Consumers See Annuities As Answer To Top Retirement Worry: Survey

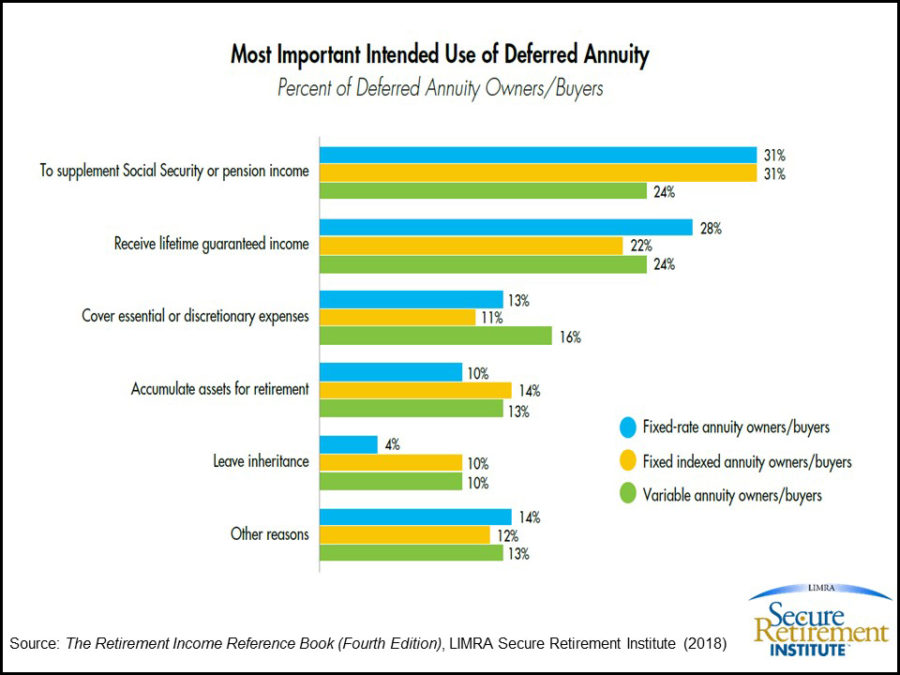

NEW YORK CITY – A new LIMRA Secure Retirement Institute (LIMRA SRI) study of annuity owners finds the top two reasons consumers buy annuities are to supplement Social Security/pension income and to receive guaranteed income payments for life.

“Our research consistently shows consumers are worried about running out of money in retirement – 67 percent of pre-retirees list having enough money throughout retirement as their top financial goal,” noted Jafor Iqbal, assistant vice president, LIMRA SRI.

“Annuities are fundamentally unique investment products, offering some combination of guarantees – guaranteed income that investors cannot outlive, protection of principal from market volatility, or guaranteed death benefits for beneficiaries. As more Americans face retirement without the benefit of a pension and growing longevity risk, an annuity can provide peace of mind.”

This new research is included in the fourth edition of LIMRA SRI’s Retirement Income Reference Book. Conducted every three years, The Retirement Income Reference Book offers an extensive view of the retirement income market, as well as unique insights into consumer behaviors and perceptions.

Shift in Sources of Income

LIMRA SRI research finds that the primary source of income for those in retirement is expected to change. Today, Social Security and pensions make up the primary sources of income for 70 percent of retirees. This shifts significantly when looking at pre-retirees (ages 55 and older, not retired) and workers ages 40-54.

Less than half of pre-retirees (49 percent) and under a third of younger workers (32 percent) say they will rely on Social Security and pensions as their primary sources of income. Instead, they will primarily use savings from employer-sponsored retirement plans, IRAs and other savings vehicles to fund their retirement years. Four in 10 pre-retirees and more than half of workers, ages 40-54, (53 percent) expect their primary source of income to be from their 401k, IRA and other savings.

“While these savings platforms are good solutions for accumulating assets, they often do not offer a way to create guaranteed income that retirees say they want and need, noted Iqbal. “Working with an advisor to create a formal retirement plan, consumers can determine whether investing a portion of their nest egg into guaranteed income through an annuity is a good solution for them. Our research shows seven in ten retired annuity owners are more confident that they are more likely to afford their preferred retirement lifestyles - even if they live to age 90 or older.”

This October marks the fifth anniversary of the LIMRA LOMA Secure Retirement Institute. Since it was established in 2013, the Institute has been supporting the retirement industry by providing research and education in order to improve retirement readiness and security.

Kelsey-Seybold Clinic Taps Prudential To Manage $413 Million In Assets

Henry J. Kaiser Family Foundation: Analysis – Workers Increasingly Have Access to Same-Sex Spousal Benefits

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Red and blue states want to lLimit AI in insurance; Trump wants to limit states

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

More Health/Employee Benefits NewsLife Insurance News