuring colorful and memorable characters like Emus, Geckos, Mayhem Men, Jake from State Farm, the Farmer’s Insurance professor, and, of course, Flo, the Progressive cashier.

Yet, despite their ubiquity and maybe annoying tendencies, surveys continue to rank the ostensibly humorous come-ons as among the most popular with consumers, and the industry stands by their cost effectiveness and brand awareness raising.

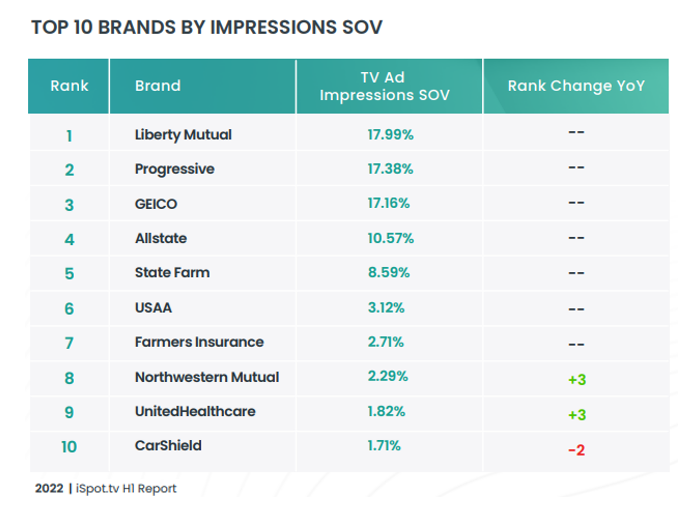

“Probably three or four of the top 10 brands across all of TV advertising are insurance brands,” said Tyler Bobin, a senior analyst at iSpot.tv, which measures the brand and business impact of TV and streaming advertising. “Some of the ads are over the top but they’re more lifestyle type ads in which you immediately recognize the people and characters in the ads and the company they represent.”

iSpot’s latest analysis of how insurance brands covered TV in the first half or 2022 found that out of the 50-most-seen insurance ads, a Liberty Mutual spot ranked as the most likable, followed closely by Farmer’s Insurance, featuring the irrepressible museum curator played by actor J.K .Simmons, and of course one with the GEICO Gecko. Like most successful ads, they win with funny vignettes, ear worm jingles, and repetitive slogans.

“Creatively we aim to break through the hyper-competitive market so that consumers remember Liberty Mutual,” said Jena Lebel, Liberty Mutual chief marketing officer for global retail markets. “In our TV ads, we leverage memorable, humorous moments and characters, and we drive brand linkage via effective brand cues such as LiMu Emu & Doug and our jingle.”

More important than likability, however, were the number of times the ads were seen on screen by viewers, or what the ad industry calls “impressions.”

“The top five insurers had about 33 billion or more impressions in the first half of the year,” Bobin said. “That is a substantial amount.”

Yet in spite of the seemingly endless volume of auto insurance company ads, estimated spending by insurers in the first half of 2022 – $1.22 billion – was flat, or slightly lower than previous periods, iSpot found. Bobin explained the industry ad buys tend to be far less than the amount spent by automakers, fast-food chains, and streaming services, because insurers typically advertise regularly during the day as opposed to during primetime or special highly rated events such as NFL games and March Madness when ad rates are much higher.

“Insurance brands are dominant on television no matter the time of year,” the iSpot.tv analysis said. “Since Jan. 2021, insurance brands – life, health, auto & general – have accounted for 9.32% of estimated national TV ad spend and 6.25% of TV ad impressions during new-airing programming. Also, four of the five most-seen brands in that timeframe were insurance brands.”

The fact that the ads emphasize humor, lifestyle, emotion, and characters over hard selling techniques is doubtlessly the result of the slight product differential from one company’s premium to another. The intent is to grab attention, brand recognition, and comfort, without ever mentioning costs or features. Liberty’s Lebel said only that the creative strategy is “rooted in our business objectives.”

“It’s definite an interesting contrast,” said Bobin. “Automakers are quick to give you a price; streaming services tell you upfront what the basic cost is; wireless companies boldly feature the monthly costs; even fast food restaurants focus on the price. So, you're really only seeing the insurance category not mentioning their prices.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Key retirement legislation could secure legacy for some powerful DC backers

Susan Neely of ACLI wins ASAE leadership award

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

- NEW YEAR, NEW LAWS: GOVERNOR HOCHUL ANNOUNCES AFFORDABLE HEALTH CARE LAWS GOING INTO EFFECT ON JANUARY 1

- Thousands of Alaskans face health care ‘cliff in 2026

- As federal health tax credits end, Chicago-area leaders warn about costs to Cook County and Illinois hospitals

- Trademark Application for “MANAGED CHOICE NETWORK” Filed by Aetna Inc.: Aetna Inc.

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News