Fidelity Investments® Releases 2024 Retiree Health Care Cost Estimate as Americans Seek Clarity Around Medicare Selection

A 65-year-old retiring today could spend

50% of Americans approaching retirement1 expect to feel overwhelmed or confused about selecting Medicare coverage.

Fidelity Medicare Services® offers impartial guidance to Americans in all 50 states.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240808840966/en/

(Photo: Business Wire)

“Health care costs are among the most unpredictable expenses, especially when it comes to retirement planning,” said

Designed to inform Americans about the importance of incorporating health care costs into retirement planning, this year’s estimate continues the decades-long upward trend of health care costs. Despite this, there continues to be a disconnect for many Americans between the actual projected costs and how much they believe they will spend on health expenses in retirement. In fact, recent Fidelity research finds the average American estimates costs will be about

“There is always opportunity to provide education around the cost of health care and the tools Americans have at their disposal to manage those expenses,” said Kennedy. “For Americans approaching retirement, understanding Medicare options and how they fit into your plan is a good first step.”

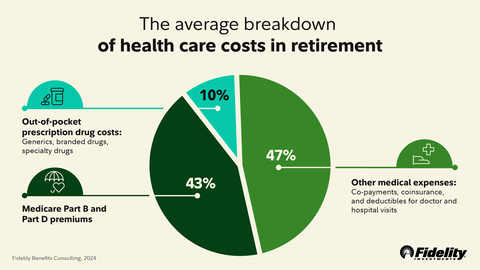

Fidelity’s estimate assumes an individual is enrolled in traditional Medicare—both Part A and Part B—which covers most hospital care and doctor visits. However, things like Medicare premiums, prescription drugs, dental and vision care, and all other health care costs that Medicare typically does not cover are left to retirees to manage on their own.

Planning for health care costs

Making a plan to cover health care costs in retirement can feel daunting, particularly as Americans balance competing priorities in day-to-day household budgets. There are a number of drivers behind this mounting retirement health care cost challenge—people are living longer, and health care inflation continues to outpace the rate of general inflation— so it's no surprise health care is creating a gap for many Americans. There are several simple steps investors can take to become better prepared for future costs while managing today's expenses, however, including exploring the utility of health savings accounts (HSAs), which give Americans enrolled in HSA-eligible health plans a tax-advantaged way to save for short- and long-term health expenses.4

Enrolling in Medicare: making the right choices can be more cloudy than clear

When it comes to selecting Medicare coverage, many Americans approaching retirement age1 are concerned that it’s easier said than done. In fact, 55% say it will be difficult to enroll in Medicare coverage, and half expect to feel overwhelmed or confused when selecting their plan.5

“As Americans wrestle with the impact of rising health care costs today, it’s understandable that preparing for health care costs in retirement would be a top concern,” said

Despite the desire for greater clarity, the effort it takes to do the necessary research can be a challenge. Notably, while nearly two-thirds (63%) of older Americans1 say they plan to review their Medicare options annually, Americans ages 75 and over are the least likely to review their coverage each year, despite shifting health conditions5.

Fidelity Medicare Services® helps Americans at any stage in their Medicare journey

Whether enrolling in Medicare for the first time or looking for coverage to better meet their needs, Fidelity Medicare Services® was introduced to provide clarity around Medicare with complimentary advice for Americans to help them support their health and financial goals.

As of

- Visit the online learning center: From Medicare basics to interactive tools and in-depth articles help guide the Medicare journey.

- Work with a Fidelity licensed insurance agent: For ongoing guidance and support, schedule time to talk.

- Compare options: Browse and enroll in Medicare plans online, which can help save valuable time when it comes to choosing the right plan for their needs.

About

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of

###

Investing involves risk, including risk of loss.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. Because the administration of an HSA is a taxpayer responsibility, customers should be strongly encouraged to consult their tax advisor before opening an HSA. Customers are also encouraged to review information available from the

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of

Fidelity Medicare Services® is operated by

We do not offer every plan available in your area. Currently we represent at least four organizations which offer at least five products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all of your options.

Fidelity Medicare Services is operated by

Fidelity Medicare Services (“FMS”) and

The services described are provided by FHIS. In this capacity, FHIS acts as an insurance broker or agent (collectively referred to as a “Producer”). FHIS and its representatives are appropriately licensed in all states in which they conduct business.

FHIS and its producers are certified representatives of insurance carriers that provide Medicare Supplement insurance as well as are certified representatives of Medicare Advantage (HMO, PPO and PFFS) organizations (and stand-alone prescription drug plans) with a Medicare contract.

The insurance products are issued by third-party insurance companies, which are unaffiliated with FHIS and

FHIS earns a commission paid by the insurance company based on your enrollment in a health plan. FHIS agents and representatives are not compensated based on your enrollment in a health plan and do not receive commissions from third-party insurance companies.

ATTENTION: Medicare has neither reviewed nor endorsed the information in this document/website. Fidelity Medicare Services, FHIS, and

For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048) 24 hours a day/7 days a week or consult www.medicare.gov.

This may be considered an advertisement or solicitation for insurance.

1158233.1.0

©2024

______________________________

1 Americans approaching retirement defined as ages 50-64

2 This estimate is based on a single person retiring in 2024, 65-years-old, with life expectancies that align with

3 Fidelity Health Solutions Thought Leadership Employer Health Benefits Blueprint, 2023

4 With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

5 This CARAVAN study presents the findings of a survey among a sample of 2,009

View source version on businesswire.com: https://www.businesswire.com/news/home/20240808840966/en/

Fidelity Media Relations

[email protected]

(617) 563-5649

[email protected]

Follow us on X @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to emailed news from Fidelity

Source:

Calm returns to Wall Street, and stocks bounce back

Walnut Insurance Secures $4.6M to Transform Insurance Distribution with Embedded Technology

Advisor News

- Ex-employees sue Verizon over pension transfer deal with Prudential, RGA

- Gary Brecka, Cardones file dueling lawsuits in battle of social media stars

- Confidence is key to cold calling success

- Overcoming the indecision of prospects

- What issues top consumers’ list of financial goals for 2025?

More Advisor NewsAnnuity News

- Sapiens wins XCelent award for Customer Base and Support for UnderwritingPro for Life & Annuities

- SB 263 expected to bring chaos to Calif. insurance, annuity sales come Jan. 1

- Lincoln Financial hires industry veteran Tom Morelli as Vice President, Investment Distribution

- Structured settlements protect young injury victims | H. Dennis Beaver

- MetLife Inc. (NYSE: MET) Highlighted for Surprising Price Action

More Annuity NewsHealth/Employee Benefits News

- Insurance assurance:

Health care proposal does little to address Hoosiers' full needs

- Studies from University of Michigan Have Provided New Information about Arthroplasty (Employer-sponsored Medicare Advantage Plans and the 2018 Therapy Cap Repeal

<i>

reduced Overall Spending Does Not Constrain Out

</i>-

<i>

of

</i>-<i>pocket …): Surgery – Arthroplasty

- City of Aurora to open new health clinic for its employees

- Mayo Clinic sues Sanford Health Plan over $700K in unpaid medical bills

- Mayo Clinic sues Sanford Health Plan over $700K in unpaid medical bills

More Health/Employee Benefits NewsLife Insurance News

- Registration Statement by Foreign Issuer (Form F-1)

- Confidence is key to cold calling success

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Assigns Credit Ratings to Min Xin Insurance Company Limited

- Proxy Statement (Form DEF 14A)

More Life Insurance News