A Simple Answer to Annuity Objections: Performance Pro®

Q: How does Fidelity & Guaranty Life address consumers’ misperceptions about annuities’ cost?

A: The costs associated with putting money into annuities may seem unknown, but ultimately they are clearly defined. Agents explain to the client there are tradeoffs, and we do a thorough job of assisting these conversations with our marketing content and our agent trainings. With agents’ help, clients can understand costs affiliated with their commitments and make better-educated decisions.

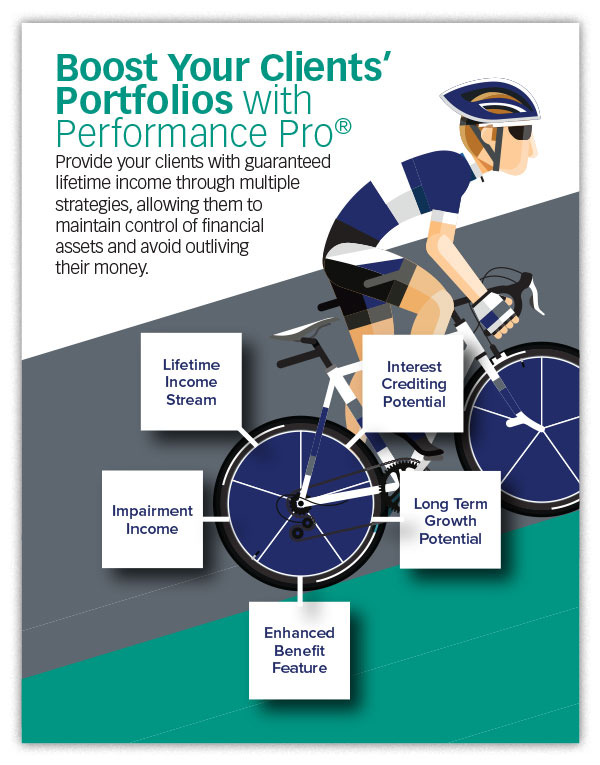

Our products are designed so clients may choose particular features that are most important to them. With our fixed indexed annuity, Performance Pro®, there is no direct cost for the safety and security or the element of guarantee that’s already built into the contract. Based on the client’s planning needs, there could then be additional costs affiliated with certain features.

Q: How does Performance Pro quell other annuity objections?

A: Many believe that if they place their money in an annuity, they lose access to their money when they need it the most. Performance Pro allows the client to access the money in case of an emergency. There’s a partial free withdrawal feature that’s automatically included at no additional cost to the client where he or she can take out a certain percentage of the money that was contributed on an annual basis. There are also additional liquidity riders for home health care and certain other features that would allow the client to access 100 percent of his or her money without incurring surrender charges. For example, if a medical emergency occurs that renders a client unable to perform certain activities of daily living, he or she could receive additional funds up to 200 percent of his or her current paycheck.

Also, there’s concern about there being money available for beneficiaries. Another unique aspect about the way these new products are structured, specifically Performance Pro, is that clients still benefit from having a guaranteed income stream, but their account values are still available in a lump sum to their beneficiaries at some point in the future, assuming the clients haven’t depleted their account values.

Q: How do Performance Pro’s features appeal to consumers?

A: There is flexibility built into Performance Pro’s income riders. Some riders are available with an upfront bonus, which can be applied to the account value and ultimately to their income base. One of the unique aspects of this particular rider in Performance Pro is the stacking income benefit, or what we call hybrid-driven income. A guaranteed roll-up rate is applied to their income value. Added to their guaranteed credit is 100 percent of the growth of whichever interest credit is dictated by the contract.

The fixed indexed annuities today that allow the client to choose an index crediting strategy are typically tied to the S&P 500®. The Performance Pro annuity actually provides multiple options that clients can choose from. They could have their money grow over a period of time based on using the S&P 500, based on a gold strategy or based on a real estate strategy.

They could also allocate some of their funds into two or three of these strategies at the same time, thereby not having to put all their eggs in one basket. There is also flexibility to choose the length of time to participate in each strategy. Some are one-year strategies, some are two-year, and we even have a five-year strategy available.

Q: What do you have available to help agents guide clients through these decisions?

A: Our illustration system shows clients projected performance based on the historical performance of particular strategies. It also illustrates some of the guarantees in the contract going forward. For example, a client putting money in the Performance Pro annuity could see on the illustration what the minimum guarantees would be, or how his or her dollars would have performed over a period of time, and thereby be able to plan appropriately to know what the guaranteed paycheck would be at some point in the future.

Q: What additional retirement income options will Fidelity & Guaranty Life be providing consumers in the near future?

A: As we’ve listened to our clients and looked at the marketplace, we are preparing to launch an exciting new index that will be added to Performance Pro, thereby expanding the possibilities for clients and ultimately how their money may grow in the future.

Offer your clients an outstanding hybrid-driven product that helps counter common objections. Download your Performance Pro sales kit today at www.FGLPerformancePro.com.

“S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Fidelity & Guaranty Life Insurance Company. Standard & Poor’s does not sponsor, endorse, promote, or make any representation regarding the advisability of purchasing the contract.

Optional provisions and riders may have limitations, restrictions and additional charges. Subject to state availability. Certain restrictions may apply.

Fidelity & Guaranty Life is the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance in the United States outside of New York. Contracts issued by Fidelity & Guaranty Life Insurance Company, Des Moines, IA.

API-1018 (06-11), ACI-1018 (06-11); et al.

#17-0144

The Financial Engine That Can Help Drive Your Client’s Strategy

Exclamation Labs Leads Insurance Company to Unprecedented Growth

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

More Life Insurance News