Despite Slowing Rate of Increase in Auto Insurance Pricing, Most Customers Still Shopping, J.D. Power Finds

Erie Insurance Ranks Highest in Customer Satisfaction for Second Consecutive Year

The rate at which auto insurance premiums increased in 2024 declined to less than 2% at year-end from 13% at the beginning of the year. But, even as auto insurance customers in

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250429141764/en/

“Auto insurance rate taking reached multi-decade highs in the first quarter of 2024, which put record numbers of customers into the market shopping for lower-priced policies as the year progressed,” said

Following are some key findings of the 2025 study:

- Insurance price volatility stirs surge in shopping activity: More than half (57%) of auto insurance customers have actively shopped for a new policy in the past year, the highest shopping rate ever recorded in the 19-year history of the study. Shopping rates were higher in Q1 2024, in line with record highs in insurance rates. As price increases slowed throughout the year, shopping rates increased.

- Stickier customers up for grabs: One-third (33%) of customers who are actively shopping for an auto policy are seeking to bundle their auto policy with a homeowner’s policy. Customers who bundle insurance have longer tenures with their insurer (7.0 years on average vs. 5.5 among those who do not bundle), which makes winning these customers a priority for carriers.

- Growing interest in dealer- and manufacturer-provided insurance: More than one-third (37%) of auto insurance customers say they are interested in embedded insurance, a form of auto insurance that is sold directly through the automobile dealer or manufacturer. Interest is highest among Generations Y/Z1 (47%), and among those who say their primary reason for shopping their auto policy is service (48%).

- Usage-based insurance (UBI) sees a small resurgence: More often, insurers are offering UBI programs, which use telematics software to monitor an insured’s driving style and assign rates based on safety and mileage metrics. This year, 17% offered UBI programs to shoppers, up from 15% in 2024 but down from 22% in 2023.

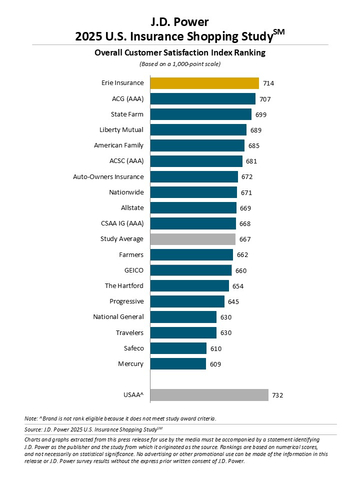

Study Ranking

The J.D. Power

For more information about the

See the online press release at http://www.jdpower.com/pr-id/2025038.

About

About

1

View source version on businesswire.com: https://www.businesswire.com/news/home/20250429141764/en/

Media Relations Contacts

Source:

RFK Jr. is the real wild card in protecting Obamacare

Comment: Has Trump learned from his 'hot stove' moment?

Advisor News

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

- Amazon Go validates a warning to advisors

- Principal builds momentum for 2026 after a strong Q4

More Advisor NewsAnnuity News

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

- 2025 annuity sales creep closer to $500 billion, LIMRA reports

- AM Best Affirms Credit Ratings of Reinsurance Group of America, Incorporated and Subsidiaries

More Annuity NewsHealth/Employee Benefits News

- Thousands in SLO County could lose Calfresh, Medi-Cal with ‘Big Beautiful Bill’

- Idaho lawmaker wants to limit the cost of certain anticancer drugs. What to know

- CQMC UPDATES CORE MEASURE SETS TO STRENGTHEN FOCUS ON HEALTH OUTCOMES AND REDUCE BURDEN

- Fewer Kentuckians covered by Kynect plans

- Fewer Kentuckians covered by ACA health insurance plans as subsidies stall in US Senate

More Health/Employee Benefits NewsLife Insurance News