Annuity Rebound Is Coming, Secure Retirement Institute Says

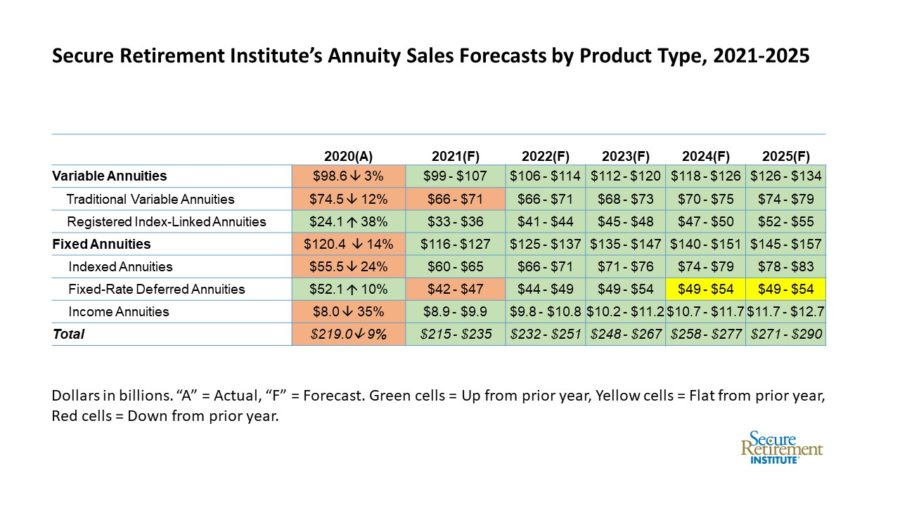

The Secure Retirement Institute is forecasting all individual annuity product lines except traditional variable annuities and fixed-rate deferred annuities to rebound in 2021.

Overall individual annuity sales could see a slight increase in 2021, as the U.S. and the insurance industry slowly transition from the global pandemic. Longer term, SRI expects the total annuity market to benefit from improving economic conditions, shifts in demographic, as well as technology implementations. By 2025, SRI is forecasting the annuity market to grow as much as 30%.

There are several factors that will likely drive the annuity market:

• While economic conditions are forecasted to improve, historic low interest rates will continue to be a headwind.

• Products with protection features will continue to be in high demand.

• Demand for guaranteed income is expected to grow.

“The most significant factors that drive annuity sales are the economic and regulatory environment,” noted Todd Giesing, assistant vice president of SRI Annuity Research. “How, and how quickly, manufacturers and distributors respond to external factors will dictate the ultimate impact of these changes. The rate of change and adoption of solutions to the challenges created by the 2020 global pandemic were accelerated, as companies looked for ways to adapt and show resilience amidst massive disruption.”

A Look Individual Products:

Traditional Variable Annuities (VA): SRI is projecting traditional VA sales to decline slightly in 2021. By 2022, traditional VA sales will flatten out as economic conditions improve. Slow growth will come back to the traditional VA market in 2023 through 2025. Improving interest rates will help carriers with pricing efficiencies in products with guaranteed living benefits, and smooth equity markets will aid in the slow growth of investment-focused traditional variable annuities.

Registered Index-Linked Annuities (RILA): The RILA market has experienced remarkable growth over the past few years and this trend is expected to continue through 2025. New manufacturers continue to enter the market and SRI expects some to introduce guaranteed lifetime benefits riders to broaden the appeal of these products to investors. By 2025, RILA sales are expected to be double what they are today.

Fixed Indexed Annuities (FIA): The indexed annuity market faced an extremely challenging environment in 2020, and as a result saw sales decrease by nearly $20 billion in 2020. Looking ahead, as interest rates improve, indexed annuities should slowly return to growth mode in 2021, but will face challenges as RILA’s continued success will likely take a portion of flows away from FIA sales, particularly in the independent BD and bank channel. SRI does expect FIA sales to enjoy slow and steady growth through 2025, and to reach or exceed 2019 record sales levels.

Fixed-Rate Deferred Annuities (FRD): Record market volatility and highly competitive crediting rates drove 2020 FRD sales to their highest annual level since 2009, as consumers sought investment protection and guaranteed growth. Despite improving interest rates and market stability — which would normally drive investors toward other products with greater growth potential — FRD sales will be bolstered by the nearly $150 billion invested in short-term fixed-rate deferred products over the past three years that will be coming out of their surrender periods. Given the current market conditions, we expect many investors will likely reinvest in fixed-rate deferred annuity products due to the rising rates, driving sales to close to $50 billion over the next few years.

Income Annuities: Despite improving economic conditions, low interest rates will continue to challenge the value proposition of income annuities through 2025. In addition, more flexible income solutions, such as guaranteed living benefits, will continue to capture a majority of the flows for investors seeking income guarantees in their retirement portfolio. While the growing aging population will benefit these products, the challenges of limited liquidity and the inability for insurers to provide robust pricing to attract individuals to income annuities will limit income annuity sales growth.

Fla. Division of Emergency Management: Critical Investments in Preparedness Support Florida Disaster Response

Guidehouse Designates US Markets Ripe for “Payvider” Adoption and Growth

Advisor News

- SEC manual shake-up: What every insurance advisor needs to know now

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

More Advisor NewsHealth/Employee Benefits News

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Tulane University Researchers Describe New Findings in Oral Cancer (Nationwide oral cancer screening and rural-urban disparities in oral cancer diagnosis, treatment and mortality: a population-based cohort study in Taiwan): Oncology – Oral Cancer

- Findings from University of Florida Provides New Data about Insurance (Barriers To Insurance Innovation): Insurance

- Data on Managed Care Reported by Researchers at Harvard Medical School (Year 1 Impact of Offering Non-Emergency Medical Transportation on Care Utilization Among Low-Income and Disabled Beneficiaries in Medicare Advantage): Managed Care

- Investigators from Harvard University Target Managed Care (Fluctuating State Medicaid Dental Coverage: Asymmetric Impact of Benefit Cuts and Expansions, 2010-21): Managed Care

More Health/Employee Benefits NewsLife Insurance News

- Best’s Special Report: US Life/Health Insurance Industry Sees Impairments Halved in 2024

- Jackson Study Exposes Stark Disconnect Between Anticipation of Policy Change and Retirement Planning Conversations

- Thrivent plans to add 600 advisors this year

- Third Federal Named a top Financial Services Company by USA TODAY

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

More Life Insurance NewsProperty and Casualty News

- Opposition dooms Oregon bill aimed at wildfire insurance discounts

- Trump tells ship captains to use the Strait of Hormuz as U.S. conflict with Iran intensifies

- SHORT-TERM RENTALS POSE INSURANCE RISKS FOR HOMEOWNERS AND MULTI-UNIT DWELLINGS

- CALL-TO-ACTION: JOIN ME THIS THURSDAY NIGHT

- Openly Announces Independent Board of Directors Appointments

More Property and Casualty News