Gen Z And Millennials Want The Benefits, Not Just The Benjamins

Competition for employees is fierce, but if employers are trying to attract Gen Z to their workforce by focusing on perks like free avocado toast and ping-pong tables, they’re going about it all wrong.

A recent study from Lincoln Financial Group (NYSE: LNC) and the Center for Generational Kinetics shows that traditional benefits like retirement plans and insurance are most important for attracting and retaining Gen Z and Millennials1.

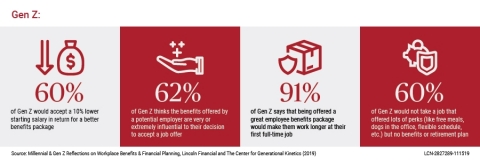

Gen Z is all about the benefits, not just the Benjamins. (Graphic: Business Wire)

Benefits open the door

The oldest members of Gen Z are 23 years old and are joining Millennials, who are the largest generation in the workforce2, in the working world. Both generations are all about the benefits, not just the Benjamins.

Both Millennials and Gen Z rank salary as most influential when making job decisions, but 60% of Gen Z workers say they would accept a 10% lower starting salary in return for a better benefits package, while 65% of Millennials would take a job that paid 10% less but offered much better benefits.

“The recession in 2008 was a formative experience for many Millennials and Gen Z-ers. Many either watched their parents face the challenges it created, or they experienced it themselves during their early years in the workforce,” said Jamie Ohl, Executive Vice President, President Retirement Plan Services, Lincoln Financial Group. “These are generations who now focus on what their employer can offer to help them save for retirement and protect their financial future.”

Gen Z ranked perks as the least important factor when they’re considering a job, and 62% said the benefits offered by a potential employer are very or extremely influential to their decision to accept a job offer. And 44% of Millennials have turned down a job because it didn’t offer the benefits they wanted.

Benefits drive retention

Strong benefits packages — including retirement plans and insurance offerings beyond health insurance, such as dental, vision, life, disability, accident and critical illness insurance — don’t just get younger generations in the door. They keep them there.

Many Gen Z-ers are just now taking their first full-time positions, but 91% say that being offered a great employee benefits package would make them work longer at that first gig.

After salary (73%), Millennials said that benefits most influence keeping them at their job (51%), and 57% have stayed at a job longer than they wanted to — even though they didn't like the job — because the job offered good benefits.

“Gen Z and Millennials aren’t just thinking about the now — they’re thinking about tomorrow,” said Eric Reisenwitz, SVP and Chief Operating Officer, Group Protection, Lincoln Financial Group. “Benefits have to meet the needs people have today, but also what they are looking for three to five years from now.”

Millennials say the benefits that will be more important to them in three to five years are a retirement savings plan, long-term disability insurance and life insurance.

“These generations are focused on the substantive offerings an employer provides,” said Reisenwitz. “They are looking for employers that will help them achieve their financial goals, and protect their financial futures.”

About Lincoln Financial Group

Lincoln Financial Group provides advice and solutions that help empower people to take charge of their financial lives with confidence and optimism. Today, more than 17 million customers trust our retirement, insurance and wealth protection expertise to help address their lifestyle, savings and income goals, as well as to guard against long-term care expenses. Headquartered in Radnor, Pennsylvania, Lincoln Financial Group is the marketing name for Lincoln National Corporation (NYSE:LNC) and its affiliates. The company had $261 billion in assets under management as of September 30, 2019. Lincoln Financial Group is a committed corporate citizen included on major sustainability indices including the Dow Jones Sustainability Index North America and FTSE4Good. Dedicated to diversity and inclusion, Lincoln was recognized by Forbes as one of the Best Large Employers, Best Employers for Diversity, and Best Employers for Women. Lincoln also earned perfect 100 percent scores on the Corporate Equality Index and the Disability Equality Index. Learn more at: www.LincolnFinancial.com. Follow us on Facebook, Twitter, LinkedIn, and Instagram. Sign up for email alerts at http://newsroom.lfg.com.

The Center for Generational Kinetics

The Center for Generational Kinetics is the leading research, speaking, and solutions firm focused on Generation Z, Millennials, and solving cross-generation challenges. The Center’s team of PhD researchers, strategists, and speakers help leaders around the world solve tough generational challenges in areas ranging from leading across multiple generations in a global company to selling and marketing to Millennials and Gen Z.

Each year, The Center works with over 180 clients around the world, from car manufacturers and global hoteliers to insurance companies, hospital groups, and international software firms. The Center’s team is frequently quoted in the media about the effect of generational differences on everything from shopping and parenting to work style and social media.

Learn more about The Center at GenHQ.com.

LCN-2827289-111519

| ___________________________ |

|

1 Millennial & Gen Z Reflections on Workplace Benefits & Financial Planning, Lincoln Financial and The Center for Generational Kinetics (2019) |

|

2 https://www.pewresearch.org/fact-tank/2018/04/11/millennials-largest-generation-us-labor-force/ |

Virginians spend more on their health insurance than people in almost every other state

MetLife Adds Health Savings And Spending Accounts To Its Voluntary Benefit Offerings

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News