Eight in 10 Affluent Americans Use Their Tax Return to Guide Financial Plan: AICPA Survey

Tax Time is the Right Time for Americans to Plan for Their Future

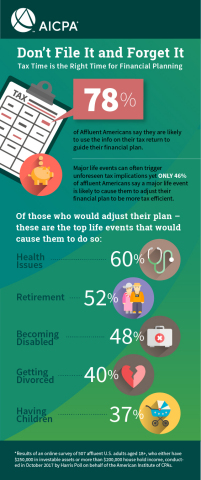

- Less than half say they would adjust their financial plan after a major life event

- CPA financial planners share a list of financial planning opportunities in the wake of tax reform

- Sign-up for free webcast: 2018 Taxes: Start Your Money Plan Here –

April 27 th @1PM ET

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180419005181/en/

Tax time is financial planning time (Graphic: Business Wire)

According to a survey of 507 affluent Americans (either

This underscores the bridge between taxes and financial planning. A tax return can double as a roadmap to a more prosperous financial future. In it, Americans can find details of their cash flows, important investment information, insights to retirement and estate planning and identify overlooked strategies to help them achieve their financial goals. With the significant changes brought about by the Tax Cuts and Jobs Act now in effect for the 2018 tax-year, Americans should revisit their financial plan while all their documents are readily available.

“By not taking advantage of various tax planning strategies, Americans could be leaving money on the table every year that could have gone towards their children’s education, their family’s healthcare savings, or towards retirement,” said

The survey found nearly a quarter of affluent adults (23 percent) received a notice from the

While tax law often changes, life events such as having a child, divorce or purchasing a home can also have a major impact on an individual’s tax situation. Alarmingly, less than half of affluent adults (46 percent) said it is likely that a major life event would cause them to adjust their financial plan to be more tax efficient. Of those who would be likely to make changes, the leading causes cited were health issues (60 percent), followed by retirement (52 percent), becoming disabled (48 percent), getting divorced (40 percent) and having children (37 percent).

“With the new tax law in effect, tax planning strategy is going to be very different this year,” said Millar. “Every individual’s personal financial situation is fluid and requires periodic adjustment. Major life events like having children, getting married or even switching jobs can be a good opportunity to sit down with a CPA financial planner to develop a holistic financial plan.”

The survey found that affluent adults appreciate the value of a financial planner with substantial tax expertise. By nearly a nine-to-one ratio, affluent Americans (53 percent) say working with individuals, such as CPA financial planners, would make them more likely to reach their financial goals (versus 6 percent less likely). Financial planning is not just for the wealthy. Every American can benefit from knowing where their money is going and taking advantage of opportunities to incorporate planning strategies available to them in the tax law.

With tax-filing season having just concluded, CPA financial planners suggest Americans review their returns and see if any the following opportunities make sense for them:

- Make your 2018 contributions as early as possible: Taxpayers should make their contributions to tax-advantaged accounts, such as IRAs, 529s, and workplace retirement plans, as early in the year as possible. By making these contributions earlier rather than later, taxpayers will benefit from additional tax-free compounding growth, which can be substantial over time. Time is an asset for financial growth and taxpayers should take advantage of it by making their contributions to any tax advantaged accounts as early in the year as possible.

- 529 College Savings Plan for education expenses: For families with kids going to private elementary or high school, take advantage of the new 529 provision that allows you to pay

$10,000 per year, per child, from a 529. If your state gives you a deduction for amounts contributed (check with your state’s plan to find out any limits on each year’s deduction), even if you don’t have a 529 established, it could make sense to deposit up to that deductible limit in the account first before paying education expenses, which can lower your state income taxes. Your CPA can help you work out the logistics. - Participate in employer 401(k): If your company has a matching program and you're not participating in it, then you're missing out on an opportunity to reduce your tax burden while you save for retirement. As you review your W-2, you'll be able to tell how much you contributed in the prior year. Make sure you’re contributing enough to get the full company match, otherwise you’re essentially turning down a “free” 100 percent return on your contribution. For the 2018 tax-year, the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is

$18,500 . - Review employee benefits: Tax time can be a good opportunity to review your employee benefits and determine if any changes need to be made during the next open enrollment period. Lots of companies are offering ways to save their employees money such as health savings accounts or pre-tax commuter benefits. Ask your Human Resources department for a benefits manual if you haven't received one already.

- Review investments: An annual investment review is always recommended to ensure that your goals and life circumstances have not changed, which will have an impact on your asset allocation. Moreover, you should determine if you need to re-balance your investments to maintain your desired level of risk. Also, consider if potentially switching to more tax efficient investments makes sense for your financial goals. A CPA financial planner can help you determine the most appropriate strategy for your unique situation.

- Consider bunching medical expenses into 2018: If you have been putting off a procedure or visiting a medical specialist, now may be the best time to schedule that appointment. Under the new law, the 7.5 percent of income medical deduction threshold will be in place only for the 2017 and 2018 tax years. After that, the threshold reverts back to 10 percent of income. For what is and isn’t deductible, visit the

IRS website.

Want help? Start your financial plan here: CPA financial planner

For more information on how tax reform will affect tax filing next year, click here.

Survey Methodology

This survey was conducted online by The Harris Poll for AICPA within

About the AICPA’s PFP Division

The AICPA’s Personal Financial Planning (PFP) Section is the premier provider of information, tools, advocacy, and guidance for CPAs and other professionals who specialize in providing estate, tax, retirement, risk management, and investment planning advice to individuals, families, and business owners. The primary objective of the PFP Section is to support its members by providing resources that enable them to perform PFP services in the highest professional manner.

CPA financial planners are held to the highest ethical standards and are uniquely able to integrate their extensive knowledge of tax and business planning with all areas of personal financial planning to provide objective and integrated guidance for their clients. The AICPA offers the Personal Financial Specialist (PFS) credential exclusively to CPAs who have demonstrated their expertise in personal financial planning through examination, experience and learning, enabling them to gain competence and confidence in PFP disciplines.

About the

The AICPA maintains offices in

Media representatives are invited to visit the AICPA Press Center at www.aicpa.org/press

About the

The

View source version on businesswire.com: https://www.businesswire.com/news/home/20180419005181/en/

[email protected]

or

[email protected]

Source:

Pension Benefits Are Critical Factor for Workers – Regardless of Age – in Deciding Whether to Accept a Job, Accenture Survey Finds

BRIEF: Wisconsin submits reinsurance proposal to feds

Advisor News

- The ‘guardrails approach’ to retirement income

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

- STATEHOUSE: Senate Republicans approve limiting health insurance program for Hoosiers

- State health plan users may see premium increases under SC House budget proposal

- Senate Republicans approve limits on health insurance program

- Health agents ‘optimistic’ as a new administration takes charge

More Health/Employee Benefits NewsLife Insurance News

- Northwestern Mutual sees record dividend, surplus

- IUL vs. annuities: Settling the debate

- While U.S. mortality spike is normalizing, 5 troubling trends continue

- Whole life vs. term life: The great debate

- Prudential launches OneLeave

More Life Insurance News