4 In 10 Americans Have No Financial Plan For A Late Life Alone

With the average life expectancy reaching nearly 79 years old,1 Americans are living longer than previous generations. But with that extra time, are they planning accordingly for it, especially when it comes to the loss of a partner?

While confident they can manage financially if separated or widowed later in life, many Americans age 40 and older don’t have a corresponding financial plan in place, according to a new survey conducted by The Harris Poll on behalf of TD Ameritrade.

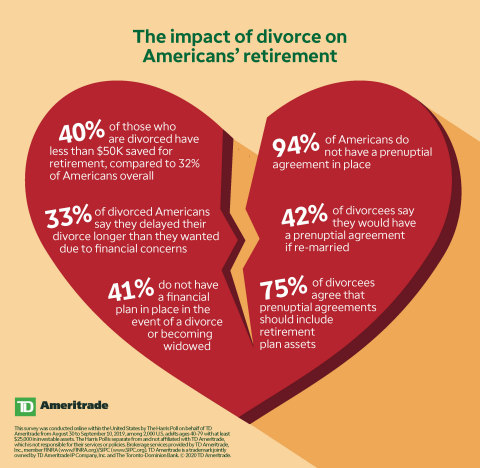

The impact of divorce on Americans' retirement (Graphic: TD Ameritrade)

“Planning your finances around the potential end of a relationship due to divorce or death can be uncomfortable at the very least,” said Keith Denerstein, director of investment products and guidance at TD Ameritrade. “While the trepidation is understandable, preparing for these possible scenarios is important for future financial security, and therefore should be a key part of financial planning.”

Americans say they’re prepared for being divorced or widowed, but are they?

- Most Americans (87%) age 40 and older are confident in their ability to manage their own financial situation in the event of a divorce or a spouse passing away later in life.

- Four in 10 (41%) do not have a financial plan in place in the event of a divorce or becoming widowed, with men (45%) being more unprepared than women (36%).

What about prenups?

- Most Americans (94%) age 40 and older do not have a prenuptial agreement in place, including 91% of those with $250k+ in investable assets.

Once bitten, twice shy

Many divorcees say divorce impacted their ability to retire, especially men.

- Forty percent of divorcees agreed that getting divorced threw their retirement plans off course (46% of men compared to 36% of women).

- Forty percent have less than $50K saved for retirement, compared to 32% of Americans overall in a similar age bracket.

- Thirty-three percent delayed their divorce longer than they wanted due to financial concerns.

- While most divorcees did not have a prenup in their previous marriage (97%), four in 10 (42%) say they would get one if they remarried.

- Among those with $250k+ in investable assets, the percentage rises to 70%.

- Three in four (75%) also say that agreement should include retirement assets.

Among those who are married, combined retirement plans are also murky.

- Half (48%) say they expect to have a different retirement timeline than their partner, while only one in four (25%) say they are very prepared if they or their spouse has to retire earlier than expected.

What’s the right way to tackle end-of-life planning?

Regardless of relationship status, many aren’t sure how to approach end-of-life planning with their families. This is especially true for those in their 40s and 50s with more than half unsure how to structure their inheritance.

- Not sure of the best way to structure an inheritance for their family:

- Ages 40-49: 59%

- Ages 50-59: 48%

- Ages 60-69: 33%

- Ages 70-79: 27%

- Don't know how to discuss legacy planning with their family:

- Ages 40-49: 48%

- Ages 50-59: 34%

- Ages 60-69: 26%

- Ages 70-79: 20%

Only one in three have shared financial passwords in case of an emergency. Even fewer have discussed inheritance planning and long-term care plans.

- Discussed desired arrangements for my funeral with my family to prevent debates about my wishes: 40%

- Told someone where to find relevant financial passwords in case of an emergency: 36%

- Set aside money for end-of-life care (e.g., caretaking, funeral arrangements): 30%

- Created an 'in case of emergency plan' in case something happens to the household's primary financial decision maker: 28%

- Told my children how to access and manage my assets in case of an emergency: 21%

- Discussed inheritance and legacy planning with my children: 20%

- Discussed health and caretaking planning with my children: 19%

“While it may be difficult to find the ‘right time,’ it’s crucial to discuss issues like legacy and caretaking planning with your spouse, children or extended family members,” said Denerstein. “Planning ahead could provide a much needed boost in financial security for loved ones who unexpectedly find themselves in these situations.”

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.4 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of approximately 1 million trades per day for our clients, more than a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of nearly 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

About The Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that strives to reveal the authentic values of modern society to inspire leaders to create a better tomorrow. We work with clients in three primary areas; building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. TD Ameritrade is separate from and not affiliated with the Harris Poll, and is not responsible for their services or policies.

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of TD Ameritrade from August 30 to September 10, 2019, among 2,000 U.S. adults ages 40-79 with at least $25,000 in investable assets. The audience was divided into four decades: 40-49 (n=500), 50-59 (n=500), 60-69 (n=500) and 70-79 (n=500).

1 https://www.cdc.gov/nchs/products/databriefs/db328.htm

Thousands of Florida homeowners face insurance change

S&P Upgrades Kemper’s Key Financial Strength Ratings

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Pear Suite Partners with Health Net and Six Other Health Plans to Launch the Pear Cares Provider Network with 1,000+ Community Health Workers

- Pan-American Life Insurance Group Reports Record Net Income for 2024 On Strong Operating Performance

- GOP lawmakers commit to big spending cuts, putting Medicaid under a spotlight – but trimming the low-income health insurance program would be hard

- Bill aims to limit insurance denials by defining care standards

More Health/Employee Benefits NewsLife Insurance News