Hurricane Ian deals blow to Florida’s shaky insurance sector

Managers at Tropicana Sands told him he likely wouldn't be able to find a carrier who would offer a policy because the home was too old. He said he checked with a Florida-based insurance agent who searched and couldn't find anything.

"I can insure a 1940s car, why can't I insure this?" Kelly said.

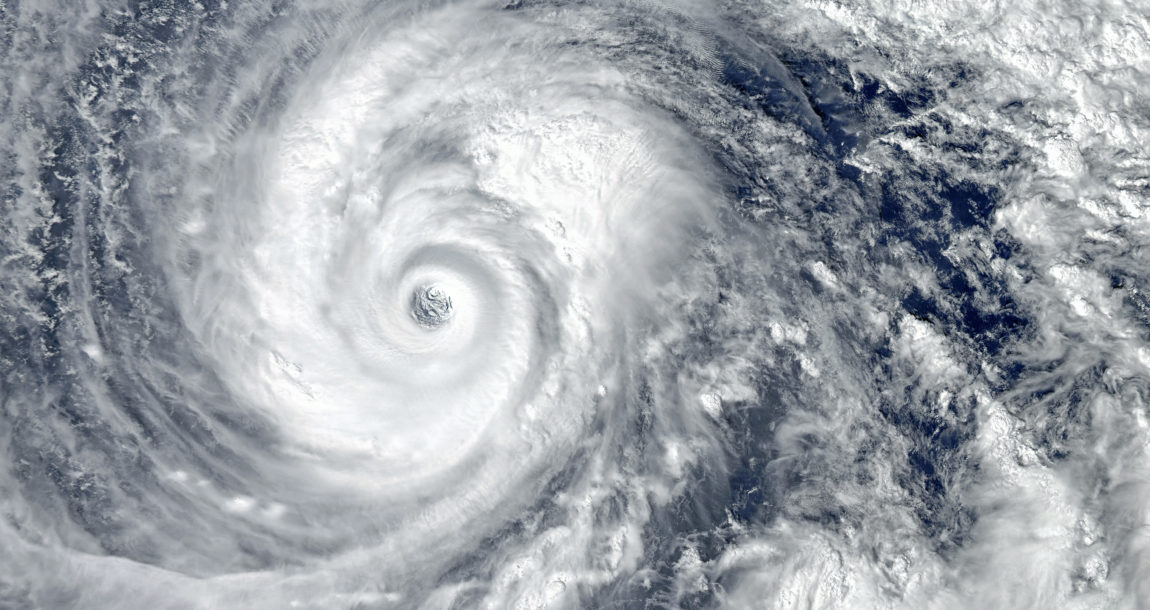

Kelly was lucky that his trailer was largely spared by Hurricane Ian aside from some flood damage. But for many Floridians whose homes were destroyed, they now face the arduous task of rebuilding without insurance or paying even steeper prices in an insurance market that was already struggling. Wind and storm-surge losses from the hurricane could reach between $28 billion and $47 billion, making it Florida's costliest storm since Hurricane Andrew made landfall in 1992, according to the property analytics firm CoreLogic.

Even before Ian, Florida's home insurance market was dealing with billions of dollars in losses from a string of natural disasters, rampant litigation and increasing fraud. The difficult environment has put many insurers out of business and caused others to raise their prices or tighten their restrictions, making it harder for Floridians to obtain insurance.

Those who do manage to insure their homes are seeing costs increase exponentially. Even before Hurricane Ian, the annual cost of an average Florida homeowners insurance policy was expected to reach $4,231 in 2022, nearly three times the U.S. average of $1,544.

"They are paying more for less coverage," said Florida's Insurance Consumer Advocate Tasha Carter. "It puts consumers in dire circumstances."

The costs have gotten so high that some homeowners have forgone coverage altogether. About 12% of Florida homeowners don't have property insurance - or more than double the U.S. average of 5% - according to the Insurance Information Institute, a research organization funded by the insurance industry.

Florida's insurance industry has seen two straight years of net underwriting losses exceeding $1 billion each year. A string of property insurers, including six so far this year, have become insolvent, while others are leaving the state.

As of July, 27 Florida insurers were on a state watchlist for their precarious financial situation; Mark Friedlander, the head of communications for the Insurance Information Institute, expects Hurricane Ian will cause at least some of those to tip into insolvency.

The insurance industry says overzealous litigation is partly to blame. Loopholes in Florida law, including fee multipliers that allow attorneys to collect higher fees for property insurance cases, have made Florida an excessively litigious state, Friedlander said.

Florida currently averages about 100,000 lawsuits over homeowners' insurance claims per year, he said. That compares to just 3,600 in California, which has almost double Florida's population.

The Florida Office of Insurance Regulation said the state accounts for 76% of the nation's homeowners' insurance claims lawsuits but just 9% of all homeowners insurance claims.

"Plaintiff attorneys in Florida have historically found ways of circumventing any efforts at reining in legal system abuses, making it likely that ongoing reforms will be needed to further stabilize the insurance marketplace," said Logan McFaddin of the American Property Casualty Insurance Association.

But Amy Boggs, the property section chair for the Florida Justice Association - a group that represents attorneys - said the insurance industry is also at fault for refusing to pay out claims. Boggs said homeowners are driven to attorneys "as a last resort."

"No policyholder wants to be embroiled in years of litigation just to get their homes rebuilt," she said. "They come to attorneys when their insurance company underpays their claim and they can't rebuild."

Rampant fraud - particularly among roofing contractors - has also added to costs. Regulators say it's common for contractors to go door-to-door offering to cover homeowners' insurance deductible in exchange for submitting a full roof replacement claim to their property insurance company, claiming damage from storms.

Things have gotten so bad with insurance that Florida Gov. Ron DeSantis called a special session in May to address the issues. New laws limit the rates attorneys can charge for some property insurance claims and require insurers to insure homes with older roofs - something they had stopped doing because of rising fraud claims.

The legislation also includes a $150 million fund that will offer grants to homeowners to make improvements to protect against hurricanes. But that program has yet to be launched, and experts say it will take years to reverse the damage to Florida's insurance market.

In the meantime, the crisis has pushed more homeowners to Citizens Property Insurance Corp., the state-backed insurer that sells home insurance for those who can't get coverage through private insurers.

Citizens had more than 1 million active policies as of Sept. 23, before Ian hit, according to Michael Peltier, a spokesman at Citizens. In 2019, that number was roughly 420,000. He said the company had been writing 8,000 to 9,000 new policies per week, double compared with a few years ago. Citizens has $13.4 billion in reserves and predicts it will pay 225,000 claims from Ian worth a total of $3.7 billion.

Even if they have homeowners' insurance, many Floridians could still be facing financial ruin because of flooding. Flood damage isn't typically covered by homeowners' insurance but can be costly; Florida's Division of Emergency Management says 1 inch of floodwater can do $25,000 in damage.

Edwards travels abroad for solution to Louisiana's insurance crisis

Mableton man wanted on insurance fraud charges

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- Genworth Financial Announces Fourth Quarter 2025 Results

- 'Welcome to the movement': Whitman College staff seek to form union

- Red and blue states want to limit AI in insurance. Trump wants to limit the states

- NABIP asks Congress to stabilize ACA market, address affordability

- Expired federal subsidies leave fewer Walla Walla residents with health insurance

More Health/Employee Benefits NewsLife Insurance News