BGAs and IMOs plan to expand their efforts to recruit female financial professionals

WINDSOR, Conn. and Fairfax, Virginia, Feb. 27, 2024 — A new study finds more than 4 in 10 intermediaries — brokerage general agencies and independent marketing organizations — already have or plan to establish programs to recruit more women financial professionals into their network.

In the third annual study conducted by LIMRA and NAILBA (a Finseca Community), Inside the Intermediary 3.0: A LIMRA-NAILBA Study — BGA and IMO Survey Results, almost half of the intermediaries (46%) said they either had programs to support female financial professionals or plan to add one within the next year.

These efforts are to bolster the number of women in the ranks. Today, just 18% of financial professionals in intermediary networks are women. This is important because prior LIMRA research shows 44% of consumers say a financial professional’s gender is important.

When asked what’s behind their gender preference, consumers — particularly those who prefer a female financial professional — often describe soft skills (60%) that they associate with women.

Gen Z women (35%) and members of the LGBTQ+ community (27%) are more likely than others to prefer working with a female financial professional. As Gen Z consumers age and look for financial advice, having female financial professionals will be critical to sales growth.

Intermediaries’ top priority: Growing their network

Sixty-five percent of intermediaries expect their producer network to grow in the next three years. Expanding their efforts to recruit and support women financial professionals advances their top priority of growing their network of producers.

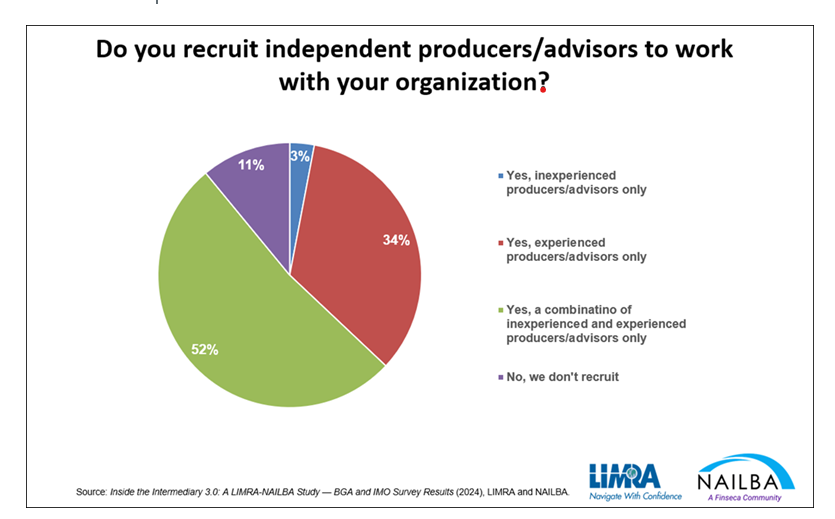

More than half of the intermediaries (52%) see this growth coming from recruiting a mix of experienced and inexperienced professionals. There is also an effort to support financial professionals once hired. Seventy-eight percent of intermediaries offer tailored training based on the experience level of recruited producers.

“Continuing to recruit new and experienced financial professionals and providing innovative services will help the industry meet the changing needs of consumers,” said Bryan Hodgens, head of LIMRA research.

Sixty percent of intermediaries expect revenues from financial planning/wealth management products and services to increase 10% or more over the next three years.

“In a relatively short period of time, BGAs and IMOs have become the largest life insurance producer channel in the United States. As such, their growth and productivity have become critically important in helping Americans get the financial guidance they need to protect the ones they love,” said Dan LaBert, president of Independent Distribution, NAILBA.

Looking ahead over the next three years, the IMOs and BGAs see the fastest growing products as life insurance (cited by 45%), followed by annuities (26%) and long-term care (17%). Forty-two percent of intermediaries have experienced an increase in life insurance production over the past two years.

When it comes to services to be offered, the intermediaries see the highest growth potential in estate and trust services (26%), retirement-income planning (22%) and insurance planning (18%).

As the U.S. demographics continues to evolve and change, it is important for the industry to keep pace. By recruiting experienced and inexperienced producers — including women — and providing innovative financial solutions, intermediaries can continue to meet consumers’ changing needs.

2023 Q4 Fact Sheet

Avalon Saves Clients Millions, Sees Record Growth in 2023

Advisor News

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

More Advisor NewsAnnuity News

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

More Annuity NewsHealth/Employee Benefits News

- As ACA subsidies expire, thousands drop coverage or downgrade plans

- Findings from Centers for Disease Control and Prevention Provides New Data about Managed Care (Association Between Health Plan Design and the Demand for Naloxone: Evidence From a Natural Experiment in New York): Managed Care

- Medicare is experimenting with having AI review claims – a cost-saving measure that could risk denying needed care

- CMS proposed rule impacts MA marketing and enrollment

- HUMAN RIGHTS CAMPAIGN FOUNDATION TAKES NEXT STEP IN CLASS ACTION LITIGATION AGAINST TRUMP ADMINISTRATION, FILES COMPLAINT WITH EEOC OVER PROHIBITION ON GENDER-AFFIRMING HEALTHCARE COVERAGE FOR FEDERAL EMPLOYEES

More Health/Employee Benefits NewsProperty and Casualty News

- RICO case alleges sham lawsuits by N.Y. firm; Photos of clients include soccer, bowling

- New business listings filed in unincorporated Cobb County for the week of Jan. 25–Feb. 1, 2026

- Lawmakers wonder if State Farm is writing Oklahoma insurance law

- CASSIDY, KENNEDY, REPUBLICAN COLLEAGUES CALL FOR END TO BIDEN-ERA FLOOD INSURANCE PREMIUMS

- TUBERVILLE, COLLEAGUES FOLLOW-UP ON CALL TO END BIDEN-ERA FLOOD INSURANCE PREMIUMS

More Property and Casualty News